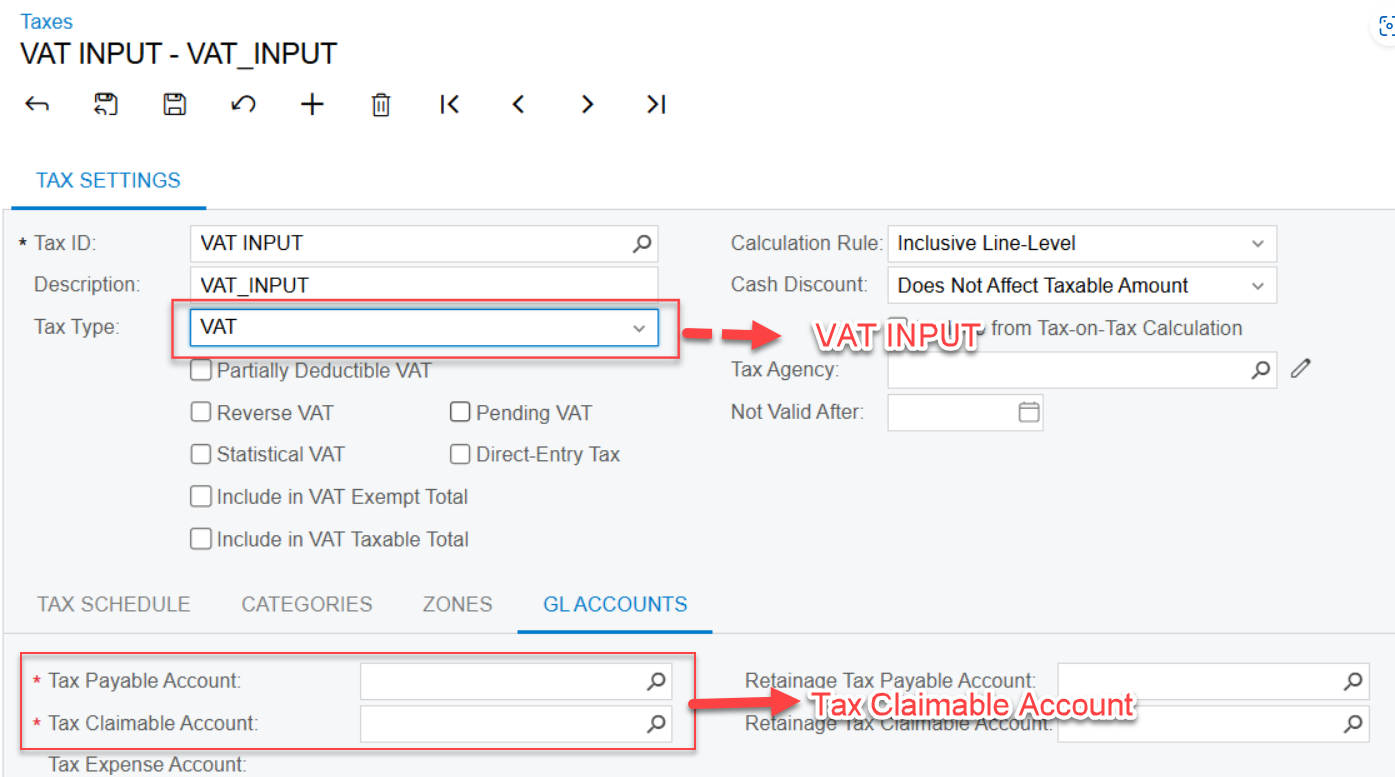

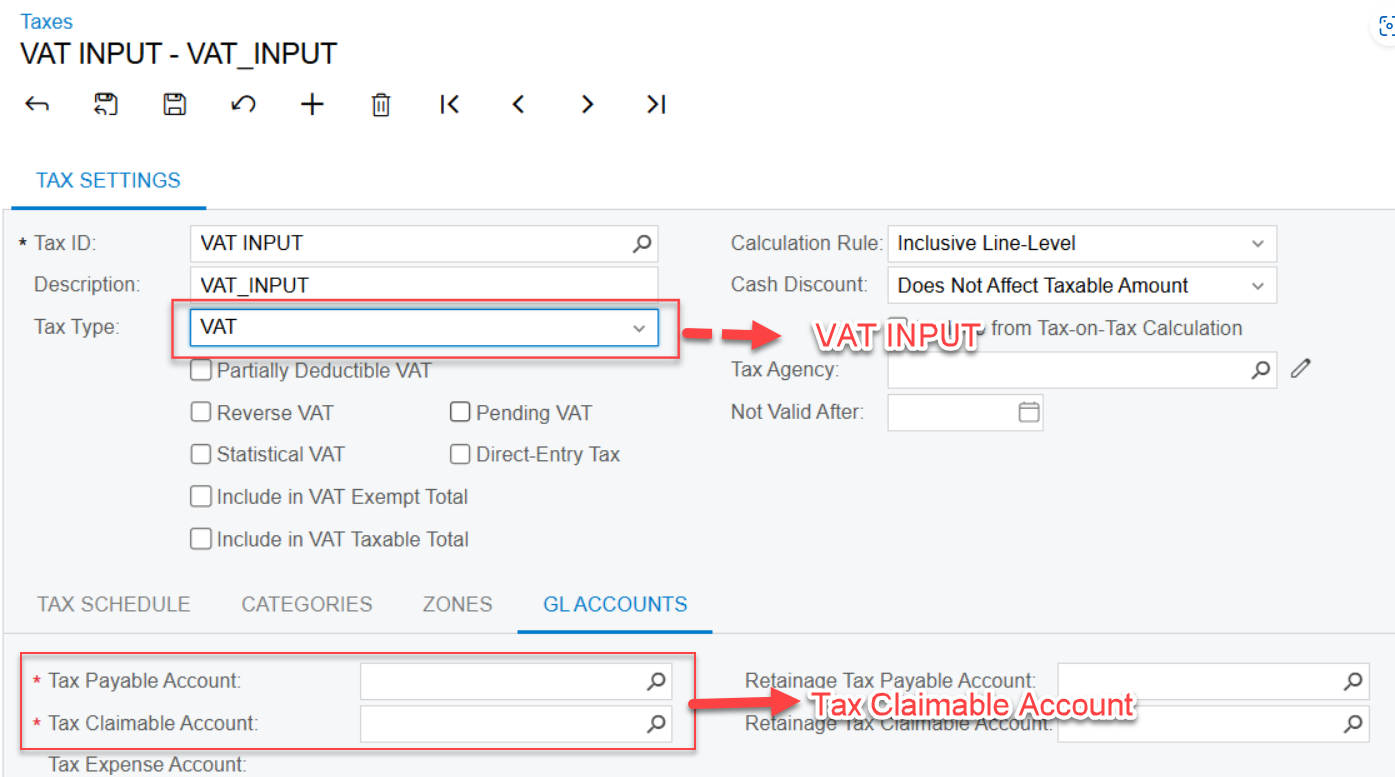

Please kindly advise how can set up Tax type from VAT-to-VAT INPUT and GL Account Mapping has 2 Types to only Tax Claimable Account Requirement in System.Thanks for help and supporting.

Please kindly advise how can set up Tax type from VAT-to-VAT INPUT and GL Account Mapping has 2 Types to only Tax Claimable Account Requirement in System.Thanks for help and supporting.

Best answer by meganfriesen37

Hello,

Acumatica Open University has a whole course on VAT set-up: F335 Value-Added Taxes 2024 R2

If you only need to track the inputs (but not output) you will have to fill in all the required GL fields, but then just set up the tax rate for input (and no rate for output) and that should work.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.