Hi, I was wondering if there is any report or GI (custom) that can display for all transactions:

- The net amount of the payment (excluding GST)

- The GST amount in the payment

- The details of the payment (ie supplier/client name, transaction description etc)

- What GL account the transaction was coded to

- Some way to be able to drill into the transaction if needed, whether that be a link in the report or at the very least a transaction number or similar that I can then go and look up in the relevant area to get more detail

The idea here is to be able to review whether GST has been claimed correctly. For example, I can look at all transactions in the “Donations” expense account and confirm straight away that no GST has been claimed on any of those, and then I can look at all transactions in the “Software Charges” expense account and confirm straight away that they all have GST claimed on them.

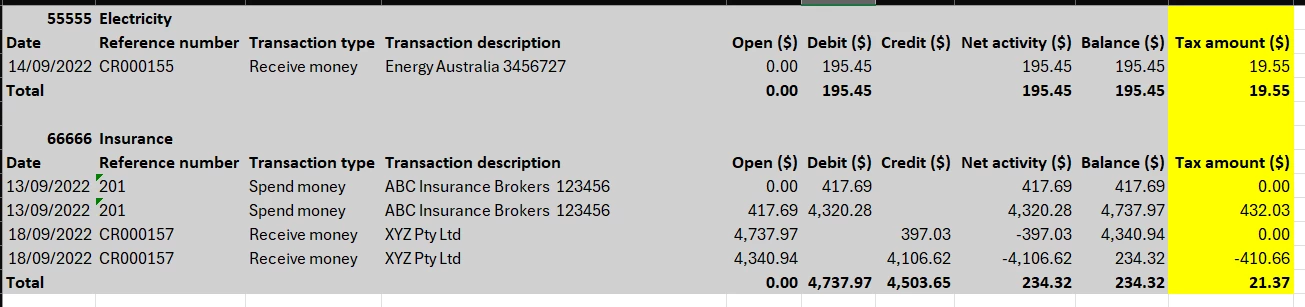

Example of what the report should display (see the yellow highlighted section). You can see straight away that GST has been claimed on everything in the Electricity account and it equals 10% of the net expense, while in the insurance account you can see that some lines have GST and some don’t – which tells me straight away that the stamp duty component has been split out and no GST claimed on that (which is how it should be).