Hello,

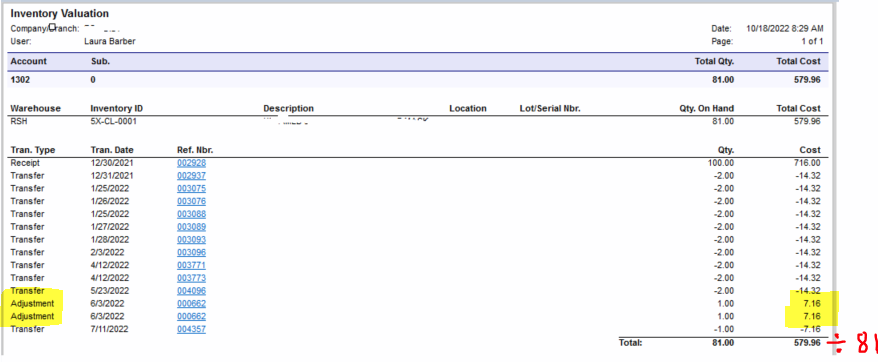

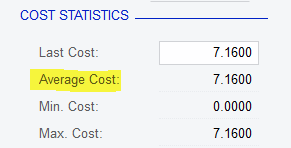

I have a small issue with landed cost as some of the landed cost goes into the Landed Cost Variance Account and it does not show in the Inventory Valuation report and the Average Cost in the Stock Items.

Does anyone know the workflow to correct this issue?

The final bill of the landed cost cost is entered after we received our goods and we start selling them right away.

Landed Cost Variance Account

The expense account to be used for this stock item to record the landed cost difference that occurred if landed costs are allocated to an item that has been sold.

Thanks,

Nelson