Is anyone transacting foreign currency payments in the real world in Acumatica?

If so, I’m curious how you’re handling the difference between the rate on the AP Payment record in Acumatica and the rate that your payment provider uses, assuming that you process the payment in Acumatica before processing it with your payment provider.

Here’s an example:

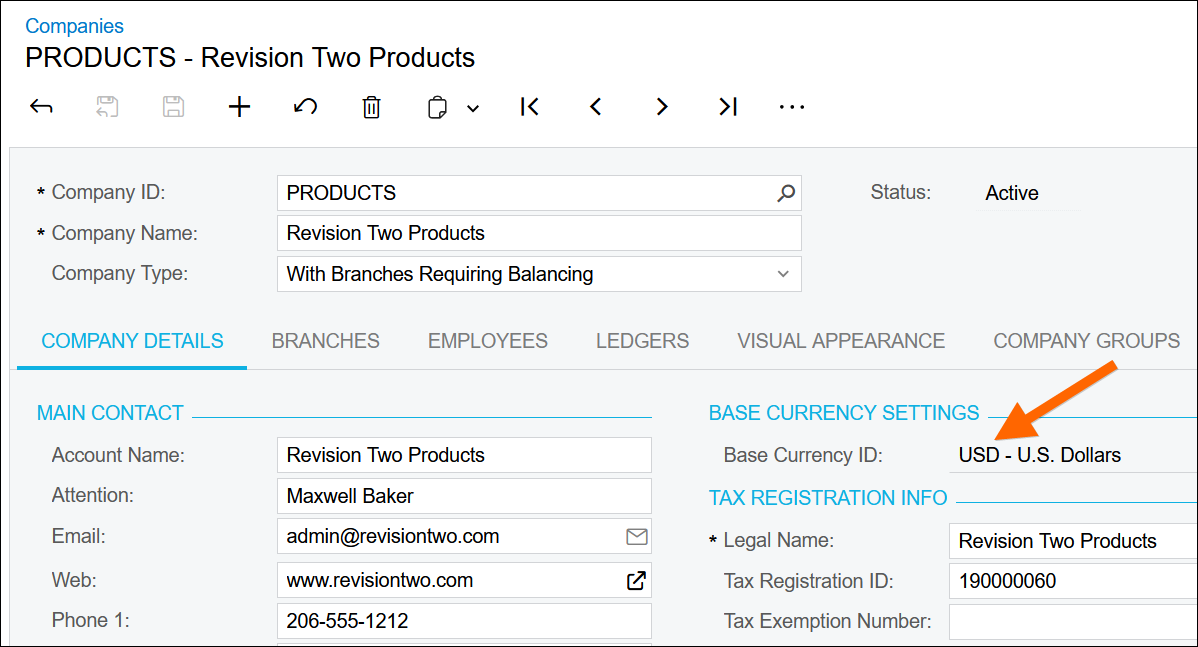

1. The Base Currency ID on the Companies (CS101500) screen is USD

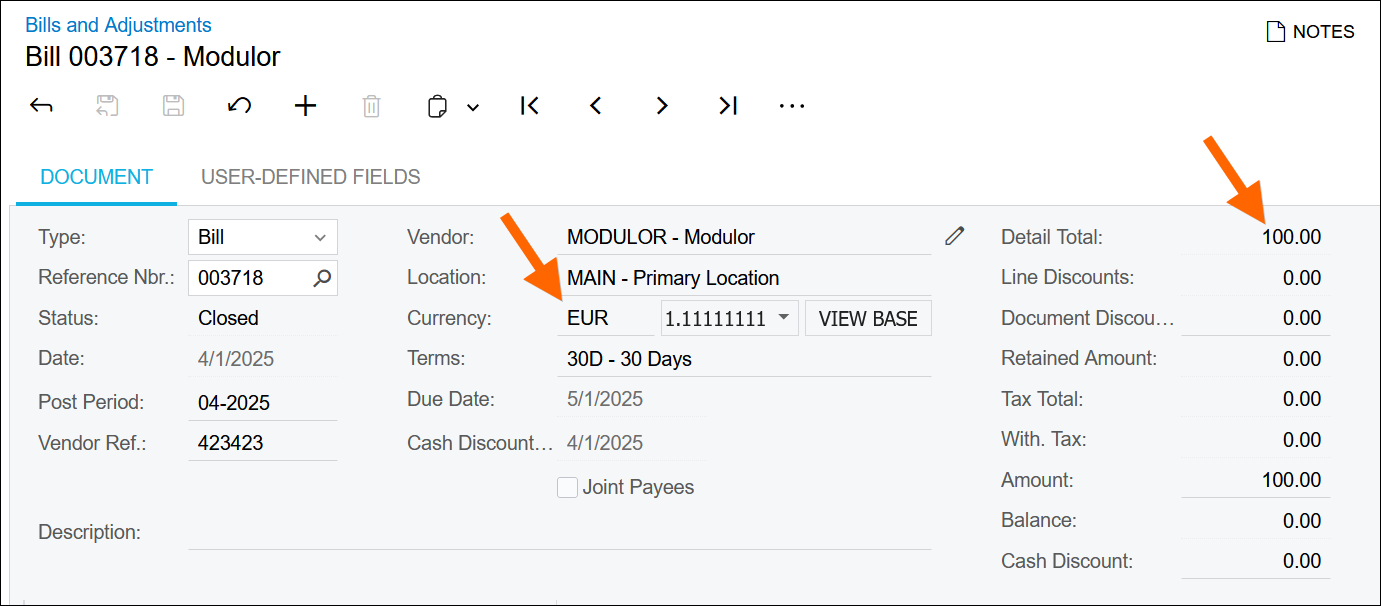

2. Enter an AP Bill in the Bills and Adjustments (AP301000) screen on April 01, 2025 for 100 EUR at a rate of 1.11111111

3. Here’s the journal entry that gets created when releasing the AP Bill showing USD of 111.11

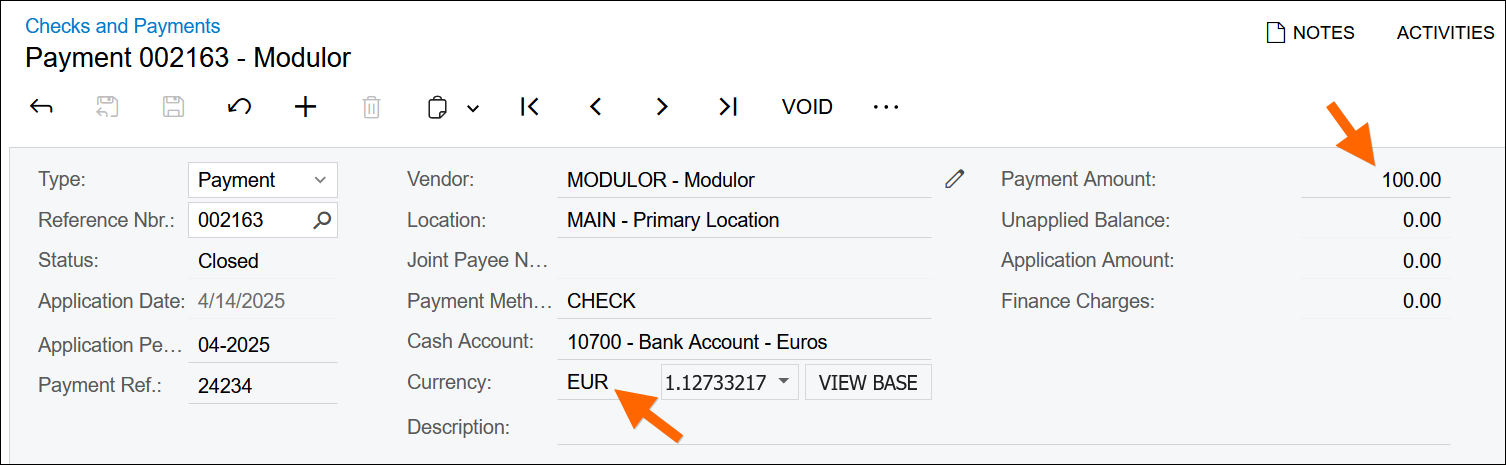

4. Enter an AP Payment in the Checks and Payments (AP302000) screen on April 14, 2025 for 100 EUR at a rate of 1.12733217

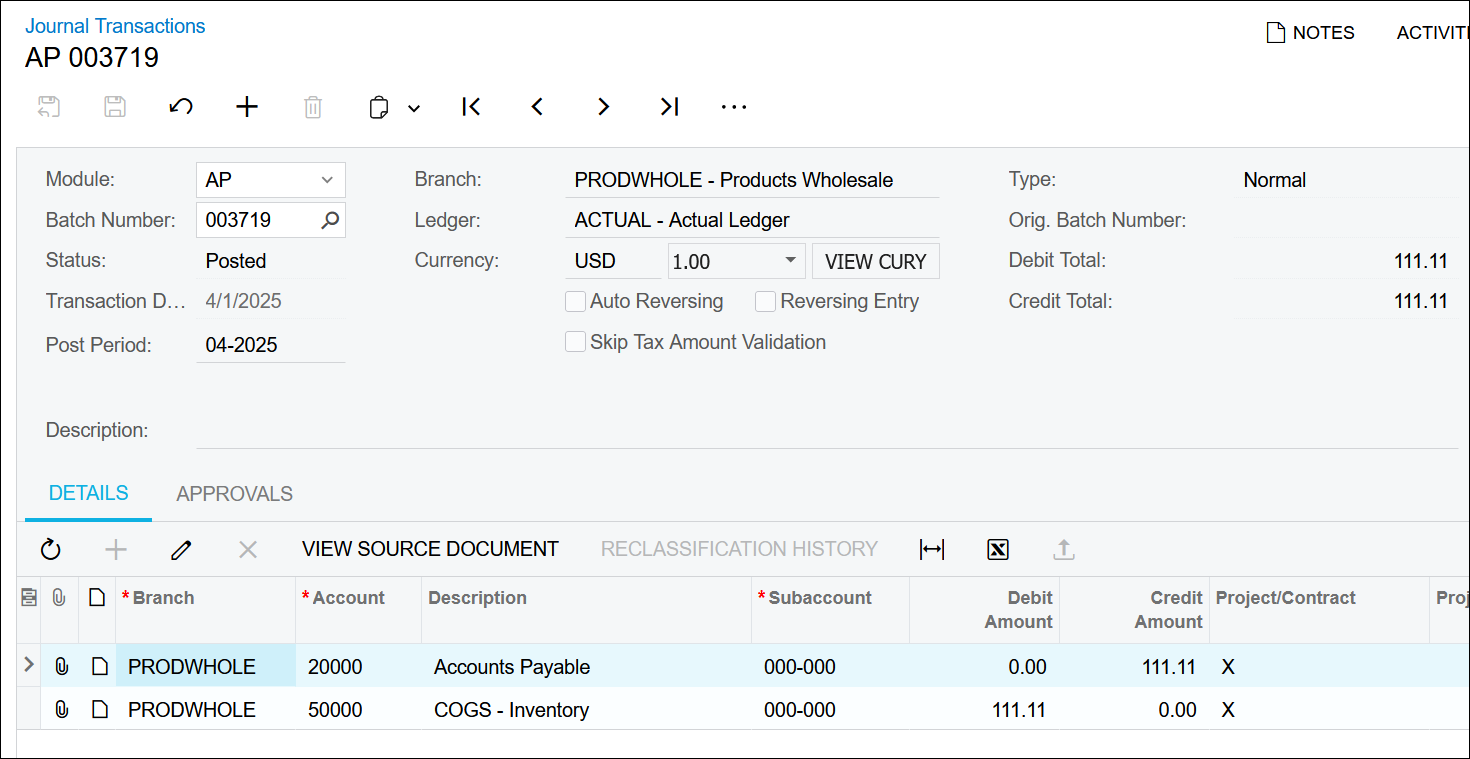

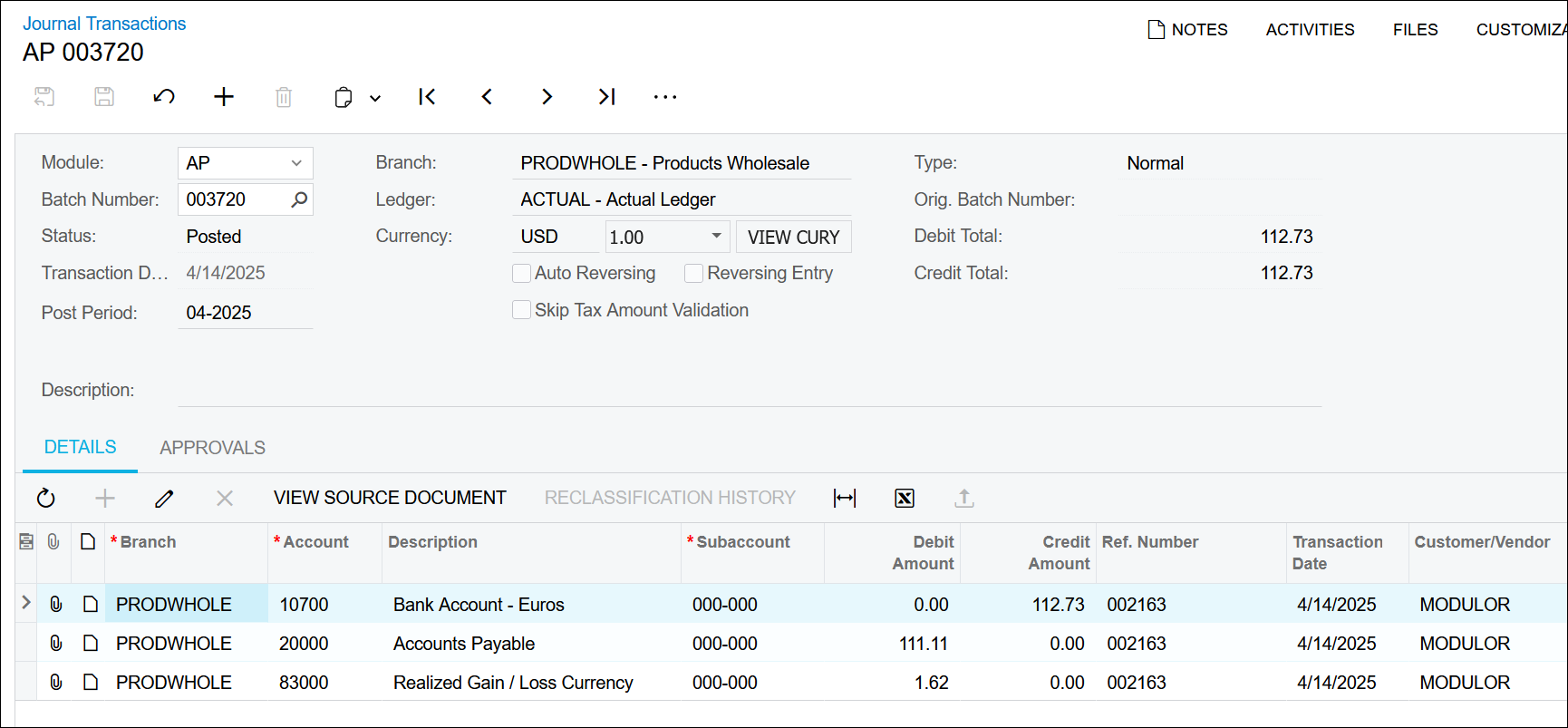

5. Here’s the journal entry that gets created when releasing the AP Payment

The cash gets pulled out of the 10700 account for 112.73 USD because of the 1.12733217 rate on the payment:

100 EUR * 1.12733217 = 112.73 USD

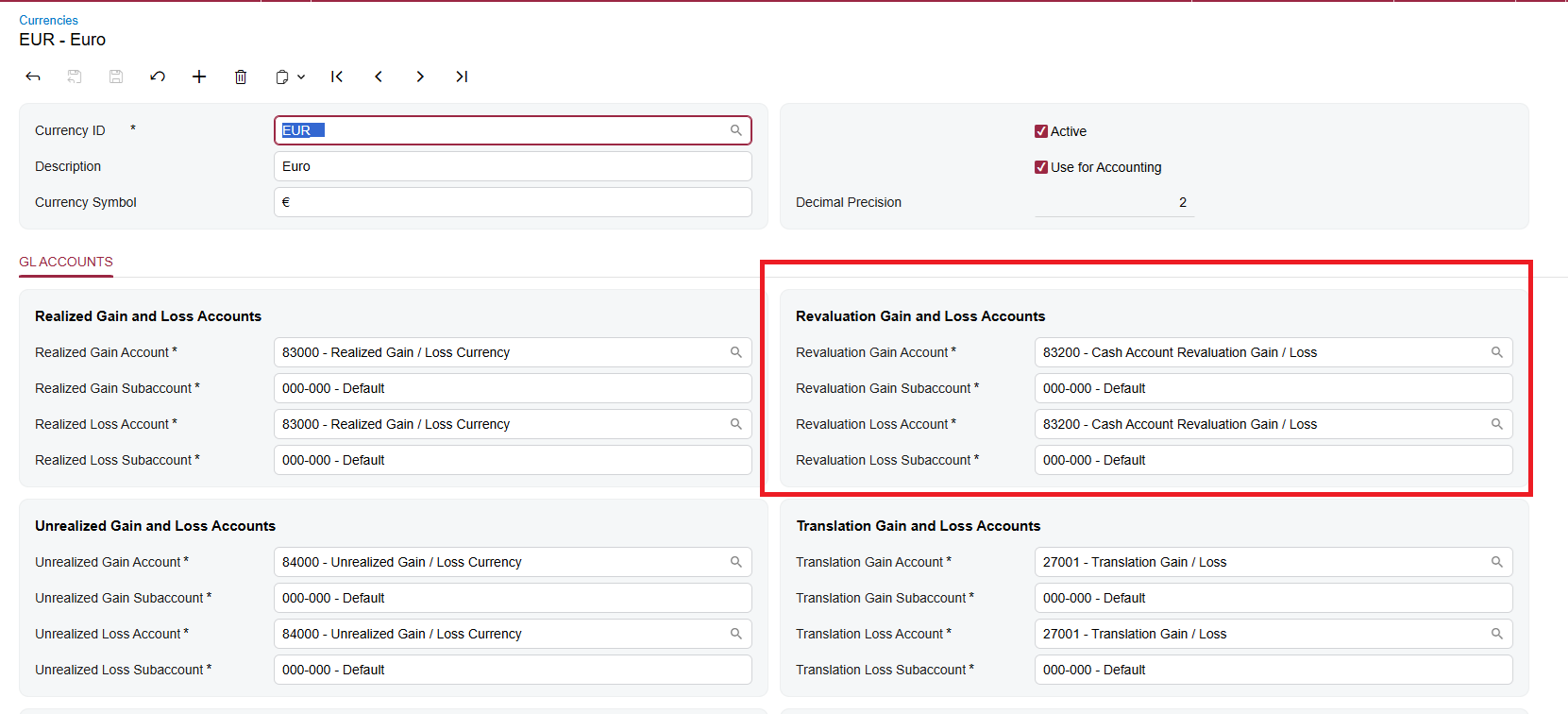

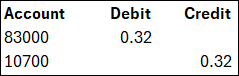

The 20000 account gets relieved for 111.11 USD since that’s the amount that went into the account and the difference of 1.62 USD gets booked to 83000 which is the account specified on the GL ACCOUNTS tab of the Currencies (CM202000) screen:

Now, the issue is, I want to process the payment in Acumatica first since Acumatica is the system that’s authorizing the transaction to happen with the payment provider.

But, whereas the rate in Acumatica fluctuates by the day, the rate with the payment provider fluctuates by the minute.

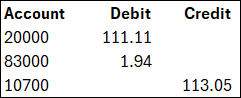

So, in the example above, the rate with the payment provider might be something more like 1.13050642 which would mean that cash should have been credited for

100 USD * 1.13050642 = 113.05 USD

Meaning the journal entry should have been:

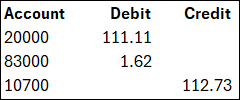

But our entry was this:

So we need to make a correcting entry of the following:

But that’s kind of clunky having to manually create a correcting entry.

Is this how people are doing it in the real world in Acumatica or is there a better way?