HI,

I have set up allocation and billing rules based on the attached document to process project billing from field service appointments.

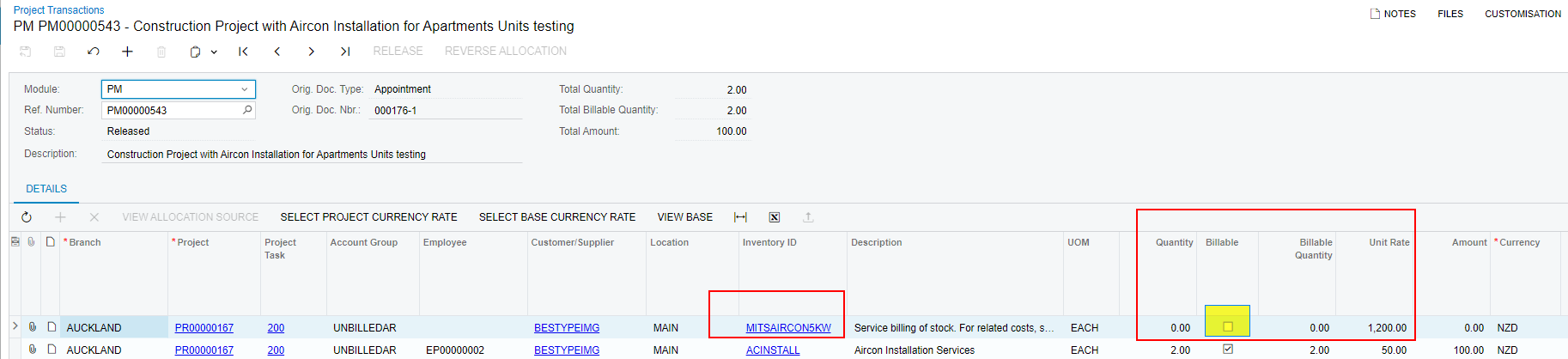

However, when we run billing from the appointments, the system is not marking stock items as billable. As a result, these stock items are not being billed in the AR invoice when we execute the project billing

I've attached a document on the field service management demo script, which includes the setup process and a detailed transaction process between pages 58 and 95.

Can someone please review and let me know why the stock item is not being marked as billable in the project transaction.

Thanks.