We want to be able to use Projects to document activities for Research and Development (R&D) tax credits. I expect that the labor expenses will be the largest component of the R&D credit, with materials and prototyping materials the next largest component. With the R&D Tax credit Solid documentation is required, but we need to be able to keep it simple as well for the engineers. Need to keep the tasks down to a minimum otherwise the engineers will not properly record their time. Has anyone setup an internal R&D Project using the projects module? Are there any tips to share, especially when generating the cost for auditors.

Solved

Projects Tracking R&D Tax Credits

Best answer by thoyt76

Hello,

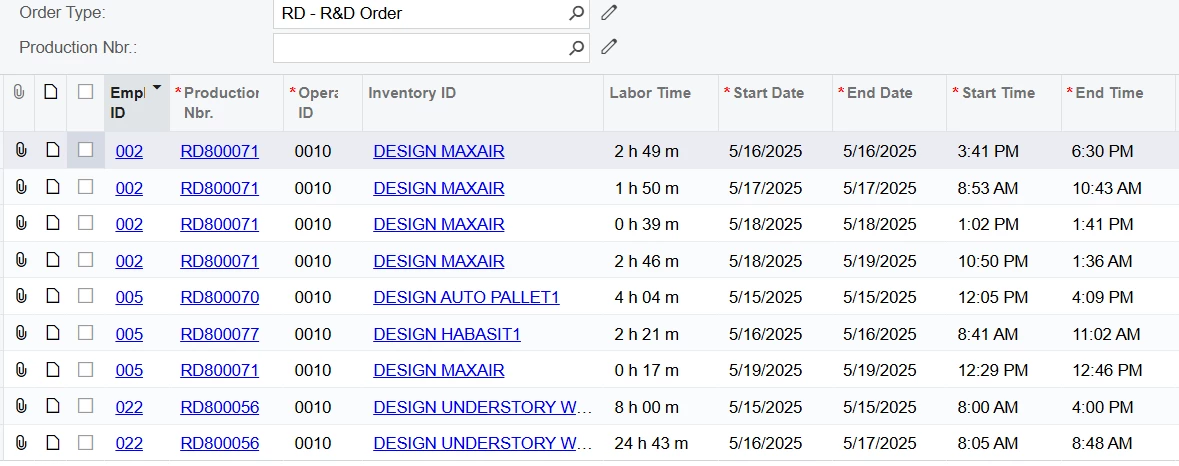

I am using a RD Order type in Production orders to record labor. Yes, my Engineers do have to punch in and out, but I can also manually add their hours or change them if need be.

Here is a screen shot of what they logged. You can see I need to manually adjust Employee 022 on 5/16 from 24 hours 43 minutes. :-)

I hope this is helpful.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.