Hello,

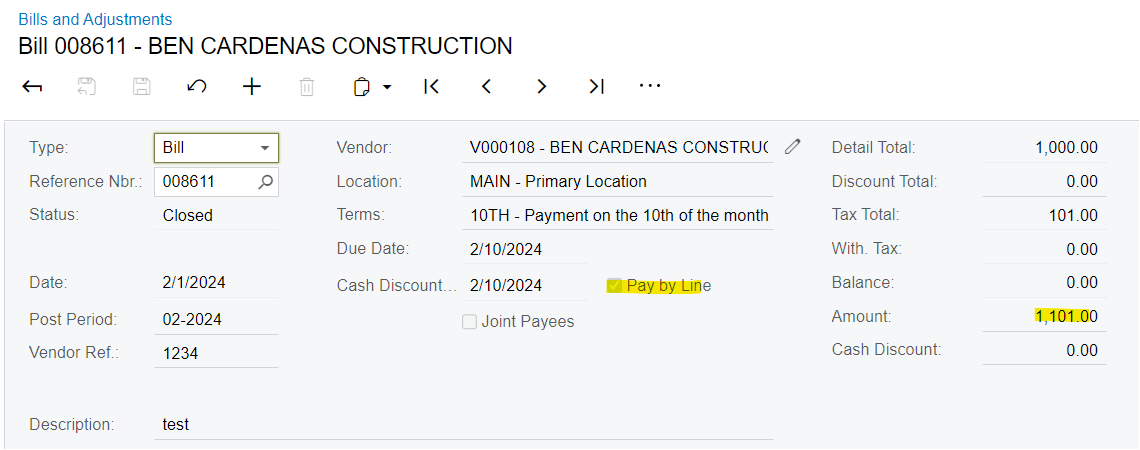

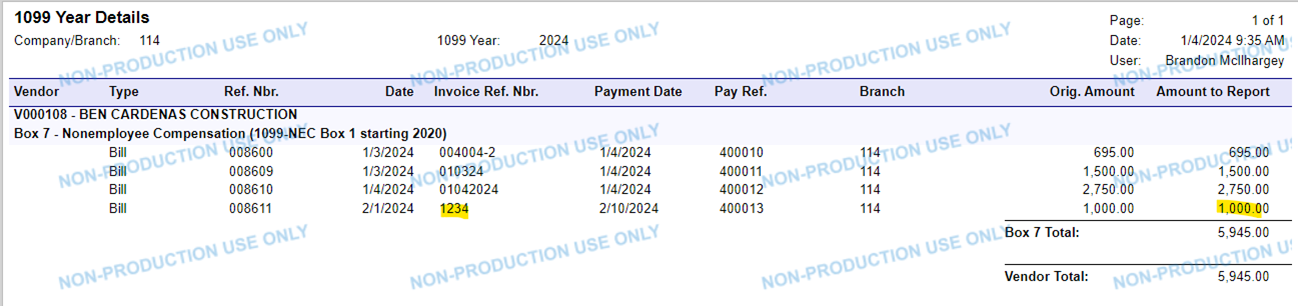

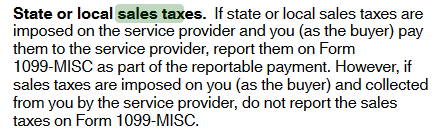

My company and I are having trouble pulling in the sales tax at the document level for the 1099 Year Details (AP654500) report in the Payables Module.

Would anyone have any ideas how to pull not only the bill detail amount, but the bill total including tax total. We have tried enabling the pay by line feature on the vendor and vendor class, but that didn’t solve our issue. Thank you, and I would appreciate any insight into this!

Example: