Our Company adopted a SIMPLE IRA plan that began funding this month. With just over a year under our belt with Acumatica, I came to the Community to get some setup pointers but didn’t find any. With that, I began experiments in our test environment and developed the setup that was eventually implemented in the live company environment. I thought a few of the procedures and observations made along the way might be helpful to someone else.

G/L Considerations: The setup will require a couple of new accounts, a SIMPLE IRA liability account (for accrual of deductions and benefits) and an Employee Retirement Benefits expense account for recognition of the matching expense.

One plan, four Deduction/Benefit Codes: I set our SIMPLE IRA with four Deduction/Benefit codes for four possible situations:

- Employee under 50 years old, Deduction expressed as percent of gross.

- Employe under 50 years old, Deduction expressed as fixed amount

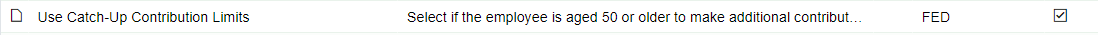

- Employee 50 years or older, Deduction expressed as percent of gross.

- Employe 50 years or older, Deduction expressed as fixed amount

Our Company has elected to match up to 3% of participant salaries, so each code was set up with this in mind.

The codes need to be set up with the “Affects Tax Calculation” box checked. The four tabs are then:

- Tax Settings: Calculated by Tax Engine with a Code Type of SIMPLEIRA

- Employee Deduction: Fixed Amount or Percent of Gross (contingent on which of the two types of codes is being set up), In the Fixed Amount codes I set the default amount to be $1 to alert me to override on Employee setup. Next, the Maximum Frequency is set to ‘Per Calendar Year.” The Maximum Amount is contingent on which of the two age possibilities is being set up (under 50 or 50 and above). The IRS-stipulated maximums go here. Lastly, the Reporting Type I set as Box 12 SIMPLE Plan.

- Employer Contribution: Percent of Gross, 3.0 (%), No Maximum, Applicable Earnings = Total Earnings and Normal Reporting Type.

- G/L Accounts: here I entered the accounts set up in the first step. I set the Deduction and Benefit Accrual accounts to be the same as I do not foresee a need to distinguish between the two.