Dear ALL,

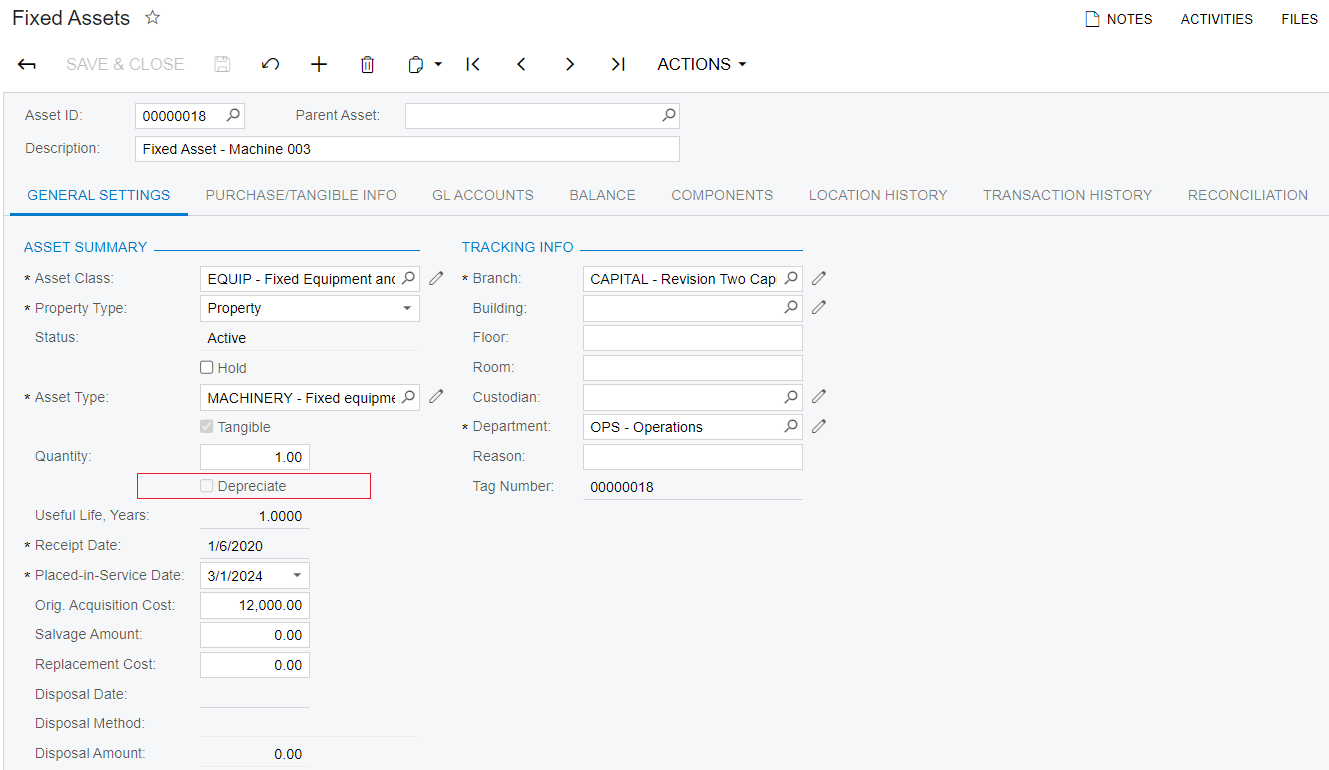

Fixed assets were purchased but have not yet been depreciated, so we unchecked the “Depreciate” field. Now we want to continue depreciating that fixed asset, what should we do?

Currently it is not possible to check again into the “Depreciate” field.

Note: Acumatica Version 2020.R1

Best Regards,

NNT