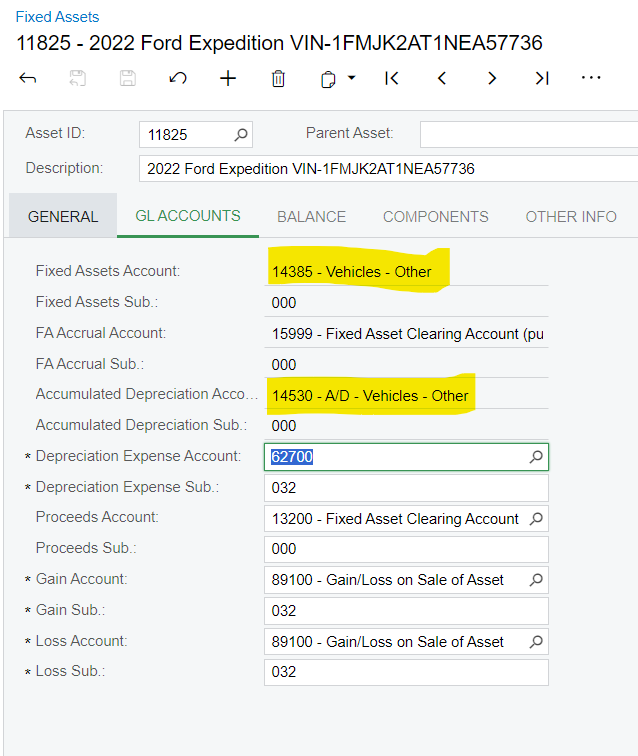

Need to know how to correct Fixed Assets Accounts on the GL Accounts section that is greyed out. The accounts should have been 14380 - Vehicles - Automobiles instead of 14385 - Vehicles - Other and Accumulated Depreciation Account should have been 14525 - A/D - Vehicles - Automobiles. I tried changing the Asset Class on the General tab and it said it would update GL accounts but did not update those above. Vehicle was placed in service on 11/3/23 and has been depreciated for two months.