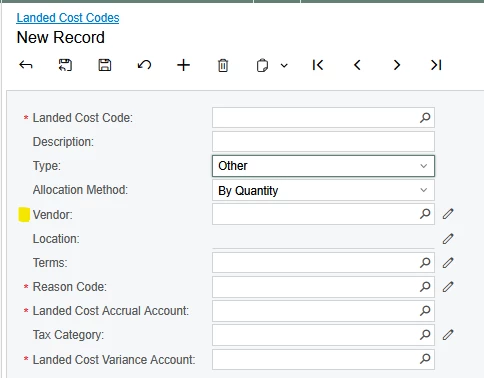

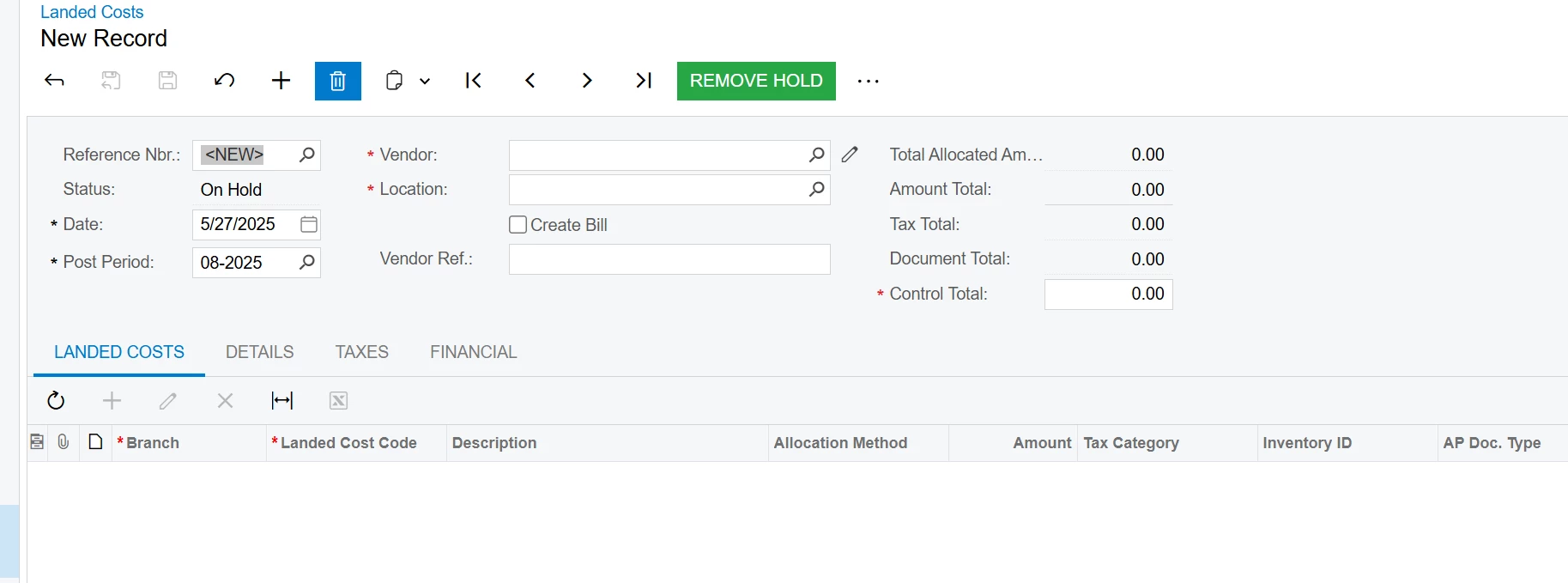

We are using our own freight trucks to pick up inventory from manufacturers. We want to include the freight cost in the cost of those items that were purchased from the manufacturer but picked up by our trucks. We do not need an AP bill for this transaction since its not third party. Is there a way to use the landed cost process without creating an AP bill?

Just FYI, we come up the with the freight cost by using a home grown freight cost estimator tool. Takes the overhead cost, repairs, maintenance, fuel price and mileage to come up with the freight cost. We would like to use the landed cost screen to enter that information and distribute the freight cost to the items on the PO without ACU forcing an AP bill. Is anyone needing this functionality?