Hi

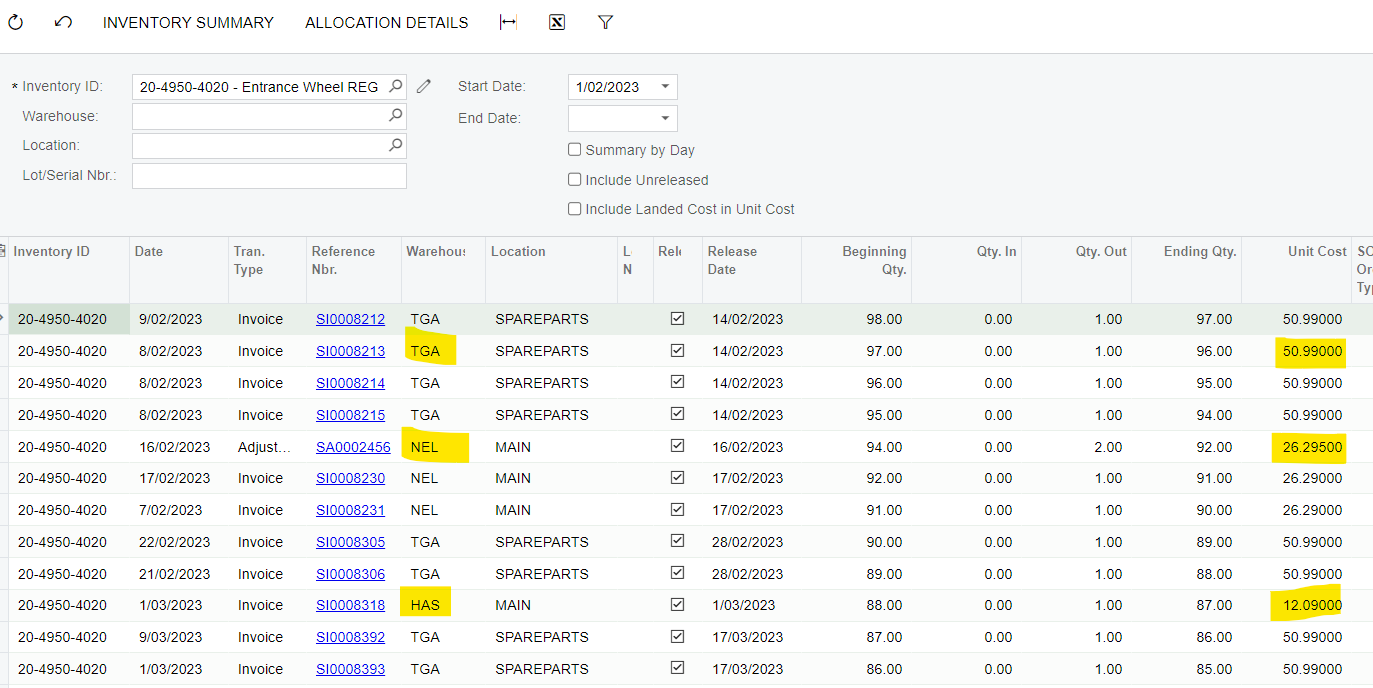

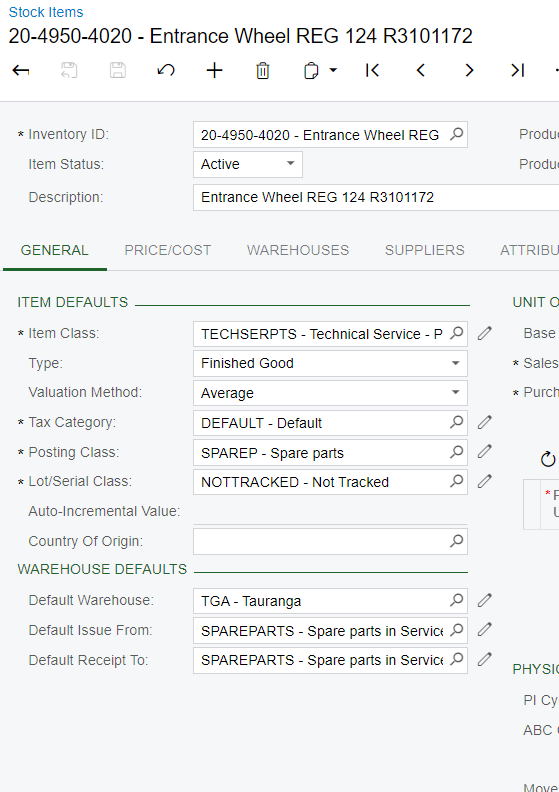

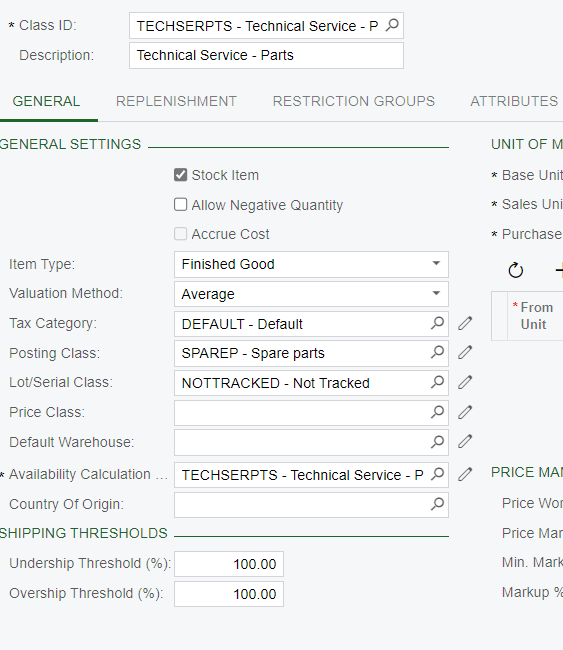

We have 9 warehouses and use average cost. We want the same stock item to have the same average cost across all warehouses. Unfortunately, this isn’t working for us, and each warehouse has its own average cost. This makes sales margin reporting a nightmare. Our auditors are also questioning our inventory costing method.

Can Acumatica do the same average cost for an item across all warehouses? The help manual says “yes”,

If the Average valuation method (also known as average moving cost) is assigned to the stock item, the unit cost will be calculated as the average weighted cost of all items at the warehouses—that is, the total costs of all quantities of the inventory items at the warehouses divided by the total quantity.

but our support company says “no”.

thanks