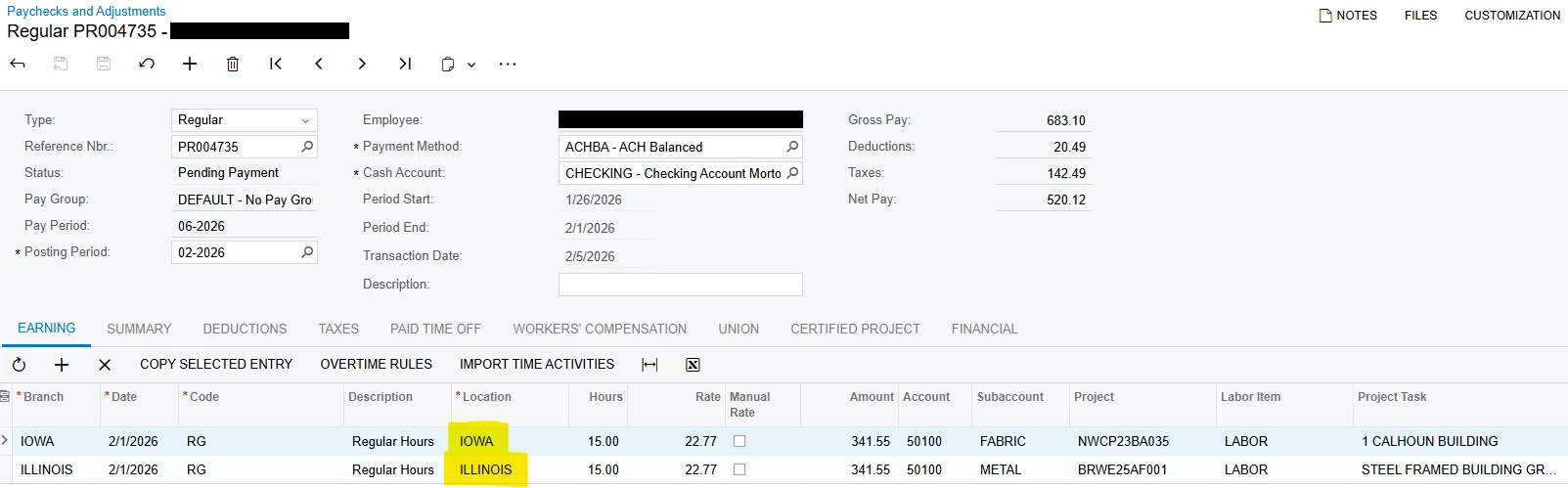

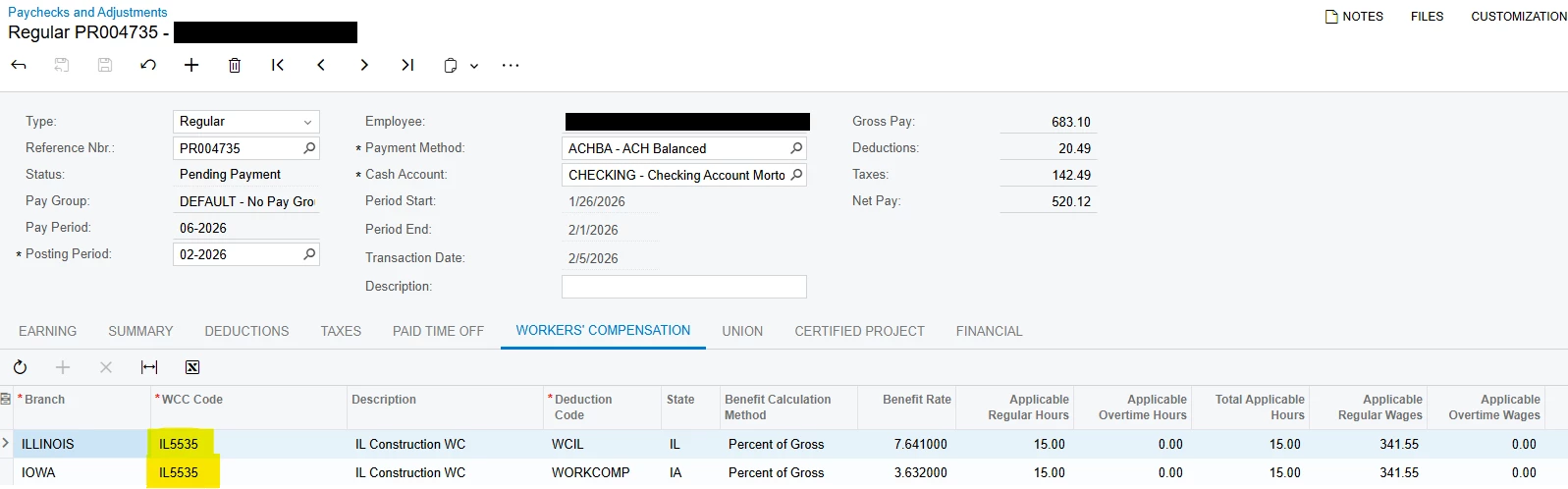

We are having an issue with the paycheck assigning separate workers’ comp codes to different work locations. As you can see, we have 2 work locations on this paycheck.

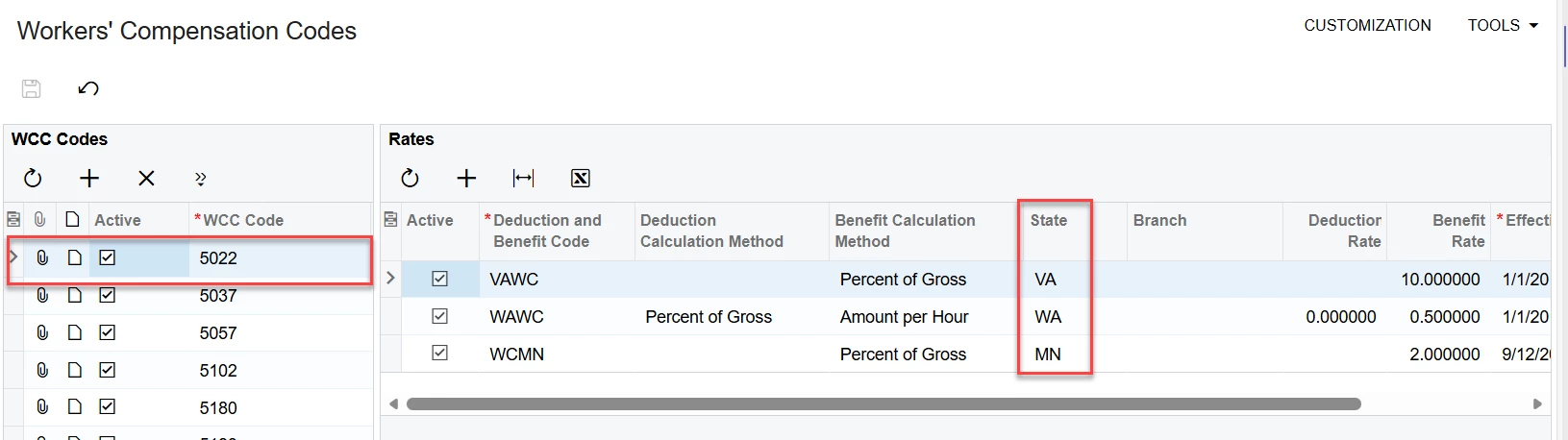

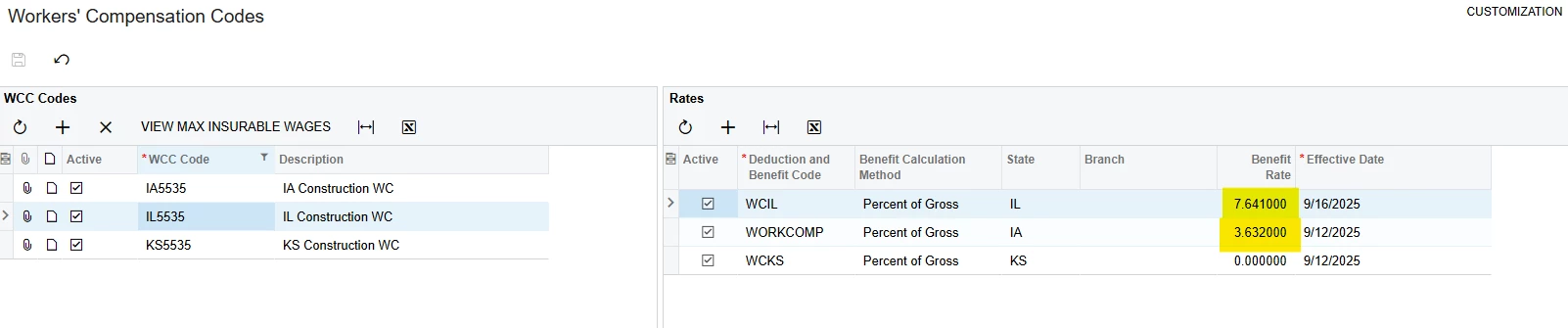

We want separate workers’ comp codes for each work location. However, currently, the system uses the same code with different deduction codes because of the 2 different states involved.

I understand that there are 2 separate deduction codes, but when we go to report these wages, we have to use 1 rate per WORKERS COMP code. When we report it to our insurance, they do not care about our deductions codes--just their WORKERS’ COMP code.

Does anyone know how to fix this? I want to be able to pull the workers’ comp report and use the numbers in Acumatica to report to our insurance. I can’t find a way to do it currently.