Hello Linkies,

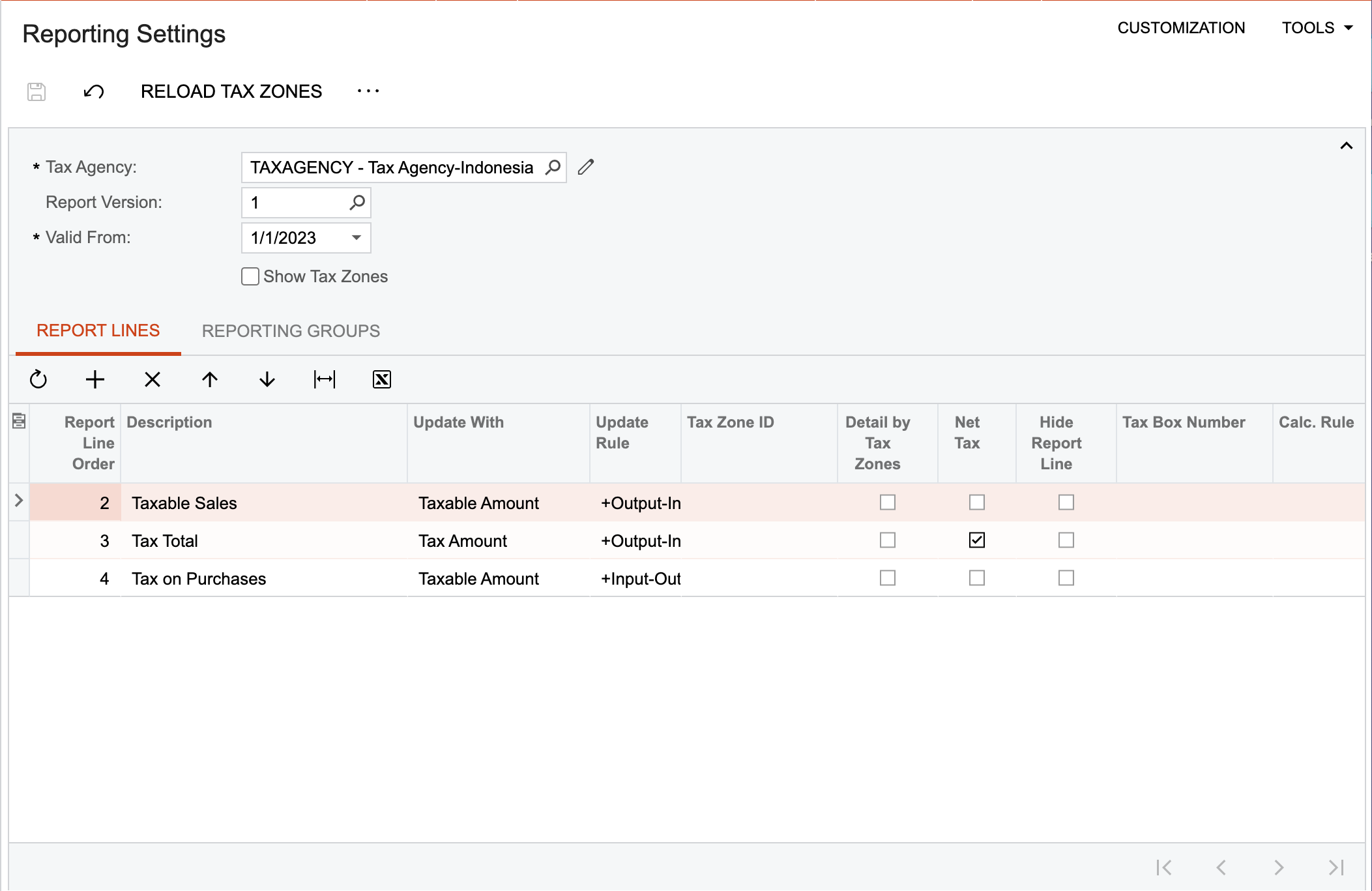

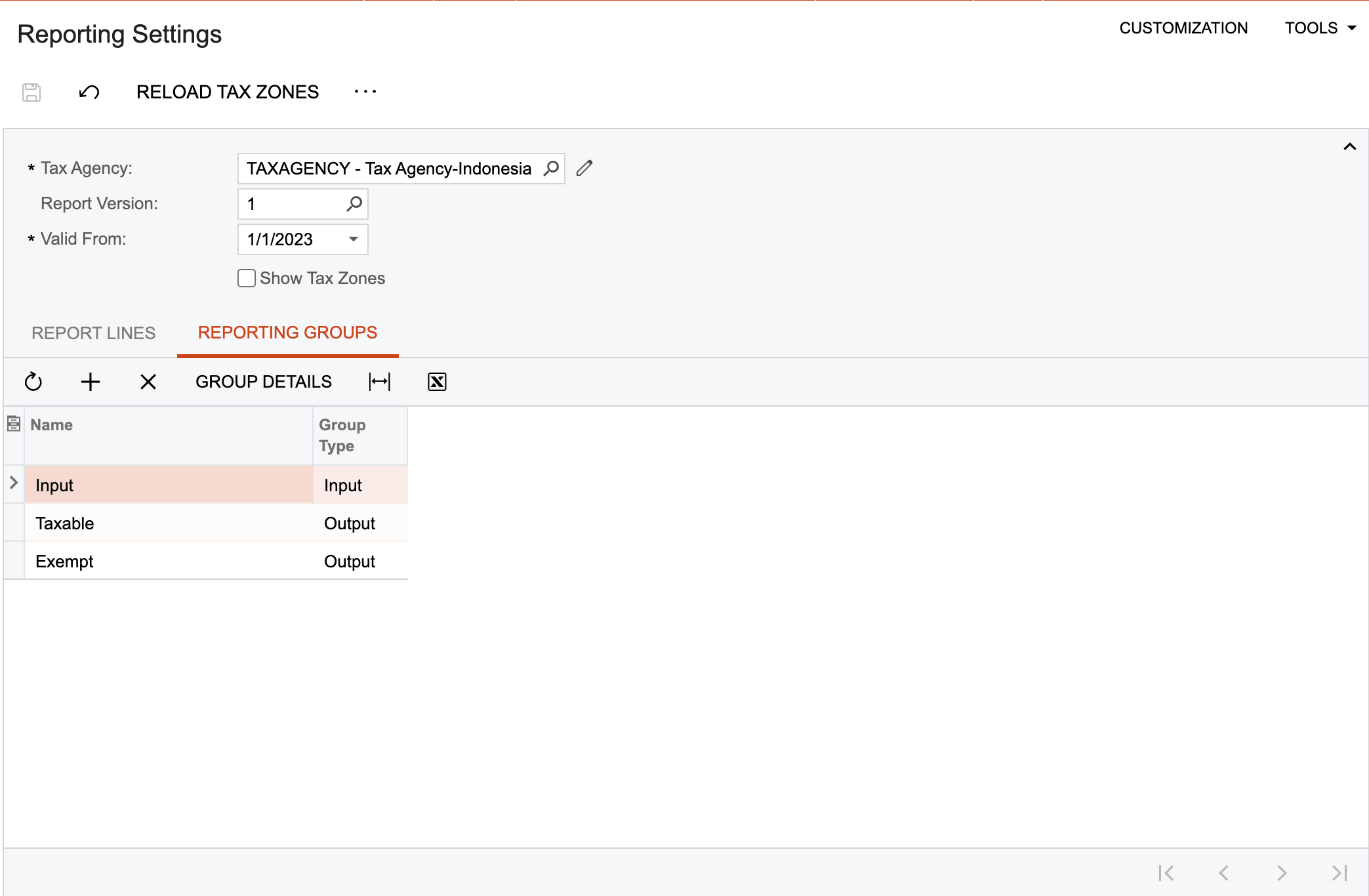

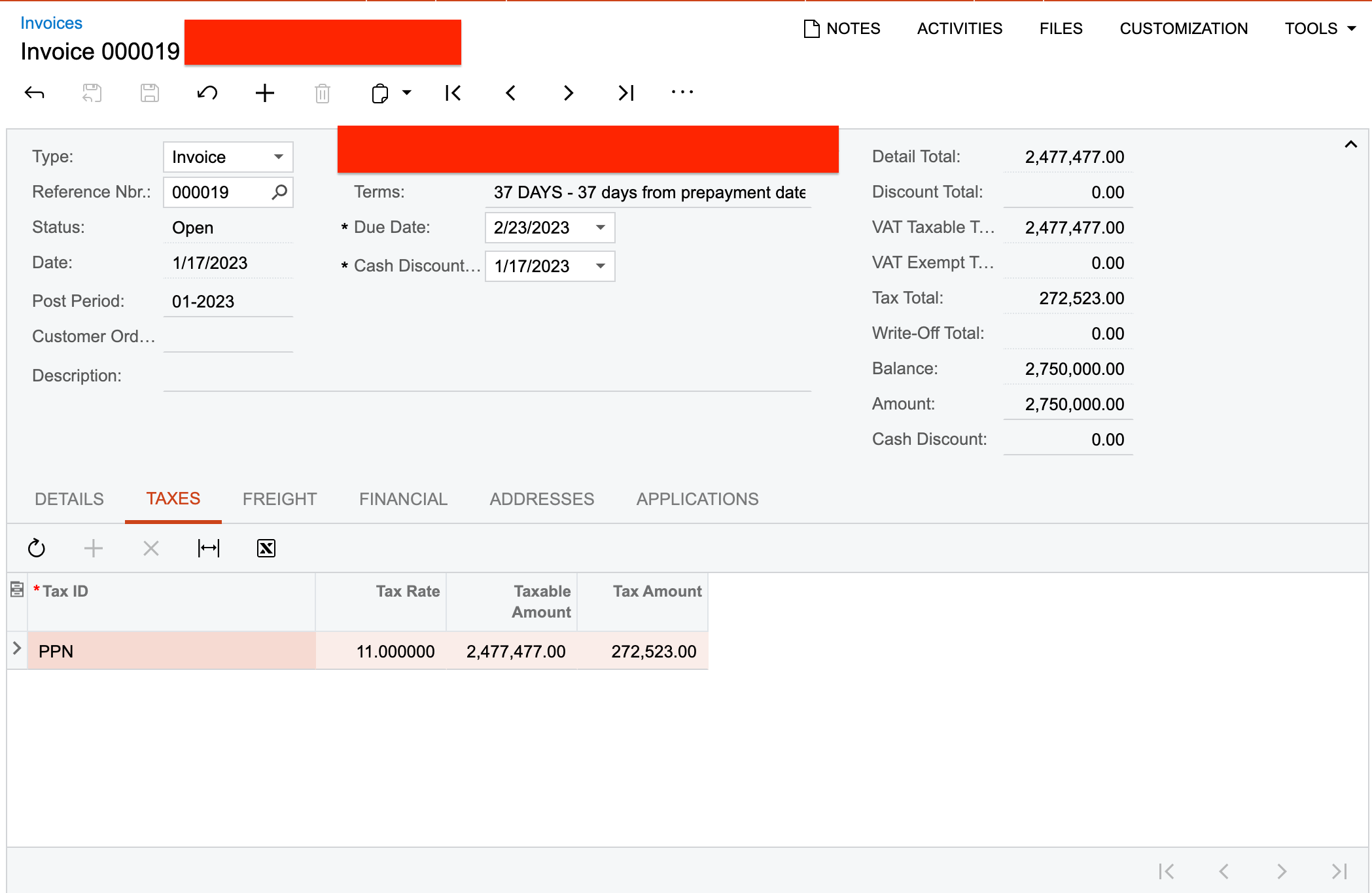

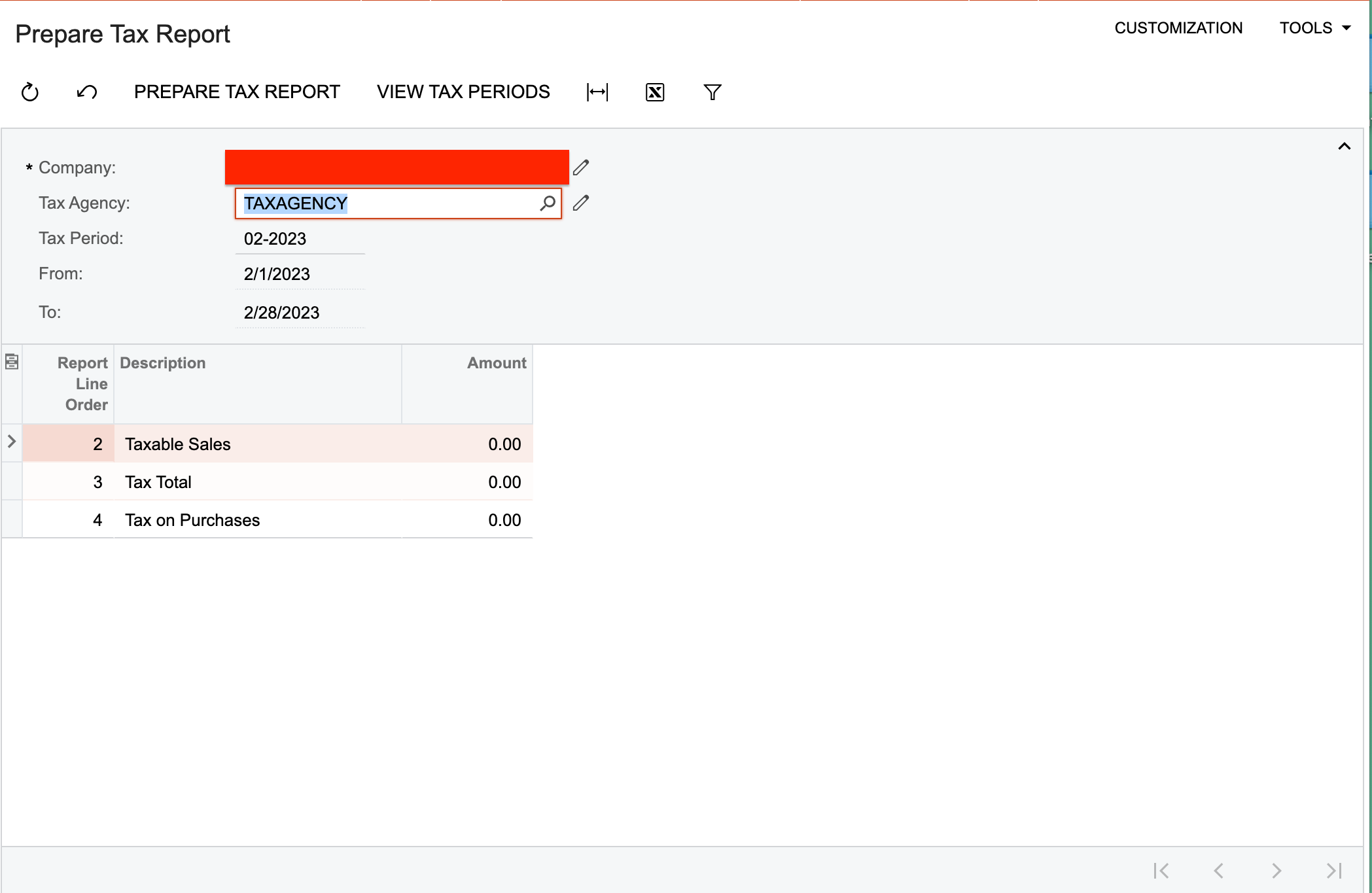

I have been trying to record the taxes payable and claimable by created SO/AR Invoices & PO/AP Bills, but not able to show it up on the Prepare Tax Reports (TX501000) form nor on the Tax Summary/Details reports. Kindly let me know what I am missing here.

The Tax Periods are also open.

Thanks in advance.