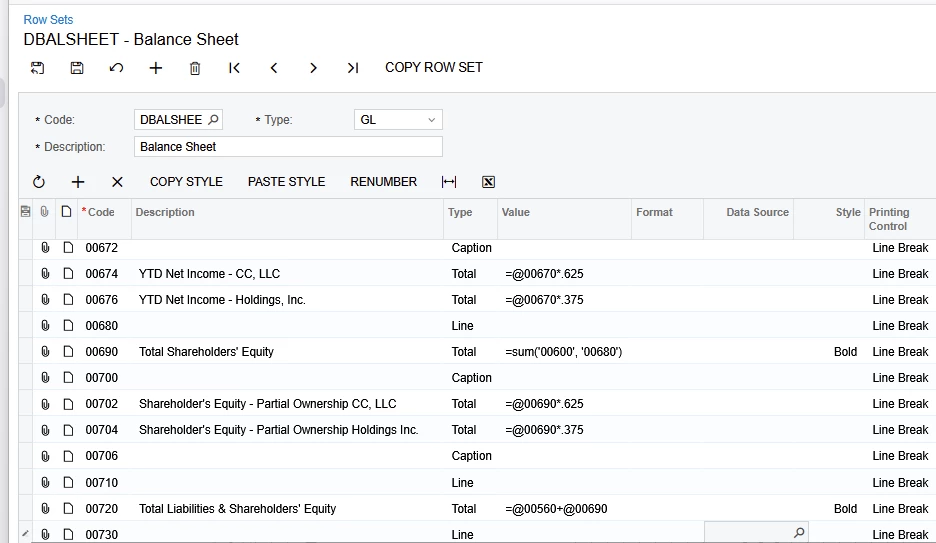

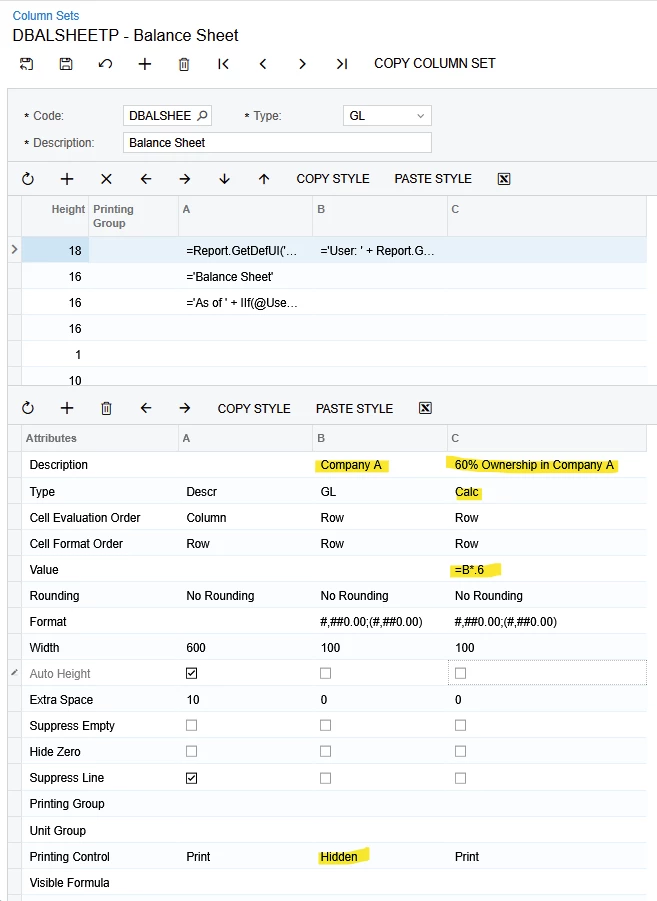

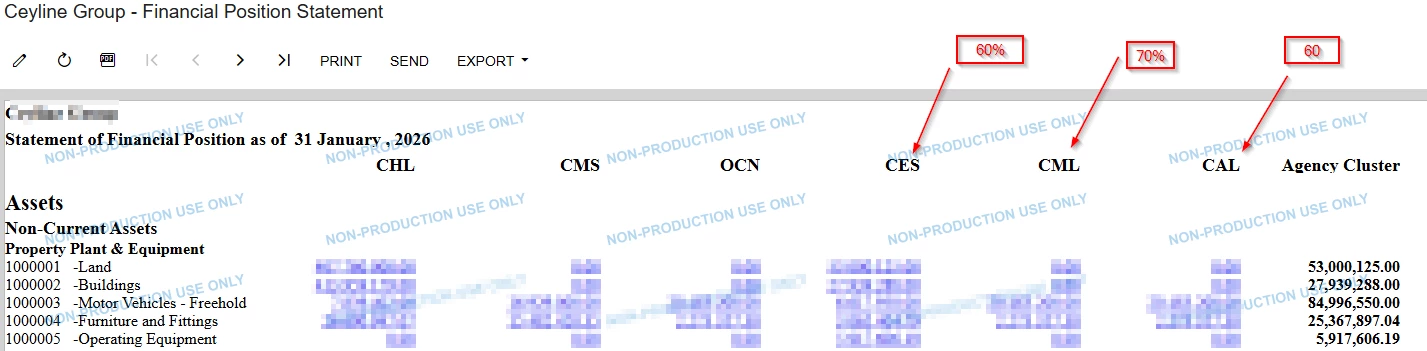

Hi, I’m trying to consolidate group of companies for financial reporting. I’m using ARM reports to consolidate different companies and there are minority adjustments to be made to remove the non-controlling interest of few companies.

Is there any way that can be configured in Acumatica?

Thank you,

Dulanjana