Hello @shmaryarichler ,

You are correct in guessing that the cost of previously sold items is not adjusted by landed cost transactions that are entered after the items are sold.

Landed Cost adjustments will adjust items that are on hand at the time that the landed cost is released.

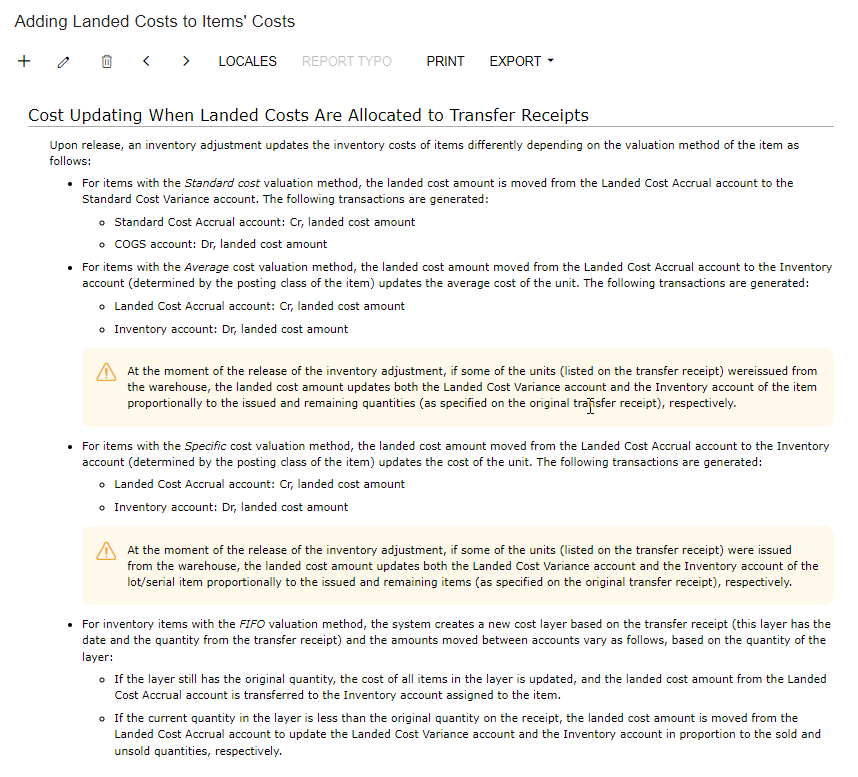

If the item’s valuation method is FIFO or Average Cost: If the items are still on hand, their costs are updated by the Landed Costs. If the items related to the Landed Cost are already sold, then the Landed Cost transactions will be posted to Landed Cost Variance.

If the item is Standard Cost, then the cost of the items is never updated (whether items are sold or still on hand) and the Landed Cost *always* posts instead to Landed Cost Variance.

Check with your CPA to be sure, but I expect Landed Cost Variance should be included in the COGS section of your P & L. Therefore it is considered part of inventory costs even after the items are sold.

I’ve created and attached an example so you can see the steps leading up to the Landed Cost entry, and the entry that results for items that are sold and for items that are still on hand. Enjoy!