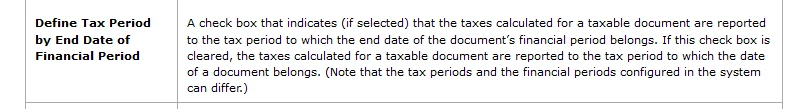

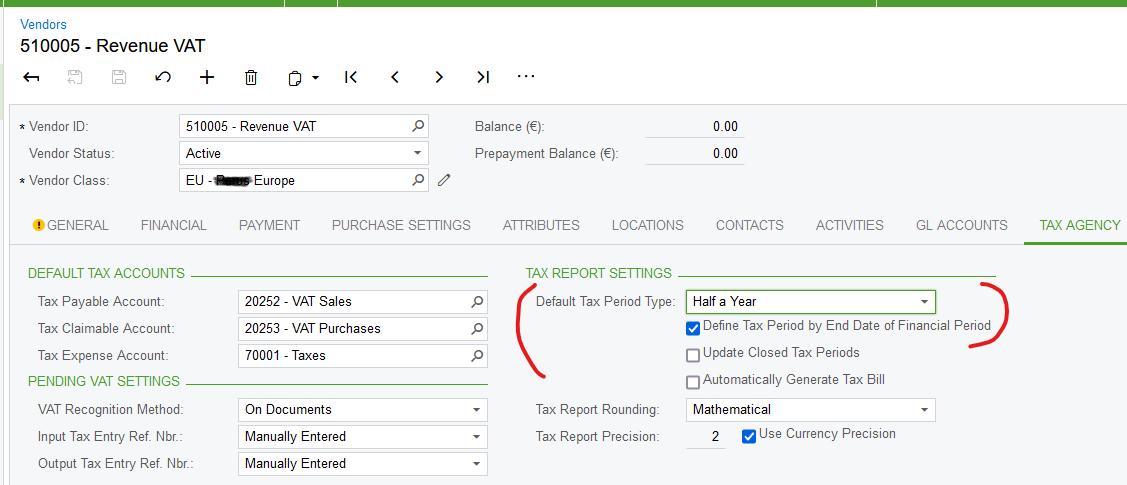

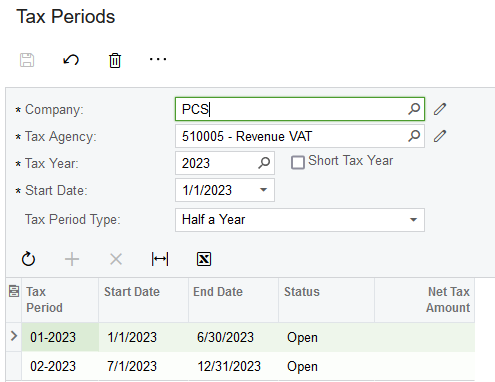

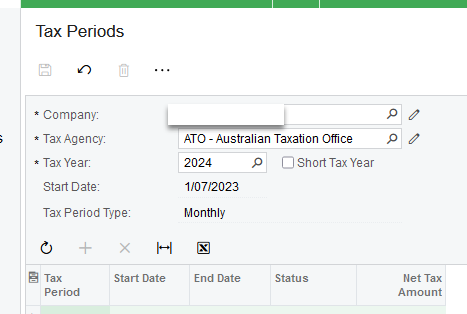

Issue is that a handful of AP Bill transactions are appearing incorrectly in the September BAS when they should be appearing in the October BAS.

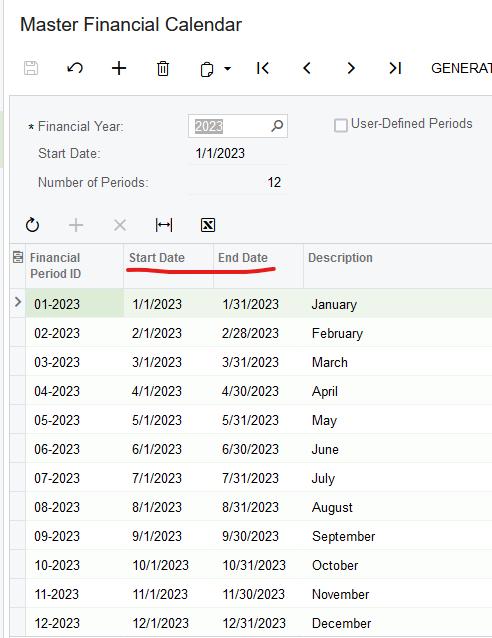

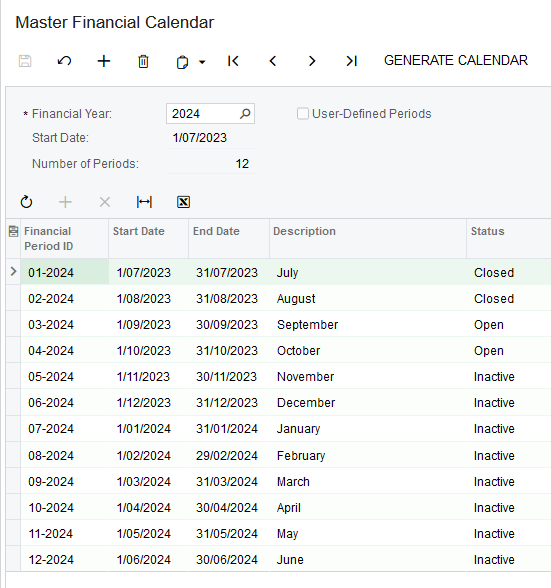

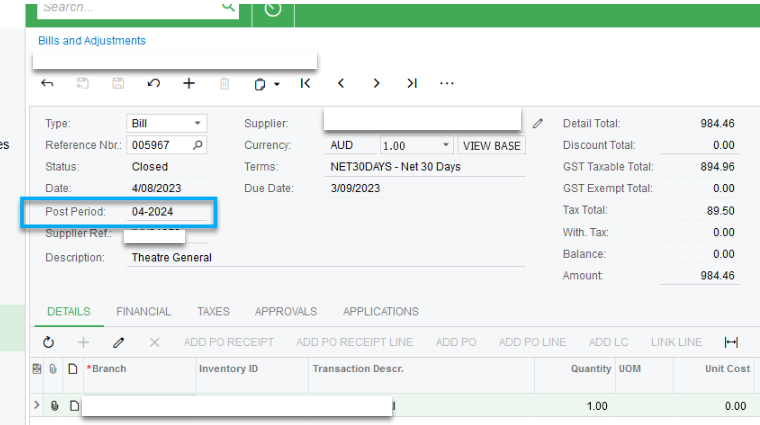

Example: Transaction itself was created in the system in September 2023, dated 04/08/23 but post dated 04-2024.

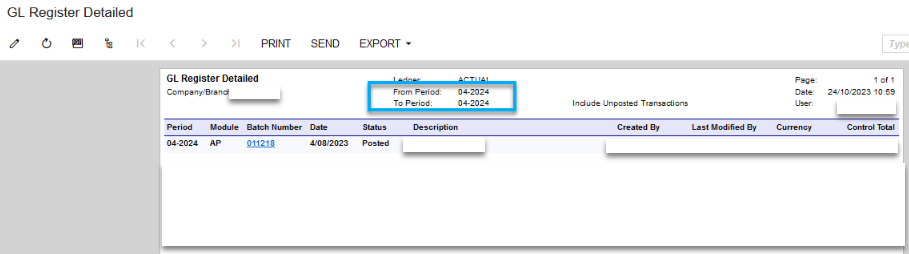

GL Register Detail for this transaction confirms the From-To period as 04-2024.

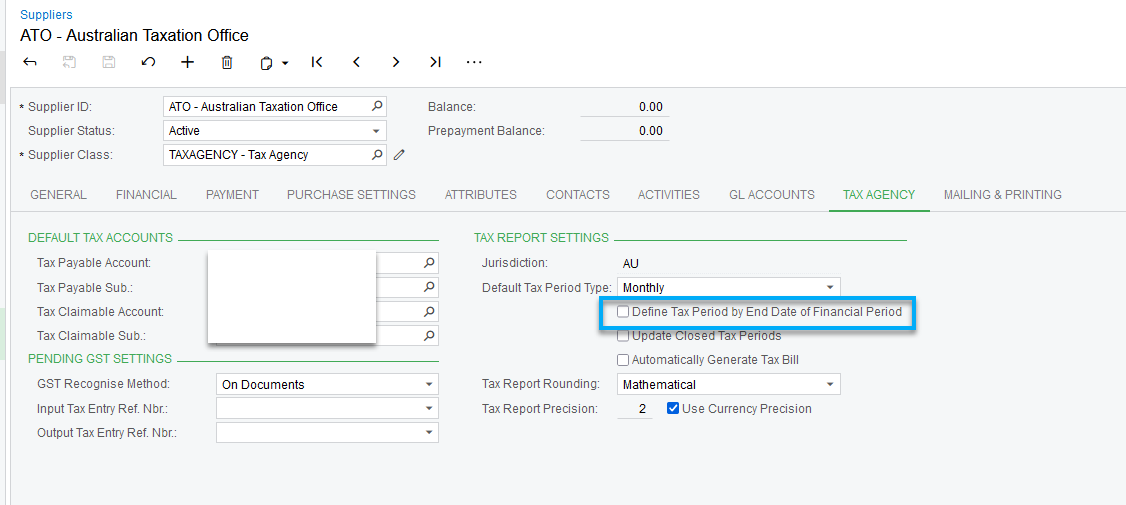

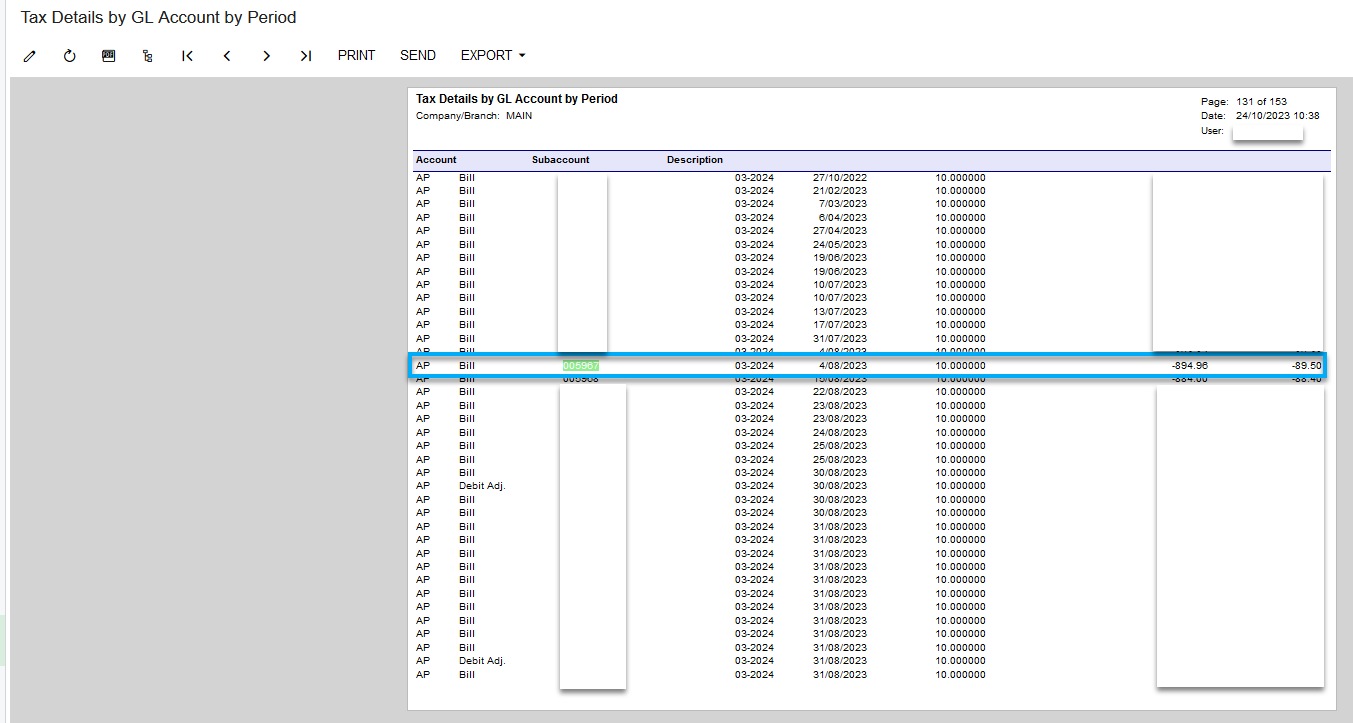

However, when running the report “Tax Details by GL Account by Period” this transaction is appearing and the Tax Period shows as 03-2024.

My question is why is this transaction appearing on this report as post period 03-2024? Where is it picking up the post period date from? I have checked the Financials Tab and batch details but all showing as 04-2024 for October.