What are the best practices for booking Shareholder disbursements in Acumatica? Should this be thru AP as Vendor payments?

Solved

Shareholder Disbursements

Best answer by Kandy Beatty

HI

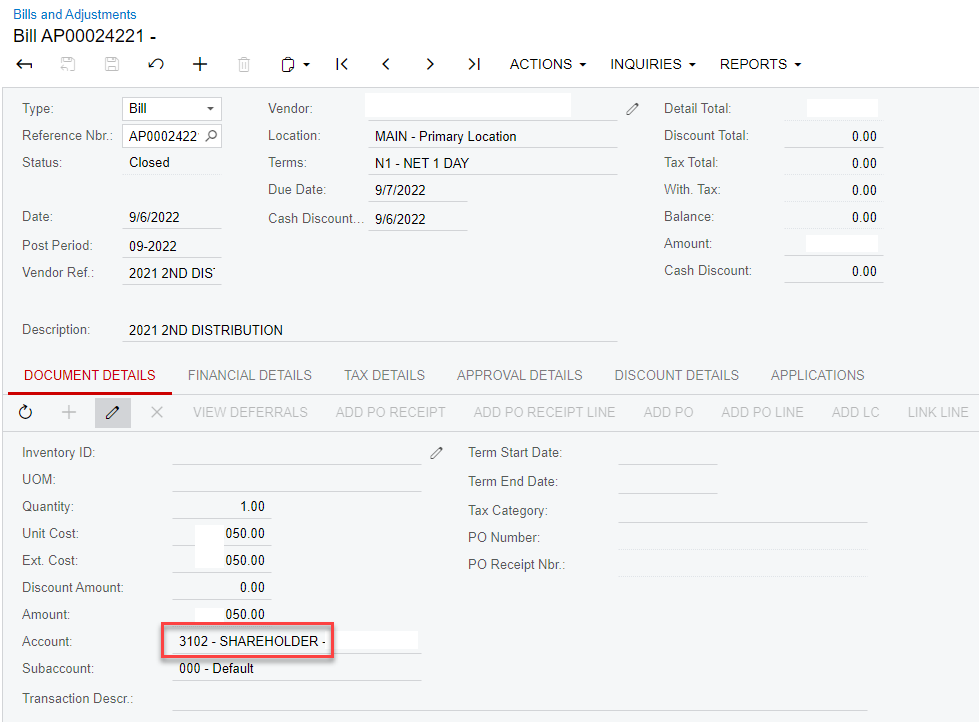

Then do it as a straight vendor Bill, you can offset to their own account as well:

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.