Hello,

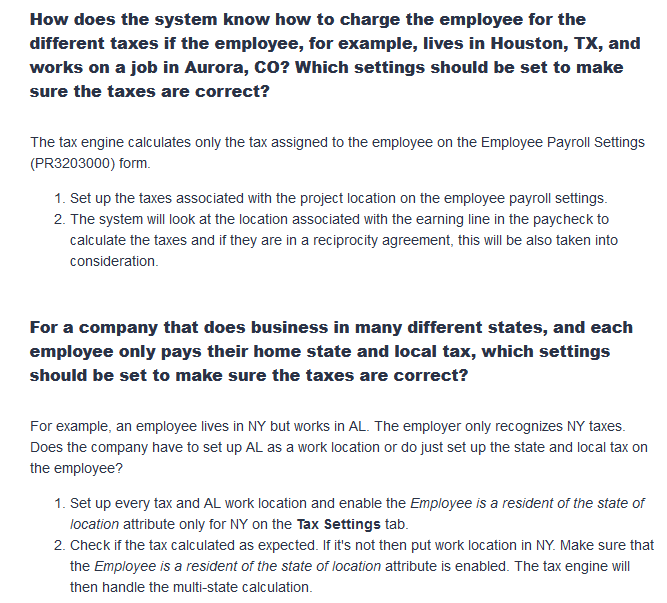

I have several Union Employees who live in New York City but at times travel out of state for work. As per the NYC tax code, all wages are subject to NYC personal income tax regardless of where the resident works.

At the same time the Employee will be Subject to the locality they are physically working in tax. This creates a scenario where I need to withold taxes for the NYC resident employees 2x once to NYC and once to the locality actually worked in. How can I solve for this in Acumatica?

Best answer by Laura02

View original