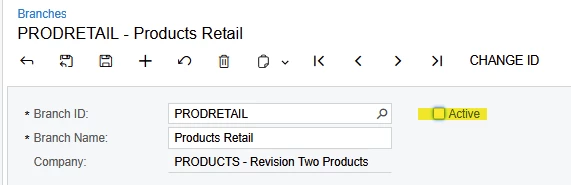

We have filed discontinued operations and closed one of our companies. This company is has active intercompany mapping. There are no gain/loss on sale as we plan to absorb these through the other entities retained earnings. What is the best process to close out this company/branch?

Closed Company with Intercompany accounts

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.