Hi Team,

Hi,

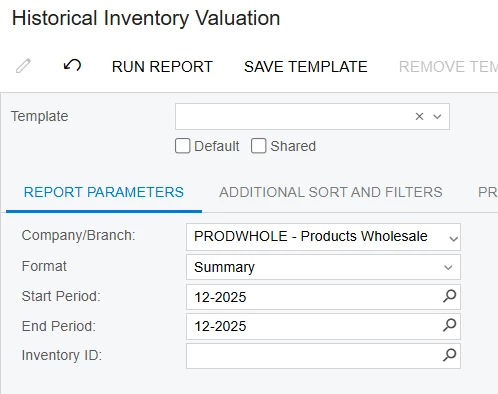

I’ve just received a landed cost invoice (dated 2026) for goods on a purchase receipt in 2025. If I enter this bill at it’s current date in 2026, but assign the costs to the goods on the purchase receipt dated 2025, will it change our inventory value at Dec 31 2025 Year end?