Hi everyone, i want to ask about the fund transactions. So, I want to send my money from bank account (USD) to the other bank account (IDR), so it’s different bank accounts and currency.

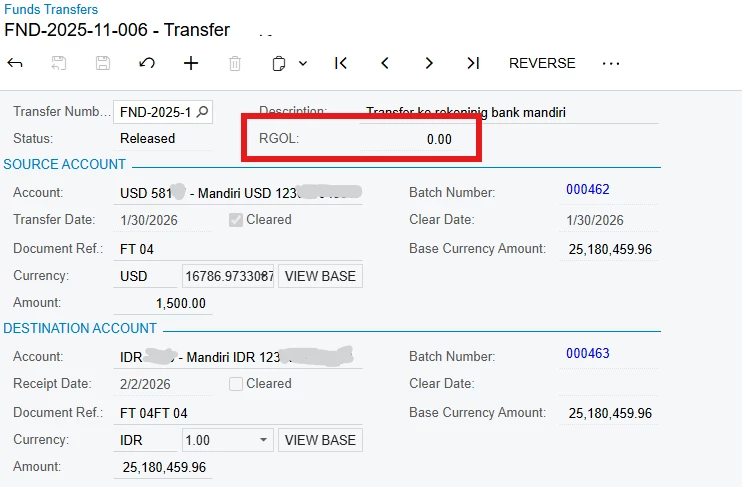

I already fill the blank item in the Fund Transactions, but I don’t get it why my RGOL is still zero (0)?

I mean in my source dan destinations have a different date but why it’s still zero RGOL.

Please help me to answer this, I’m just confused, where I should put the adjustment transactions of RGOL?

Here I put the screenshoot bellow, Please help me to solve this, I really appreciate it.

Thank you