Hi,

I am looking for input on the retirement plan: IRA Simple Plan

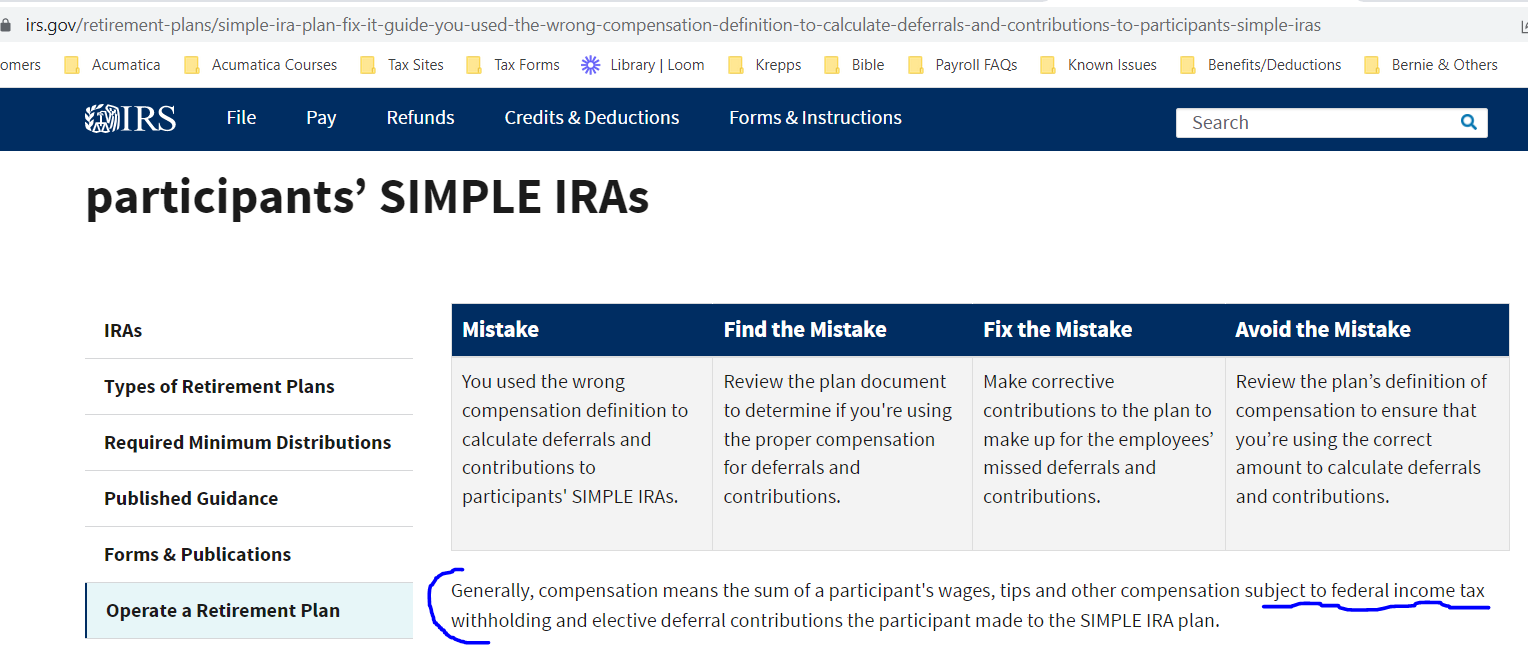

We are using 2021 R2: After doing a tax update last week the employer contribution for our IRA Simple plan suddenly changed from the ER contributing on total Gross Pay to contributing on Taxable Wages - which is less contribution dollars since this implementation has a few pretax deductions.

This sudden change in behavior has sparked a debate. Looking for input from others who have this retirement plan. What should it be? On Gross or Taxable Wages?

The deduction is setup with Tax Settings of:

Thanks in advance,

Amy