For tax year 2021, the IRS made minor changes to the 1099-MISC and 1099-NEC forms. Details of the changes can be found on the IRS website.

Acumatica will implement these changes in upcoming versions of the software to assist with customer 1099 filings. There are 3 changes that impact Acumatica.

- Form 1099-NEC sizing. Acumatica will reduce the height of the form to match IRS changes.

- Form 1099-MISC, box 11. New use for box 11 includes any reporting under section 6050R, regarding cash payments for the purchase of fish for resale purposes, from a individual or corporation who is engaged in catching fish.

- Form 1099-NEC, box 2. Payers may use either box 2 on Form 1099-NEC or box 7 on Form 1099-MISC to report any sales totaling $5,000 or more of consumer products for resale, on buy-sell, deposit-commission, or any other basis.

1099 Paper Forms:

Changes to the 1099 Paper forms are currently available in the following builds of Acumatica:

- 2021 R2 Update 3 Hotfix 1 (21.203.0030) and later

- 2021 R1 Update 17 (21.117.0037) and later

- 2020 R2 Update 19 (20.219.0018) and later

- 2020 R1 in the form of a customization package, see this knowledge base article

When running 1099 reports, make sure that:

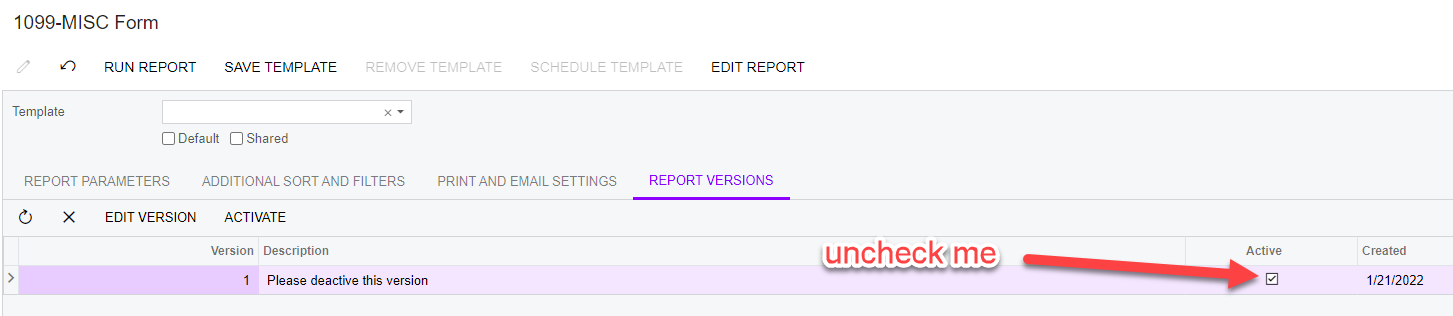

- There are no active custom versions of the report on the Report Versions tab. Please note that customized reports cannot be updated. In order for changes to take effect, all custom versions of the report should be deactivated.

- A proper year is selected when for 1099-NEC report.

1099 E-filing:

Changes to the 1099 E-filing are currently available in the following builds of Acumatica:

- 2021 R2 Update 5 (21.205.0063) and later

- 2021 R1 Update 17 (21.117.0037) and later

- We have discovered an issue that in some cases affects generated e-files of NEC format. The issue was fixed in the Update 18 (21.118.0038), see this knowledge base article for more information

- 2020 R2 Update 19 (20.219.0018) and later

- We have discovered an issue that affects e-files generated when the Direct Sales Only check box was selected on the Create E-File form. For detailed information and applicable workaround, see this knowledge base article

- We have discovered an issue that in some cases affects generated e-files of NEC format. The issue was fixed in the Update 20 (20.220.0016), see this knowledge base article for more information.

- 2020 R1 in the form of a customization package, see this knowledge base article