Can we key a payment transaction in a cash account along with a loan account with bill/invoice in 1 journal?

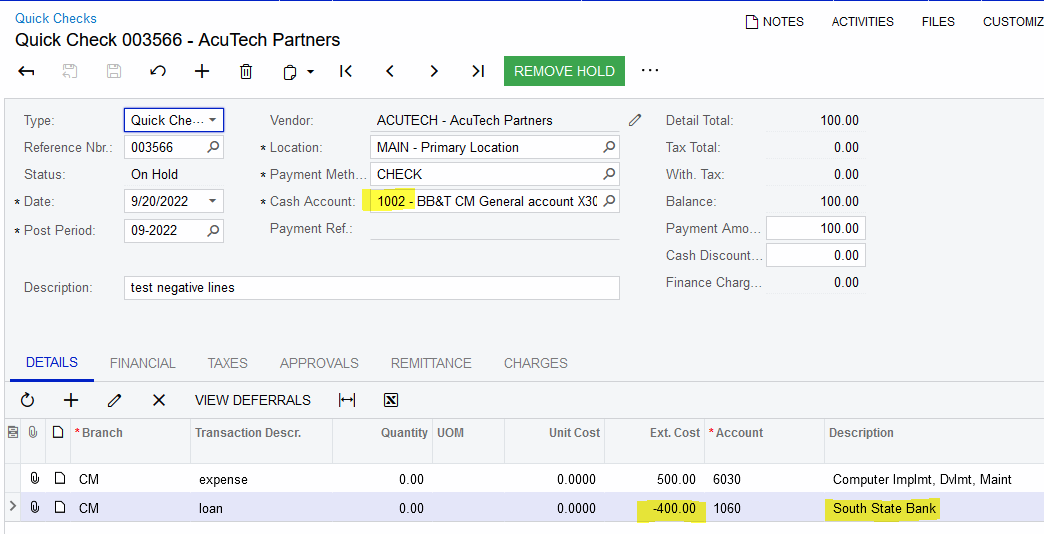

For example, payment 500 USD bill for a supplier, 100 USD from a cash account, and 400 USD from a loan vendor account

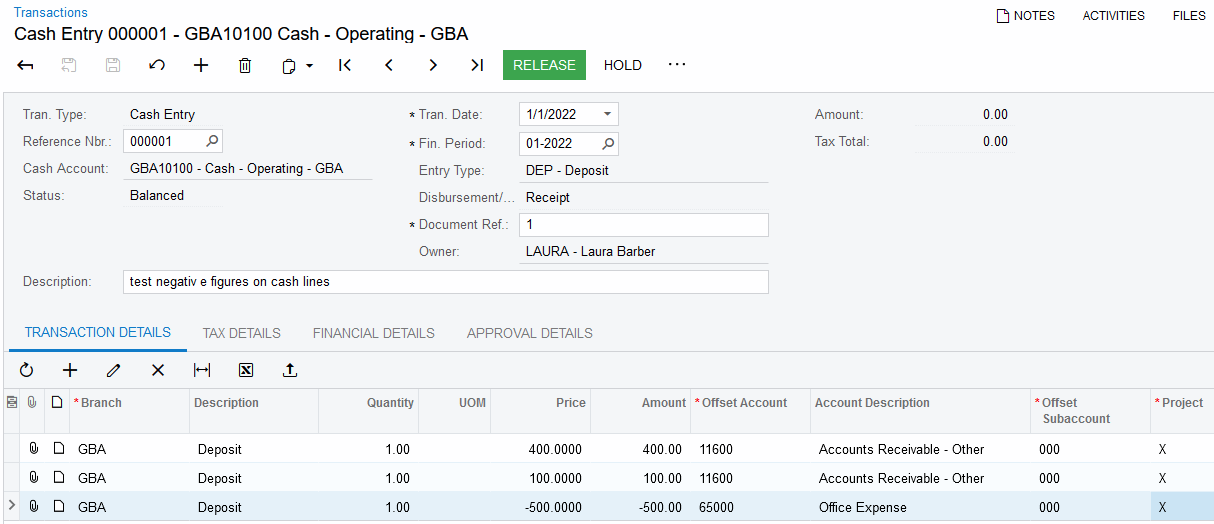

Currently, in ACU, we have to record the payment 500 USD bill for the supplier with a cash account. Then revert back of 400 USD cash account to loan vendor account.