We just resolved a long standing dispute with a vendor that resulted in a refund. I want to record this through the AP module so that my vendor history is complete. It seems like the GL entries should be:

dr AP/ cr expense

dr cash/cr ap

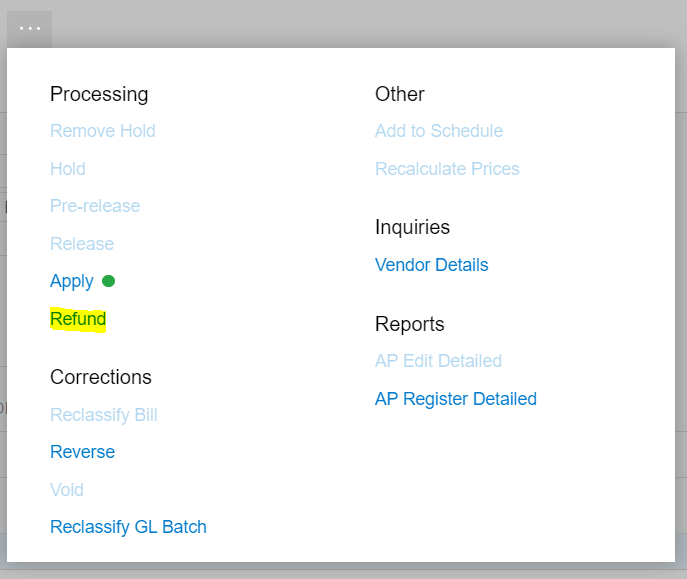

I must be missing something because I see a lot of posts here saying to enter a “vendor credit” but I don’t have that option in my AP. This leaves me with either entering a “debit adj” or a “credit adj”. A credit adj records dr exp/ cr AP, so that’s wrong. This seems to leave me using a debit adj. But, once I record that it seems I can only apply it to an invoice or a credit adj. I can’t seem to then cash settle it.

I can enter it directly in the banking module and the GL will be correct (dr cash / cr expense) but my vendor history will be incomplete.

Thanks in advance for any help.