Hi,

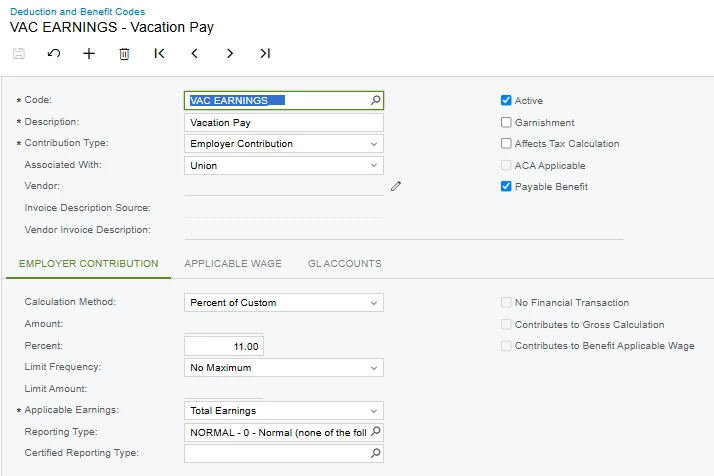

Appreciate your help on this. we are setting up the Deduction and Benefits for vacation and we encountered this concern.

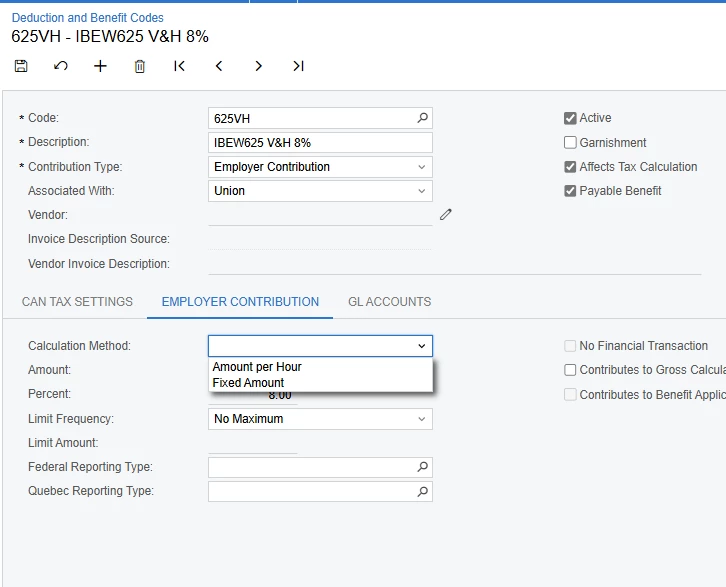

Context: Vacation should be set as Percentage of gross wages and should be taxable. In Acumatica payroll, when the Affects tax Calculation box is ticked, the Percentage Custom in the Calculation Method is not available.

Note: We cannot use the Amount per hour because the hourly rate may vary and we may need to calculate it manually in every paycheck.

Thank you.