Hello Sarah,

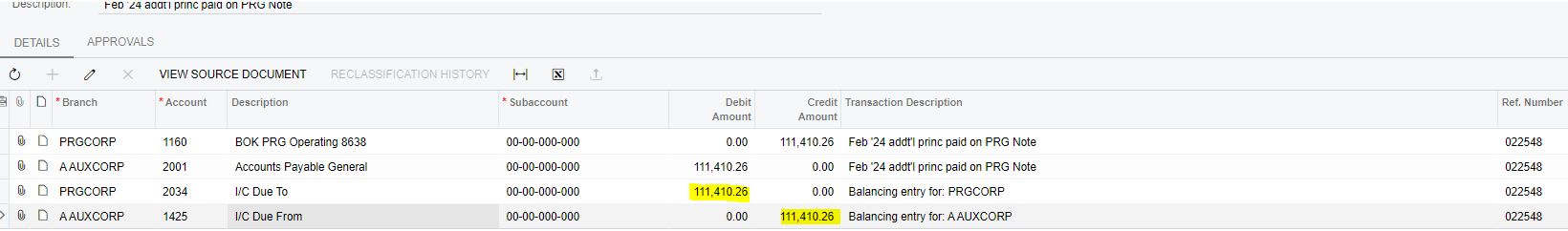

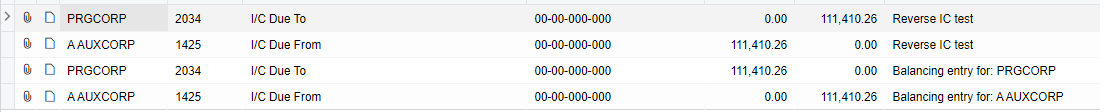

If I understand your question, you would like to make a credit to branch PROCORP account 2034 in the amount of 111,410.26 with a debit to branch A AUXCORP account 1425 in the same amount.

Correct? Let me know if I’ve misunderstood.

The above suggested entry would cause an out of balance situation where Assets do not match Liabilities (Balance Sheet does NOT balance) in either company. I can’t recommend the above (out of balance by branch) entry as a solution.

Please check with your CPA: is there another account that can be used, in each branch to make the entries balanced by Branch? For example:

PROCORP 2034 credit 111,410.26

PROCORP 9999 debit Misc Expense Account 111,410.26

A AUXCORP 1425 Debit 111,410.26

A AUXCORP 9999 Credit 111,410.26

Laura