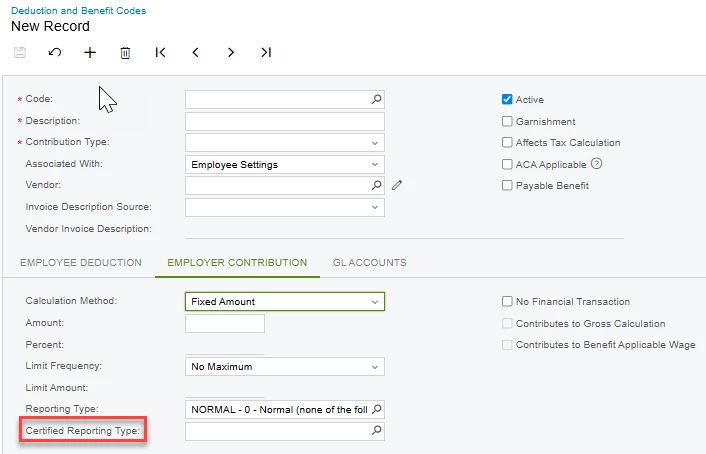

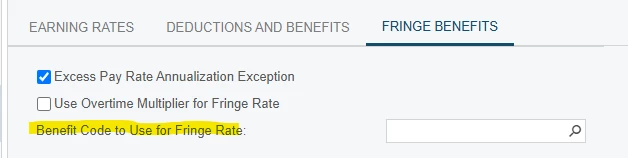

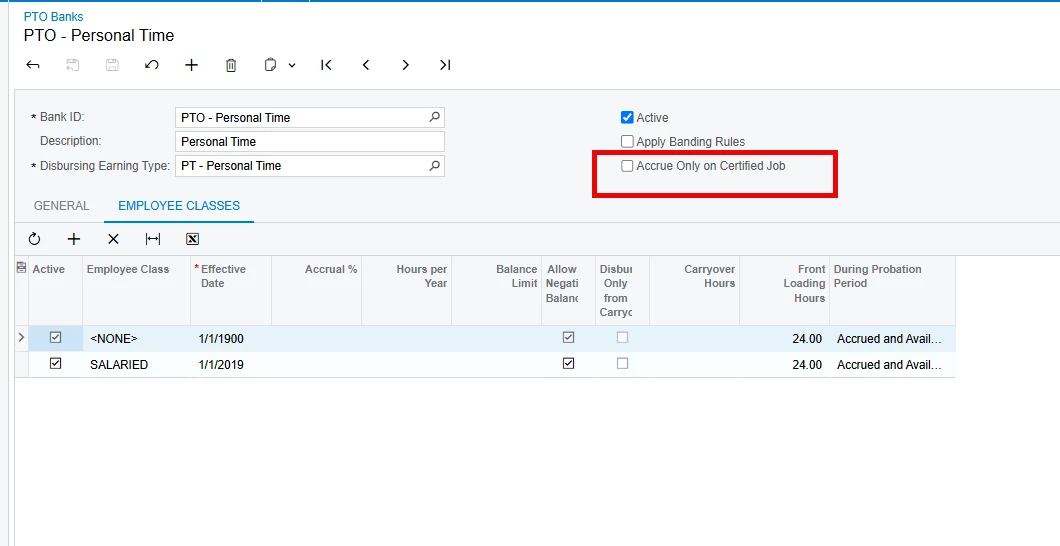

I am wanting to set up prevailing wages, and fringe benefits for our certified projects in Acumatica. I was able to figure out how to set up the wages, but need assistance with the fringe benefits.

Can anyone teach me how to set this up? Or point me in the right direction? Thank you!