When a Purchase order has been received and later returned. We need the system to block the bill of the PO Receipt.

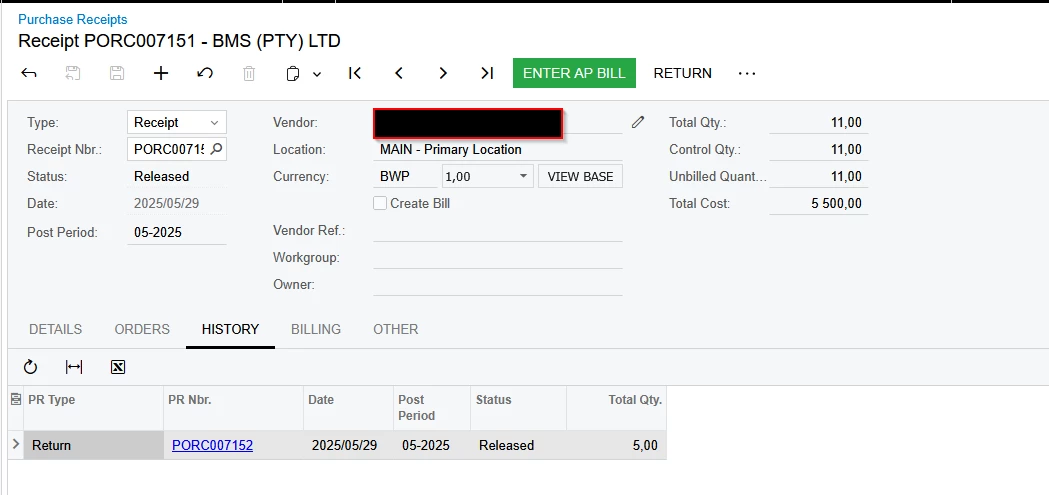

On the PO Receipts the history Tab will show the Returned items.

Sample Scenario:

Purchase 10 items.

Receive all 10 items. Return 5 Items and create and release the Debit Adjustment to return the 5 items.

On the Purchase Receipt, when I enter AP Bill the Bill QTY is 10 and it does not consider the 5 Items that I have returned.

How can I stop the Enter AP Bill for all 10 items