Good day,

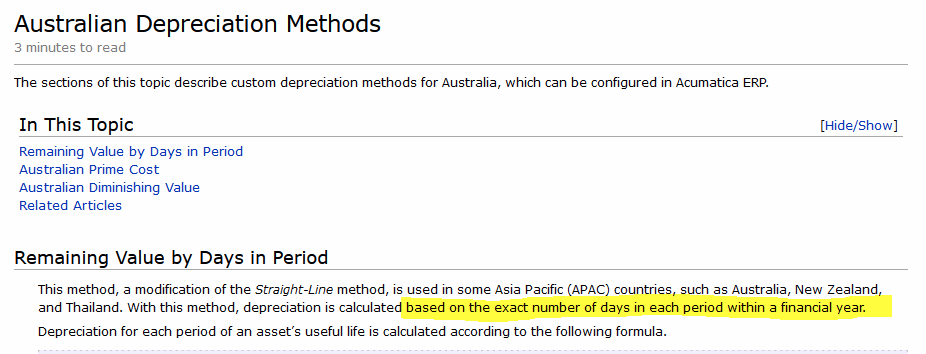

I am trying to depreciate a fixed asset per calendar days per period. For example, if an asset has an original acquisition cost of $365 (useful life 1 year, straight-line), the depreciation schedule should look as follows:

Jan: $31, Feb: $28, Mar: $31, …… , Dec: $31.

I have created depreciation methods using the full day averaging convention but this feature seems to prorate the depreciation when placed in service during a period, for example if an asset is acquired half way through the period - only 50% of the depreciation will be posted to that period.

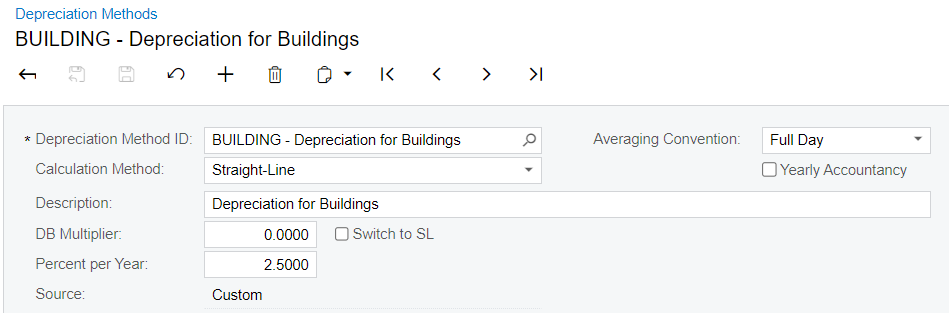

Example of Depreciation Method setup:

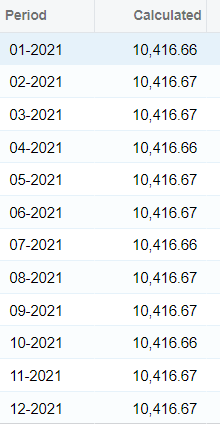

Example of Calculating Depreciation for Fixed Asset:

May you assist?

Kind regards,

Nicolas