Hey all —

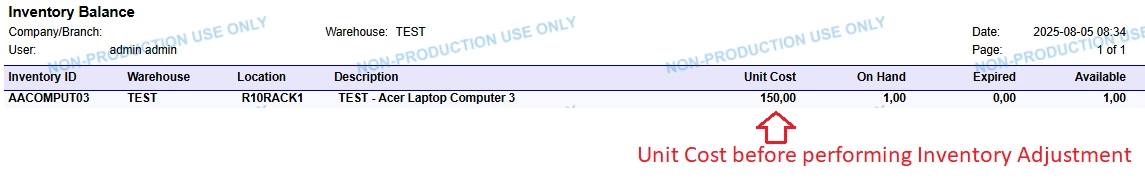

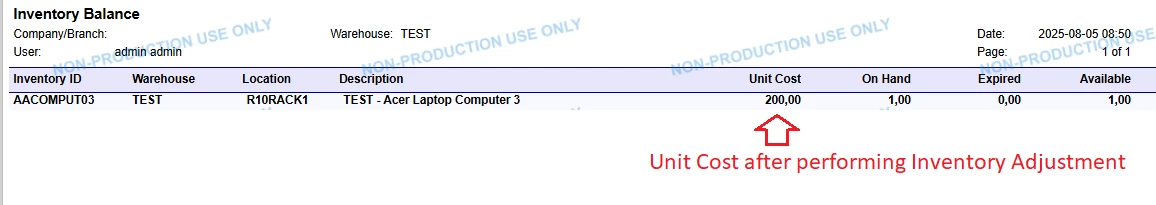

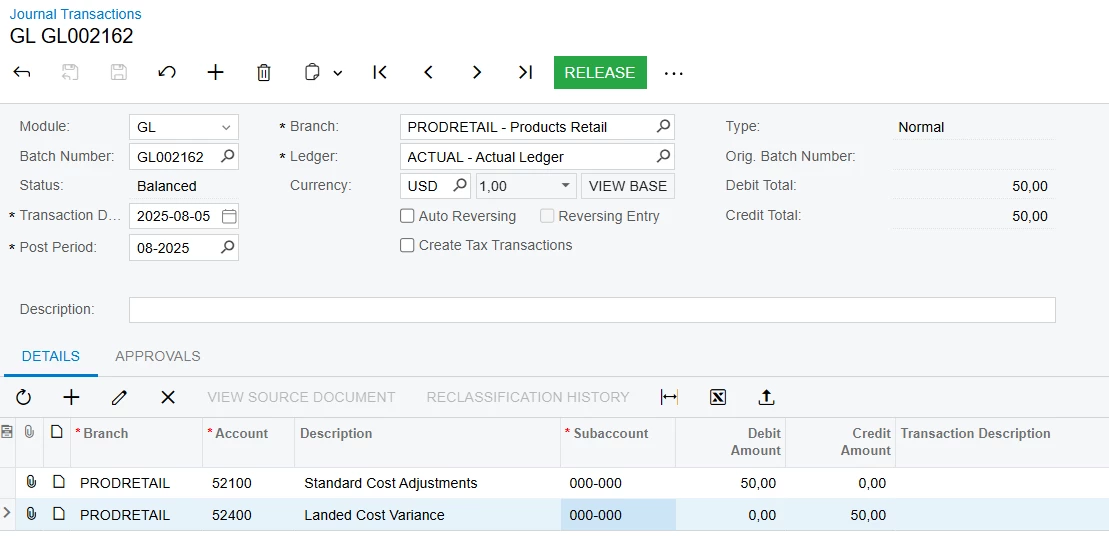

Before we had a solid handle on how landed costs worked in Acumatica, we used to just enter those charges (like freight, duty, etc.) directly onto AP bills as non-stock items. The issue is, that didn’t update the actual cost of the stock items.

Now that we do understand how landed costs work, we’d love to go back and properly incorporate them into the cost of those items.

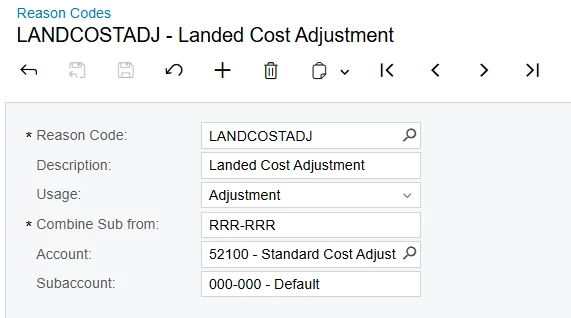

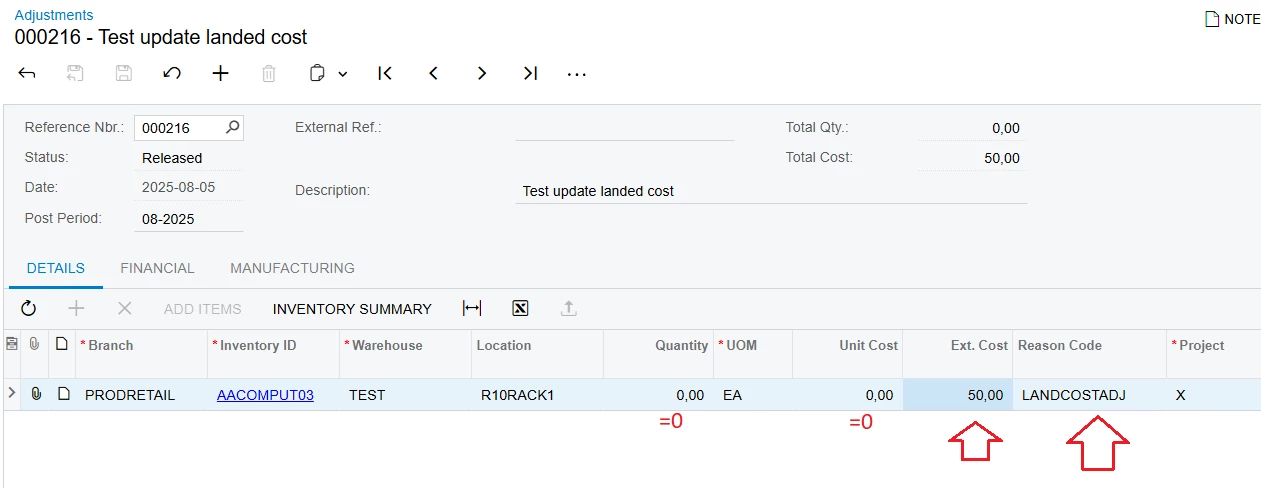

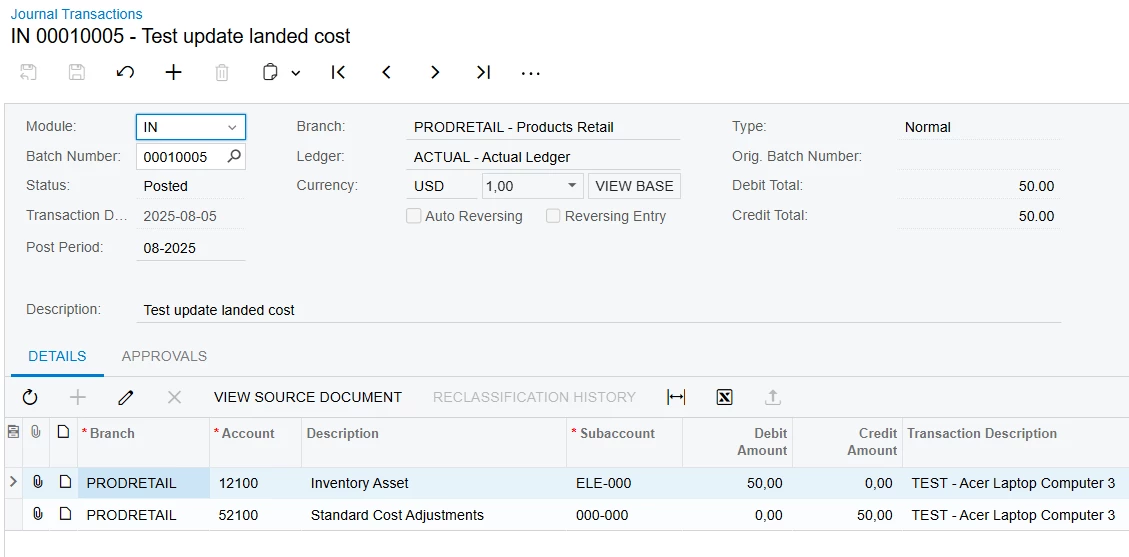

My first thought was to create debit adjustments for those AP bills (where the fees were added as line items), then create actual landed cost docs tied to the original purchase receipts and pay them with the debit adjustments. But after testing, it doesn’t look like that method actually updates the item cost the way we need.

Has anyone found a good workaround for applying landed costs to POs/bills that are already completed and paid? Would love to hear what’s worked for you. Thanks!