We are currently paying expense claims via payroll, but considering to move paying expense claims via AP. What does your company do?

Solved

Pay expense claims via payroll or AP?

Best answer by Doug Johnson

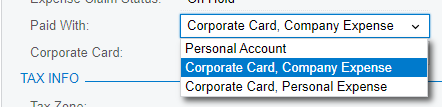

Currently expense claims are paid to employees directly from AP as if the employee is a vendor. Customers who have Acumatica Payroll and Advanced Expense Management can offer both through Acumatica. Employees receive separate checks for payroll and expenses. One person requested a way to merge these in ideas.

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.