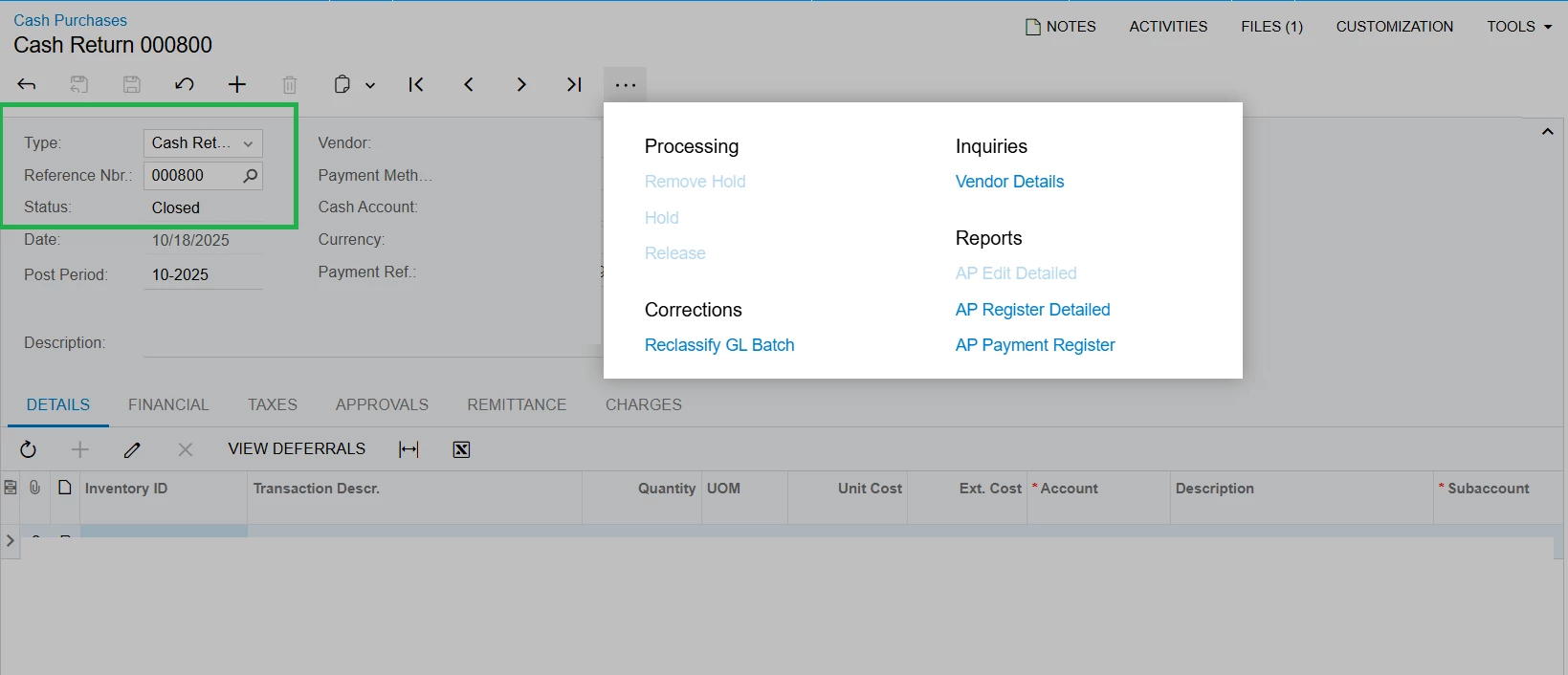

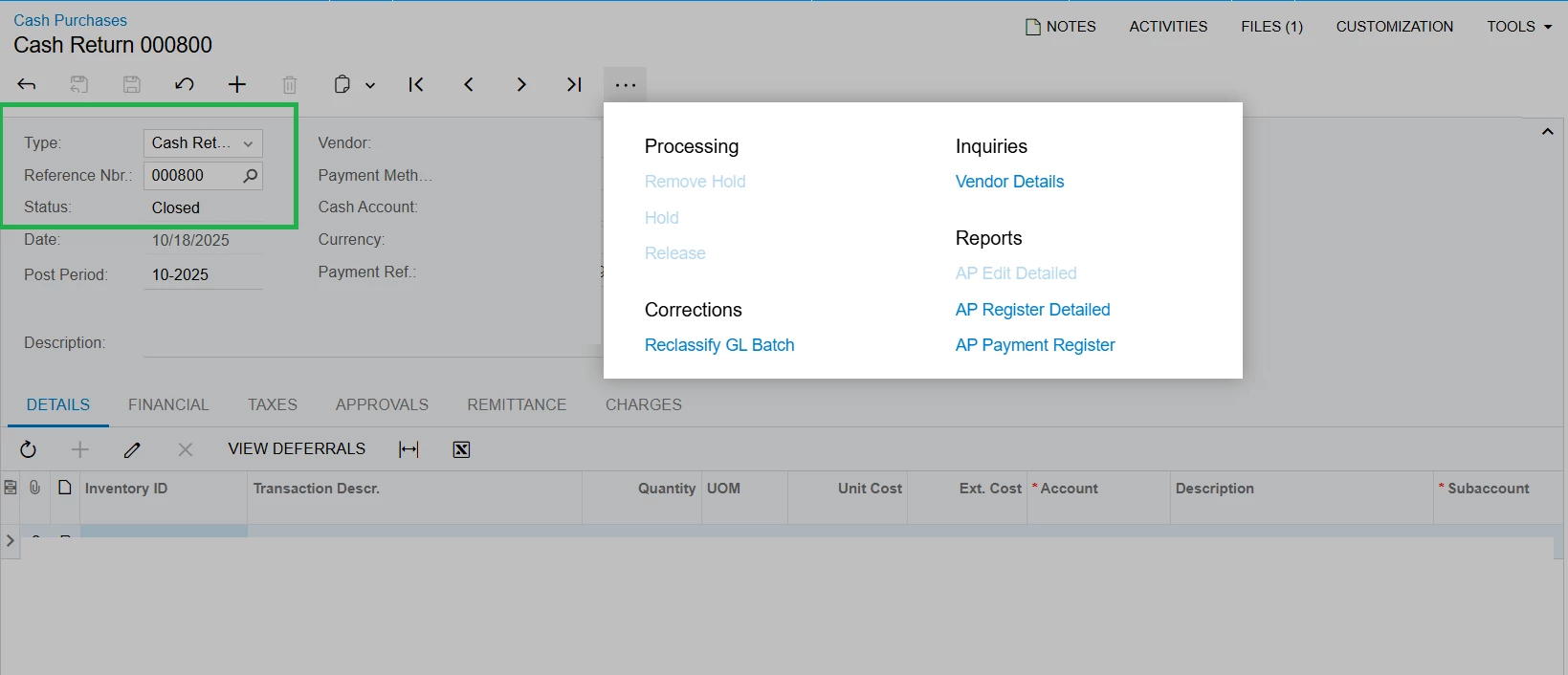

I mistakenly created a cash return and want to void it but do not see an option to void .

I mistakenly created a cash return and want to void it but do not see an option to void .

Best answer by Laura03

Hello,

If a Cash Return was mistakenly entered, and there is no related Cash Purchase that you were trying to reverse… Entering a Cash Purchase transaction with the same Date, Posting Period, Vendor, Cash Account and Details as the Cash Return will nullify the mistaken transaction.

Laura

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.