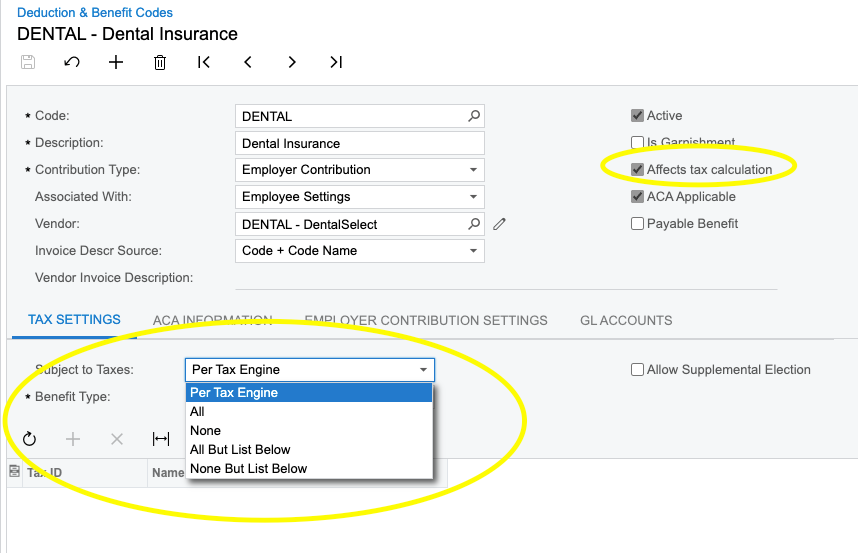

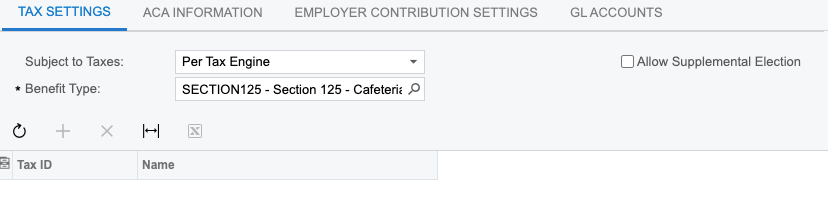

Which setting configuration is needed to setup a deduction/benefit pre-tax? I can’t find this in the documentation. Thanks!

Solved

Payroll question > How to setup a deduction/benefit pre-tax (Ex: health insurance)?

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.