I have a Washington Cares withholding for Washington State and it’s nowhere evident in Acumatica, is there something I need to do to get it to appear or is this a deduction I need to set up myself?

Thank you!

I have a Washington Cares withholding for Washington State and it’s nowhere evident in Acumatica, is there something I need to do to get it to appear or is this a deduction I need to set up myself?

Thank you!

Best answer by mikedavidson07

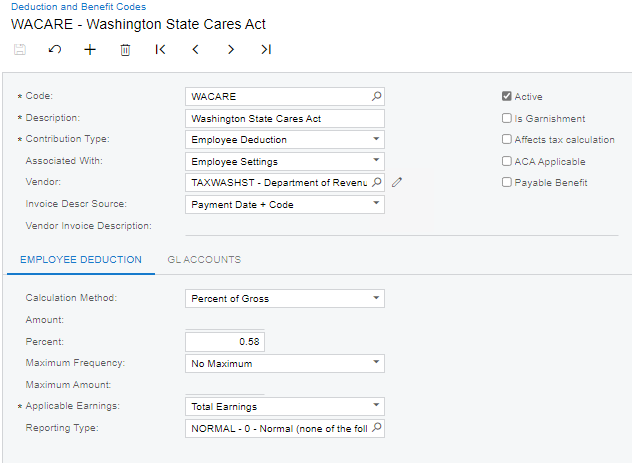

It looks like the Washington State Cares Fund is an employee deduction managed by the state that will go into effect July 1st 2023? You may need to gather a little more information taxation and reporting requirements.

I don’t think there is a specific accommodation for this in Acumatica. You should be able to handle this with a regular deduction.

On your first pay run, after you have calculated (prior to processing the payment) you should confirm the withhold amount is correct. If not, you can adjust the rate and recalculate.

Hope this helps.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.