I just upgraded from 23R2 to 24R2.. In 23R2, the employer contribtuion did not calculate correctly but I was able to do an ajdustment for that after the paycheck was released (which wasn’t a big deal).. However, now that I have upgraded, I have 3 employees who all have the following in common:

- participate in the SIMPLE IRA (3% employer match)

- Have medical, dental, and vision insurance withheld from their paychecks

- Have IRA amounts that do not match and are also not the correct (3%) amounts

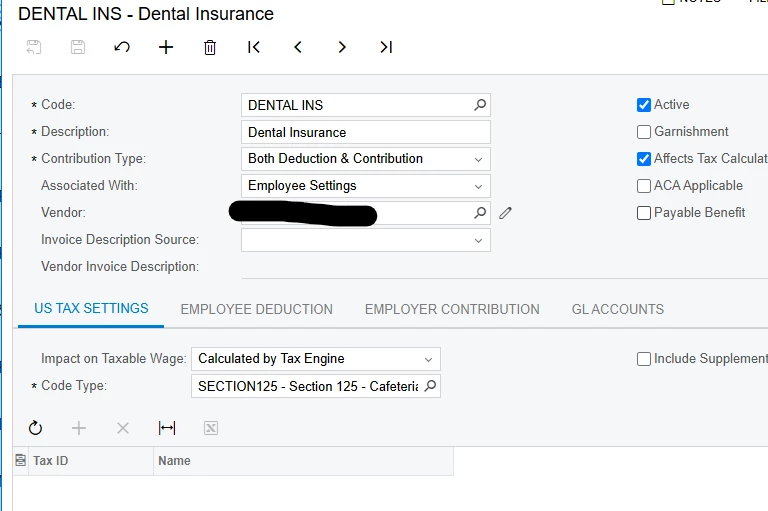

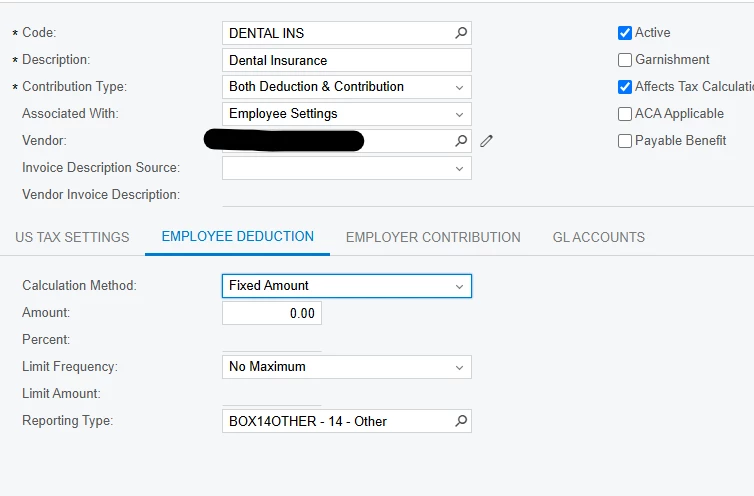

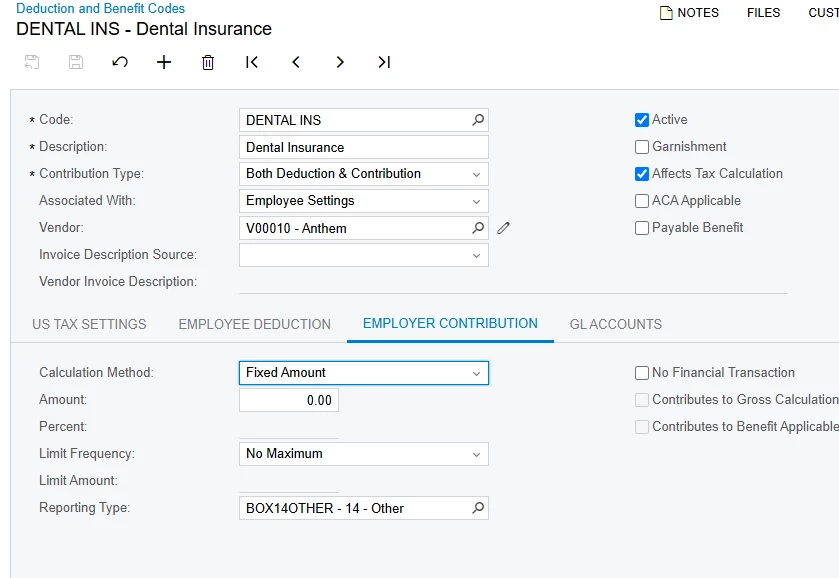

Our Medical, Dental, and Vision insurance are a SECTION125 Cafeteria plan.

How do i get the IRA deductions and benefits to calculate correctly?

Do i have to change some settings on the codes?

Any help would be greatly appreciated!

Below are the screenshots of the settings i have..