Hello community,

I have come up with a scenario, where I would like to record a security deposit along with prepayments.

So for eg: if I have an equipment to rent with rental price of 100$. And I want the customer to prepay (200%) of the complete rental price along with the security deposit. So Rental price = 100$ and Deposit = 100%. But I dont want the security deposit to be recorded into books as I would then be refunding the deposit completely. How can we achieve this in Acumatica?

Thanks in advance.

Recording security Deposits but not in books

Best answer by meganfriesen37

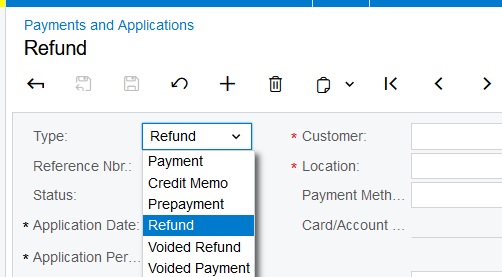

You can do a “prepayment” that is only linked to the Customer and their AR account and have that sit unapplied. (That’s the first scenario I outlined above). Then, when you actually recognize the revenue, you apply the prepayment against the invoice (revenue) at that time.

Take a look at the “how to” article here, this is more about doing physical checks but I think you would also be able to select a batch payment method instead.

In terms of the fee for damaged items, when the rented item is returned, if there was any damage, create a new invoice for the damage (i.e. $20) and apply that to the remaining balance of the prepayment.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.