We recently migrated all our SKUs from average to standard costing due to average costs getting all mixed up. We did this by issuing out all of the inventory, updating costing to standard and entering a receipt back in.

I am running the inventory valuation report but continuing to see the inventory valued at average cost rather than the new standard cost of the SKU for many items.

One example is the following SKU:

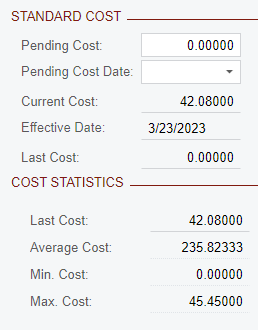

L175:

Standard Cost - $42

QTY on Hand - 425

Expected Cost - $17,850

Cost per Valuation Report

Average Cost - $235

QTY on Hand - 425

Cost on Inventory Valuation Report - $99,875

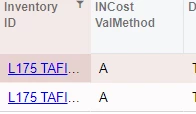

This appears to be an issue for all SKUs with an INCost ValMethod of “A”.

Any reason why this INCost ValMethod would remain as average despite the SKU having been changed to Standard Cost?