Does anyone know how I can assign more tax years to the tax agency in the Tax Period?

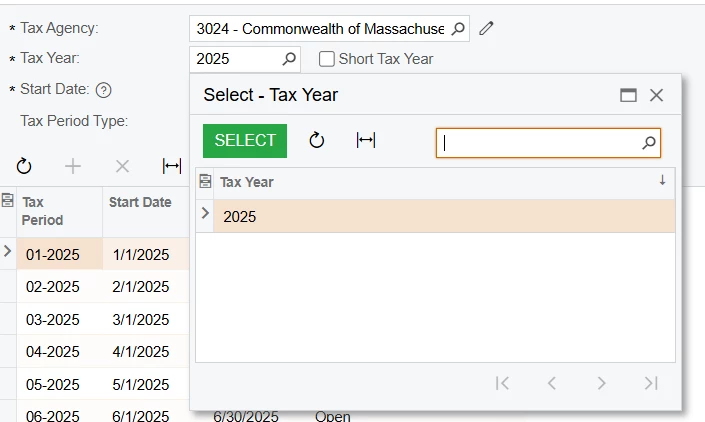

My issue with the system is that I can see multiple years as a filter for some tax agencies. However, for some tax agencies, I can see only one or just a few years .

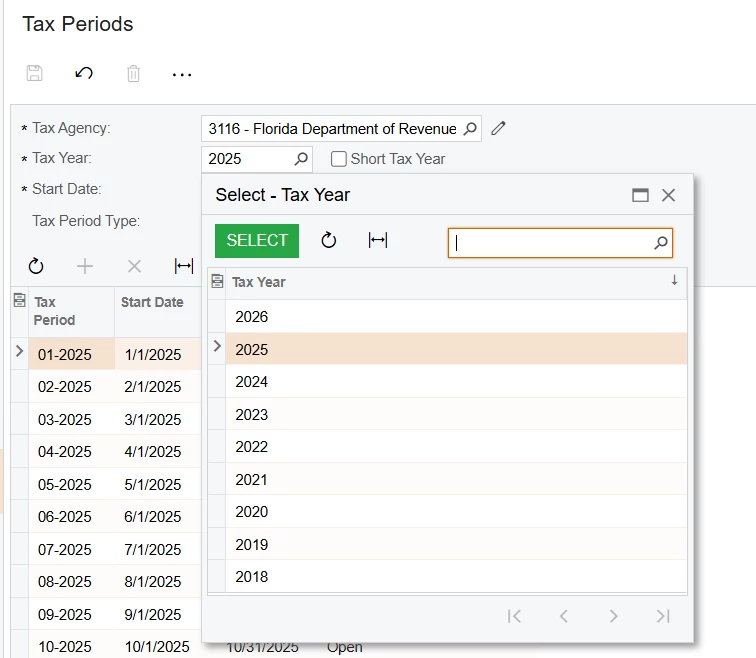

For example, for the Florida state tax Period, the system shows the years between 2018 and 2026

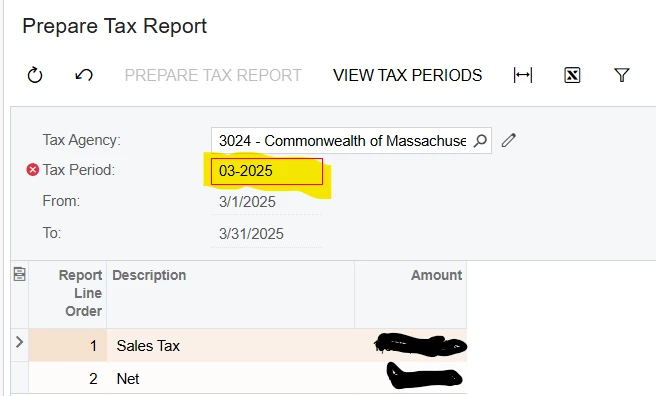

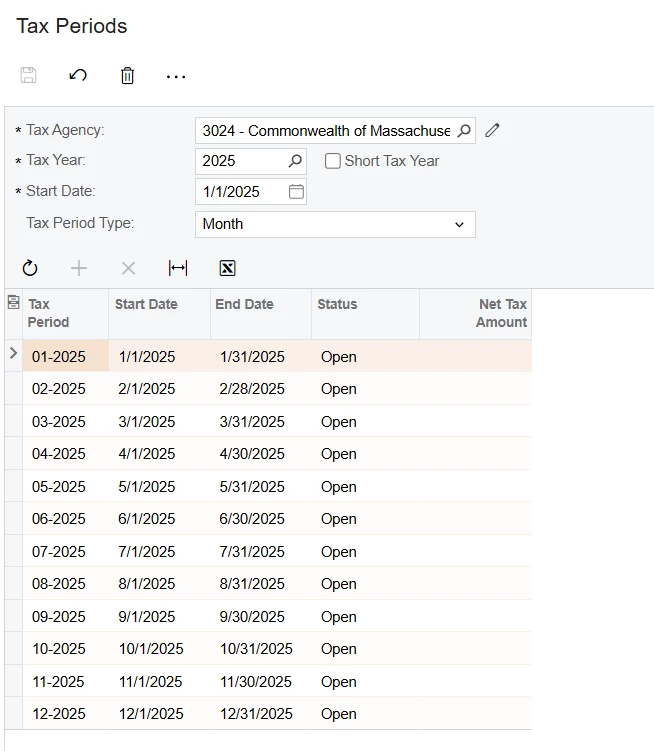

but for Massachusetts, it is different.

Just for your information, at first, I thought it might show the years that have transactions. However, Massachusetts has transactions in 2021 and 2022, but those years are not displayed.

On the other hand, I checked the Company Calendar, and there was no issue with that either.