Hi all,

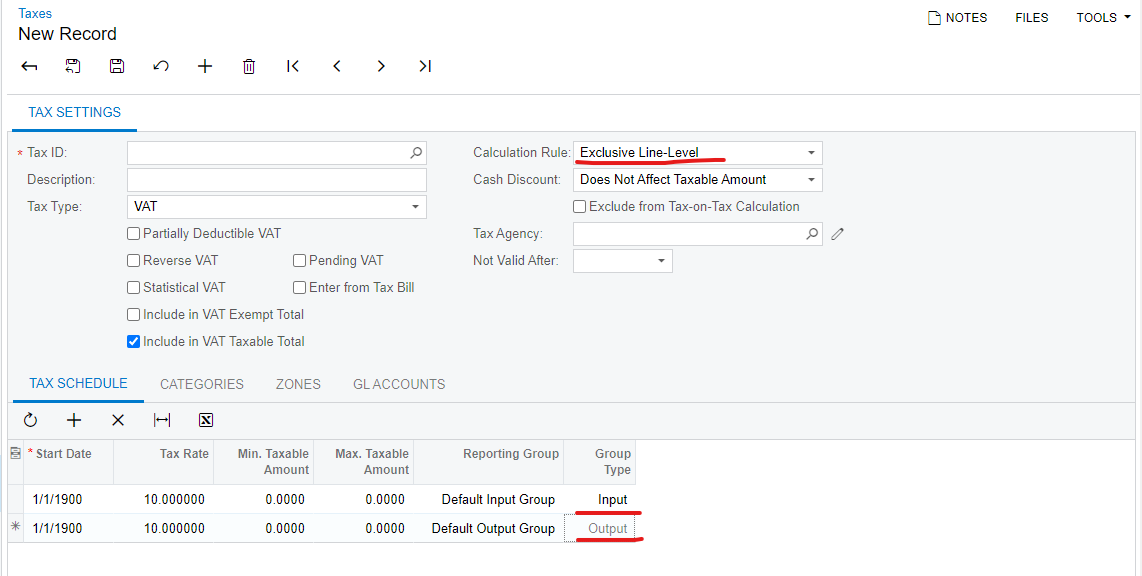

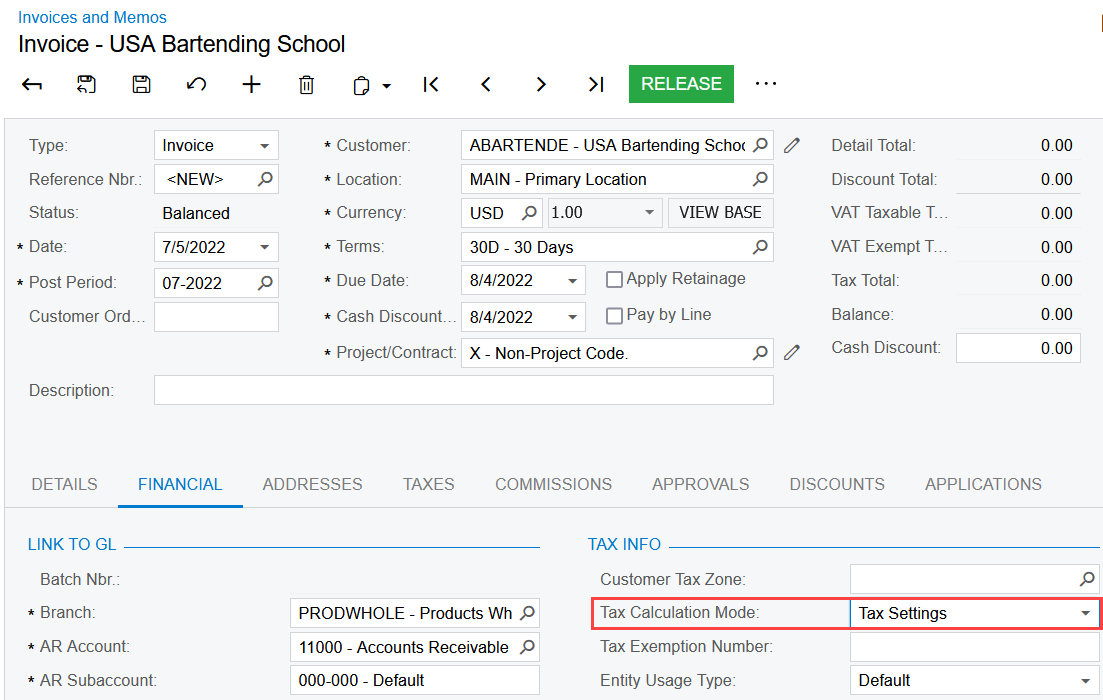

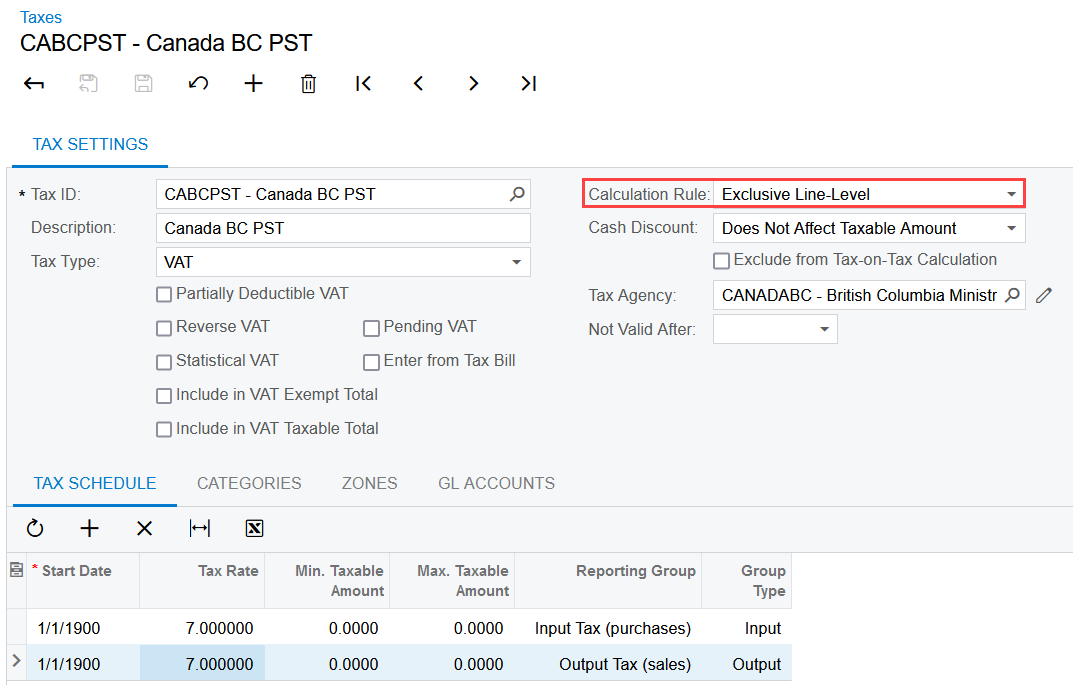

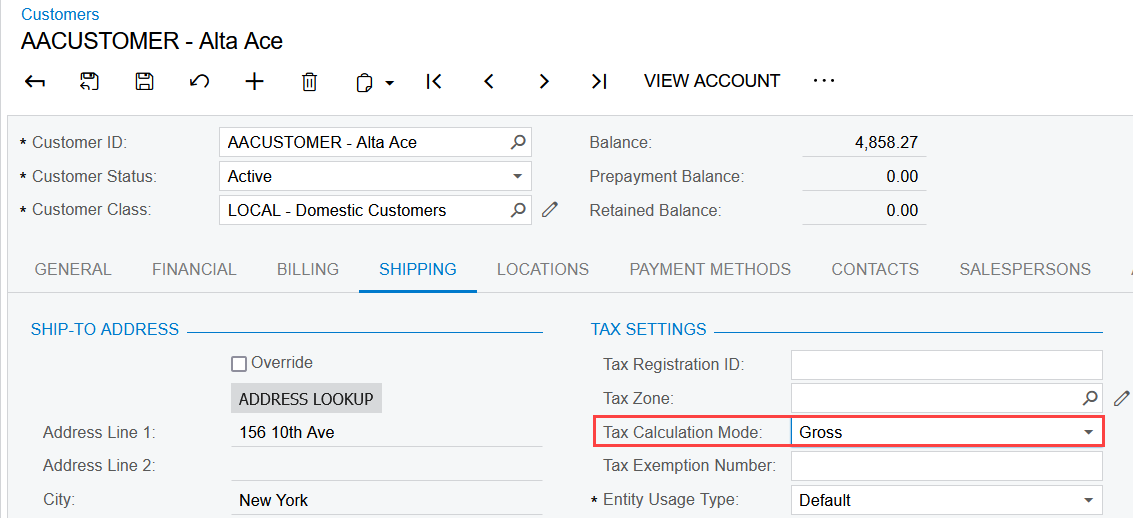

I was wondering if there’s any way to configure a tax code with Net/Gross amount entry on AR invoices and AP bills respectively. For example, I’d like the calculation rule to be inclusive line-level for output VAT, and exclusive line-level for input VAT. Is there any way to achieve that, other than creating 2 tax codes?

Thanks!