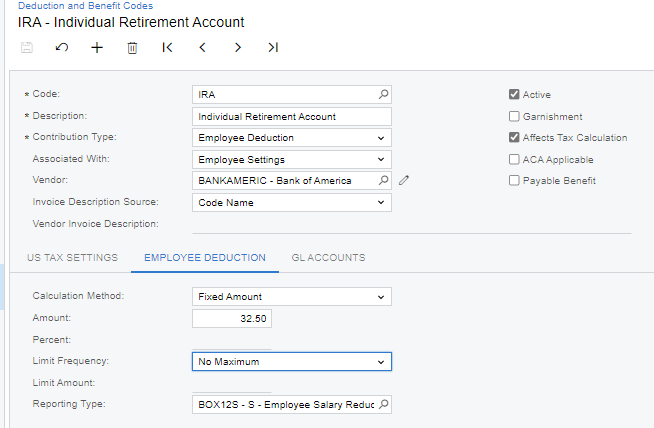

We have one employee choosing to max out his SIMPLE IRA deduction limit for the year. The employee is over 50, so the deduction limit for 2023 is $19,000 (15,500 normal limit + 3,500 “catch-up” provision). The deduction is set up with the higher limit for those 50 and older:

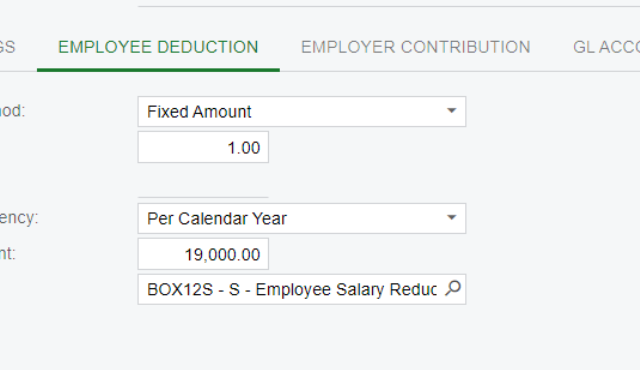

The employee’s individual setup reflects the higher limit:

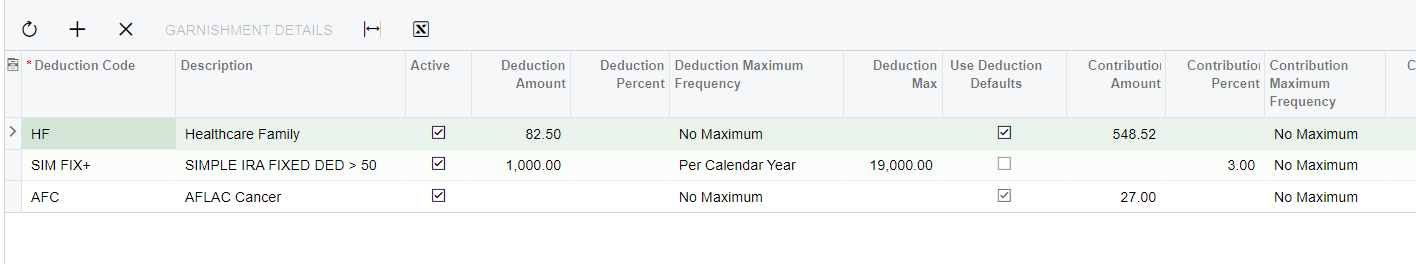

Processing the employee’s check, today, Payroll limited the deduction to $500.00, thereby limiting the employee’s cumulative deduction to $15,500. The employee has $3,500.00 remaining by statute.

Does anyone have any idea why Acumatica Payroll is overriding the Deduction setup as if the employee were under 50 years of age? More to the point, does anyone have any idea how to fix this so the remaining allowable deductions can be made prior year end?