Hello,

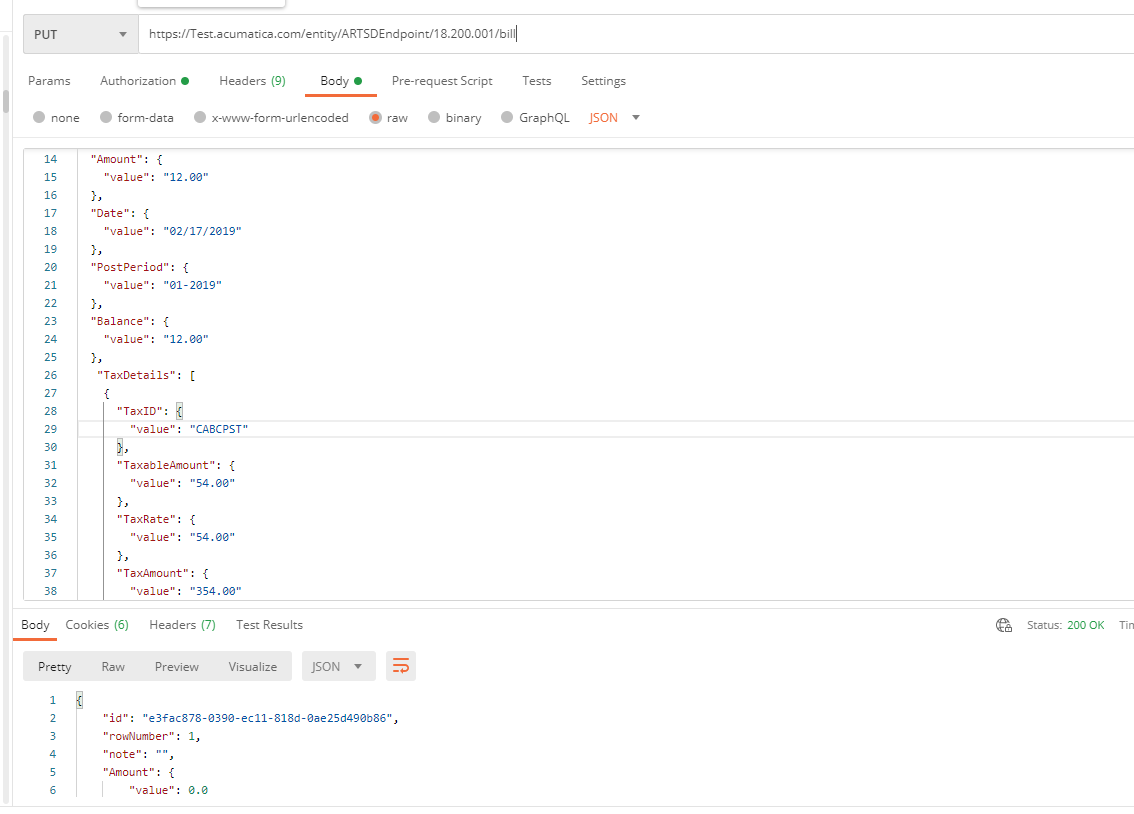

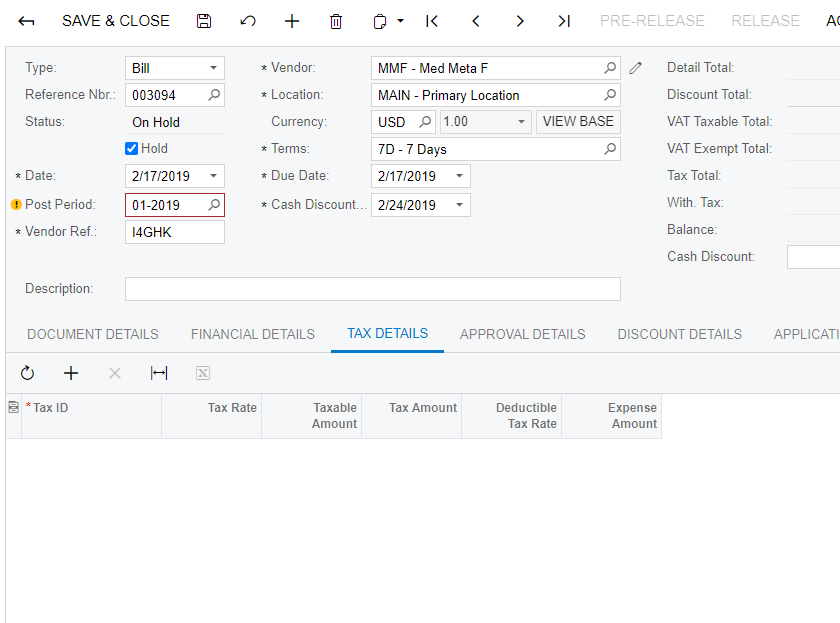

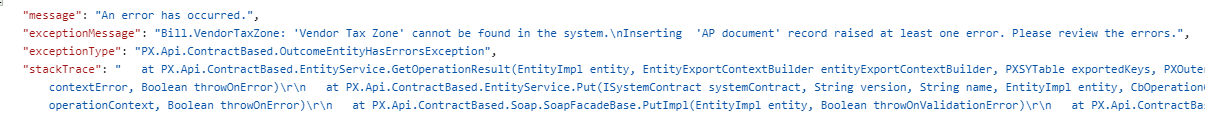

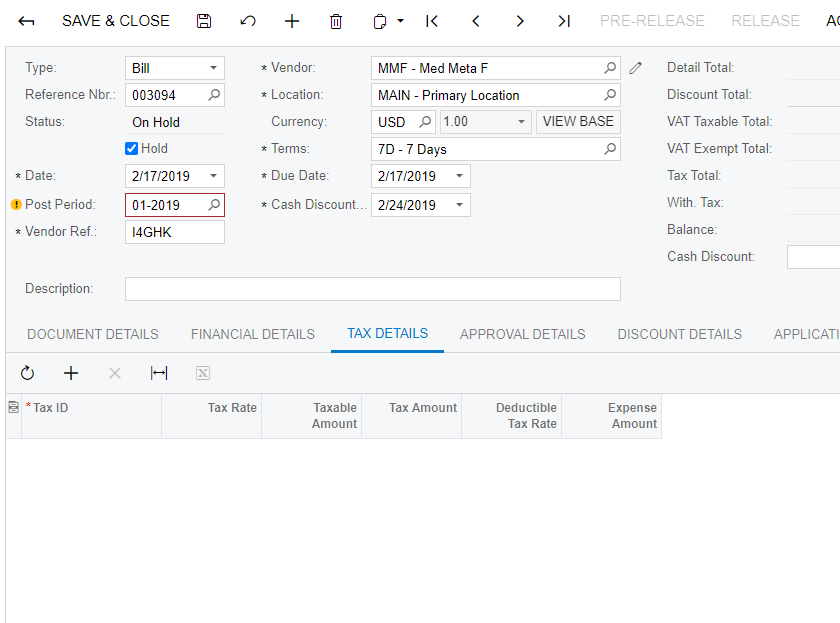

I have an issue to export TaxDetails table to Acumatica together with bill data.

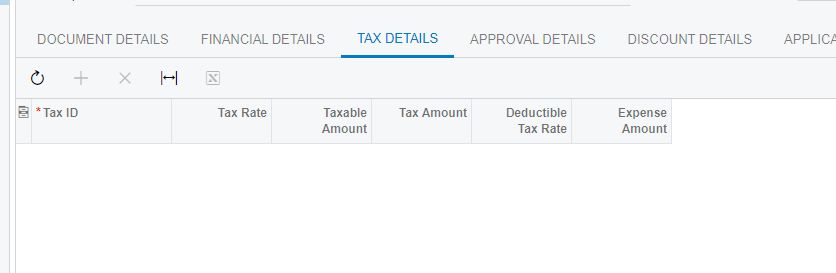

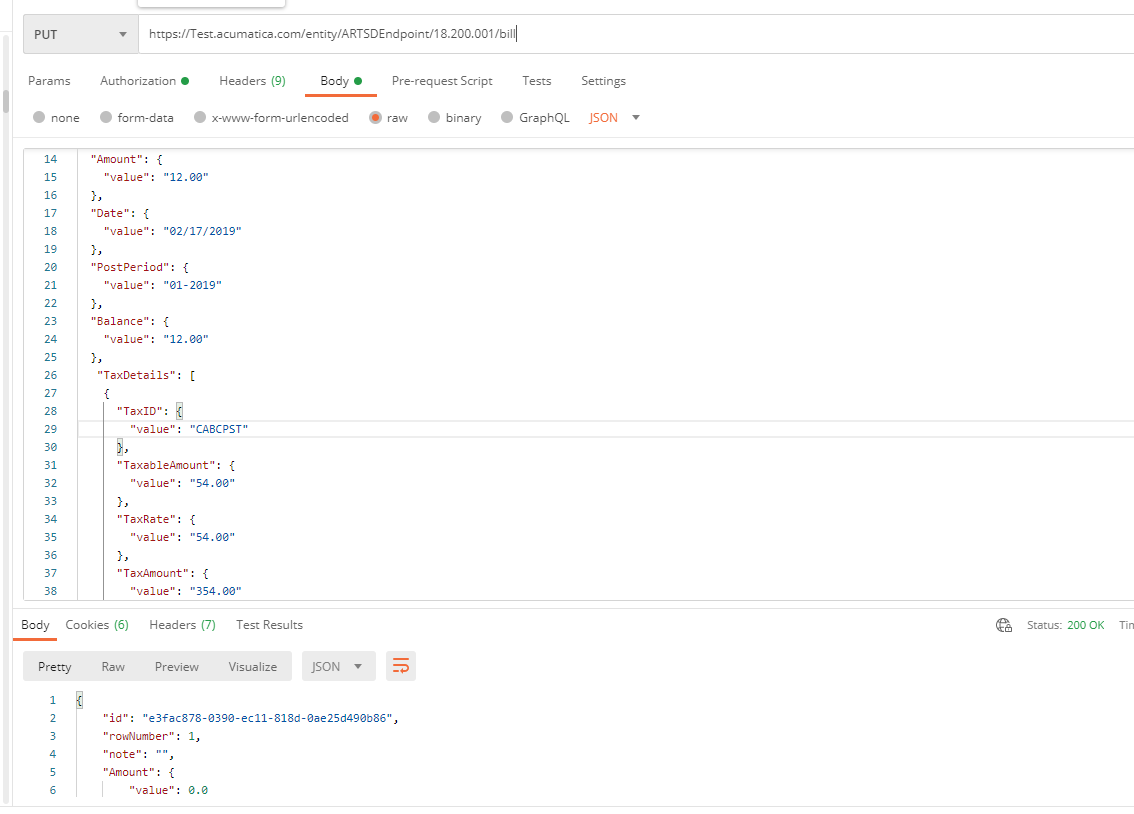

I prepared columns : TaxID, TaxRate, TaxableAmount, TaxAmount. for request

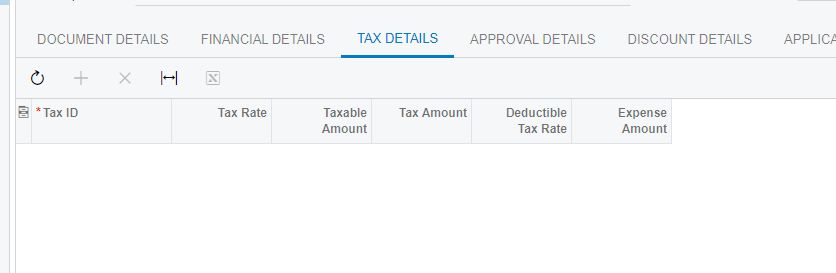

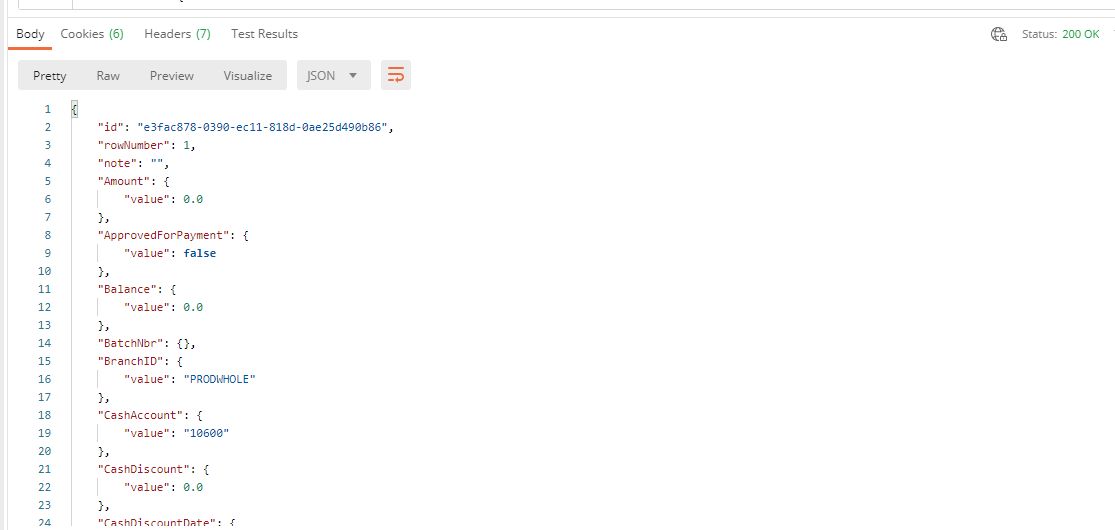

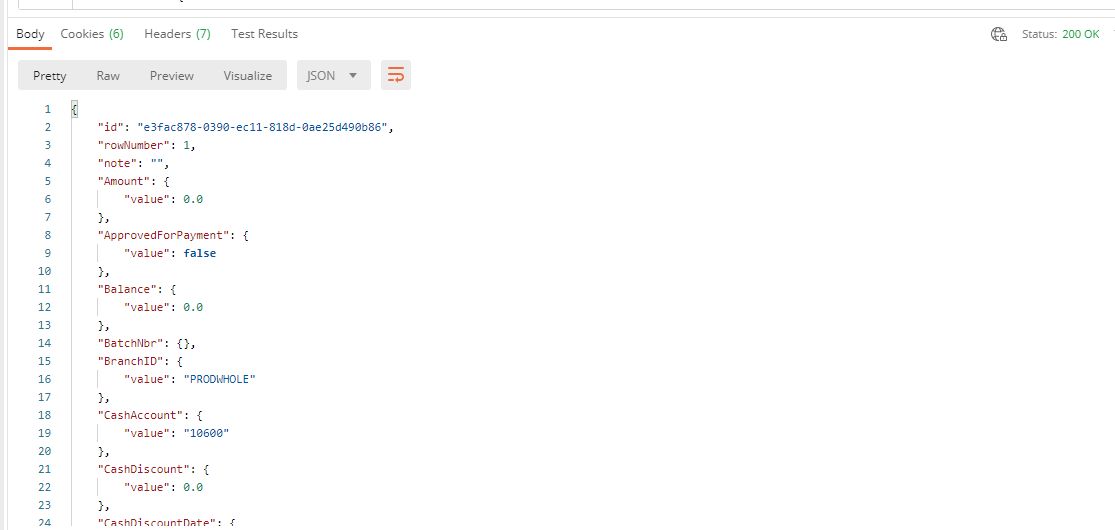

Request is received status OK, new bill Item is appeared at acumatica

, but tax details is empty

Is there any special conditions, with the help of which I can send TaxDetails table data to Acumatica?

Best answer by jinin

Hi @Ivan

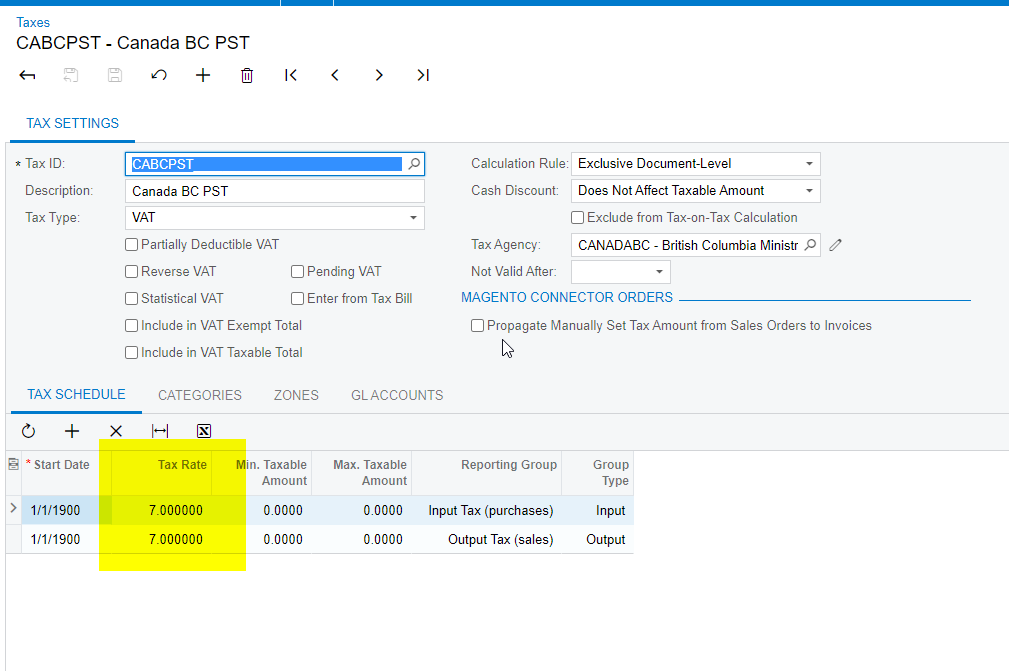

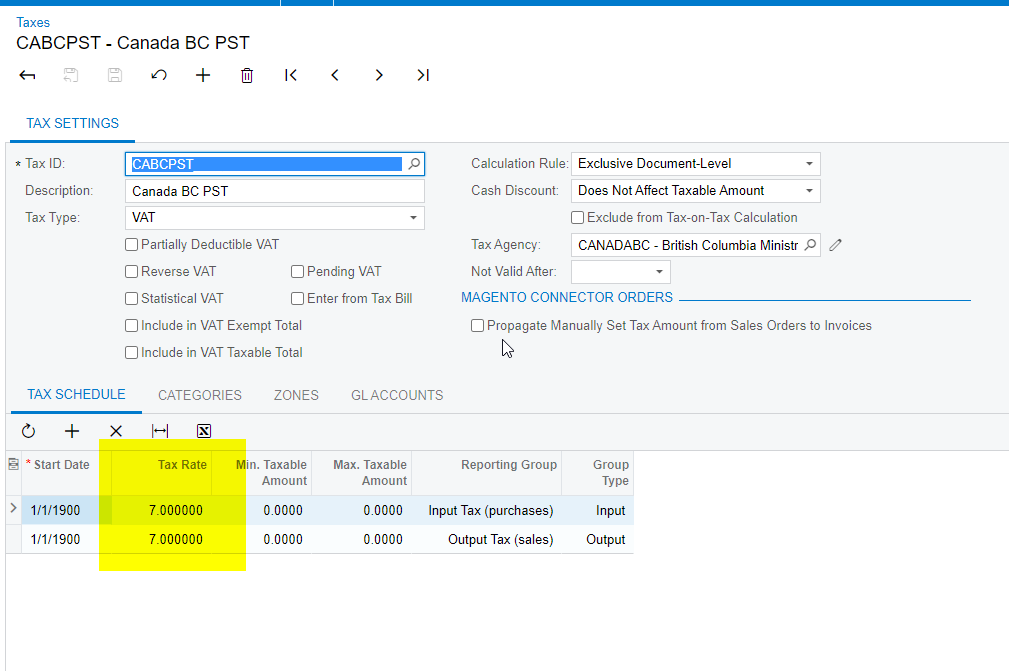

The tax details insert the records based on the Tax configuration.

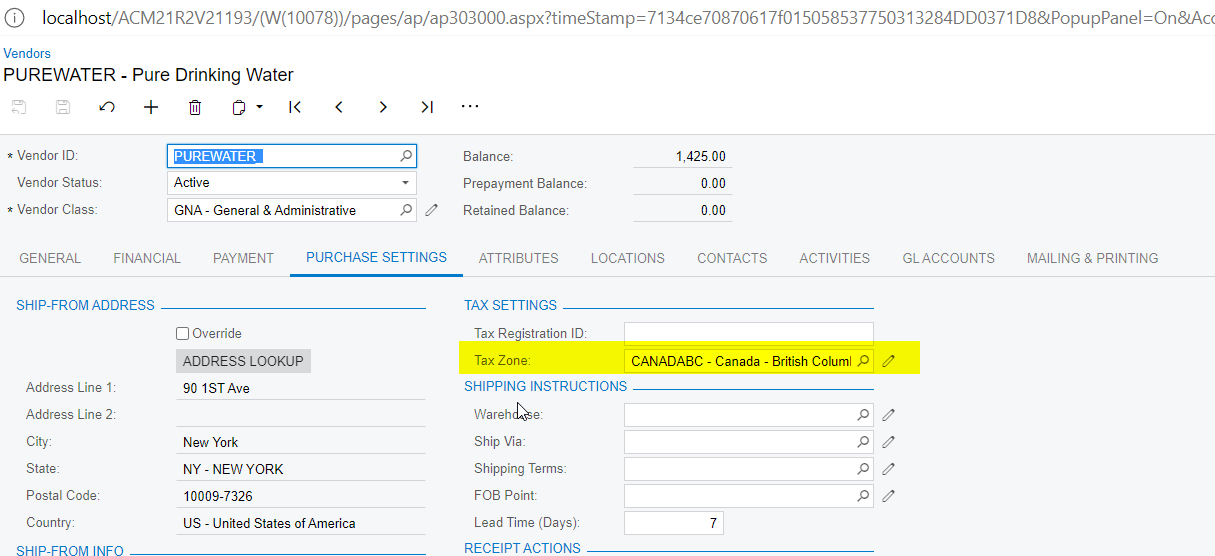

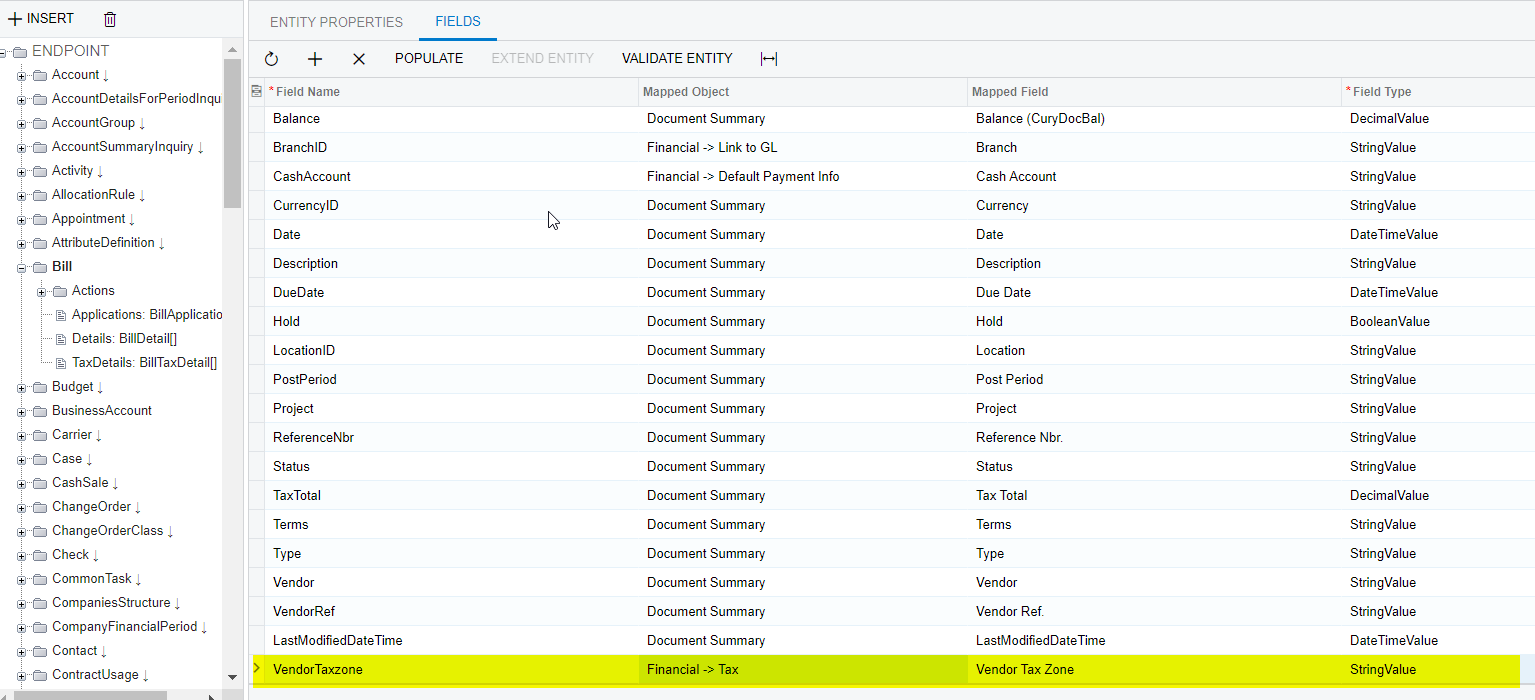

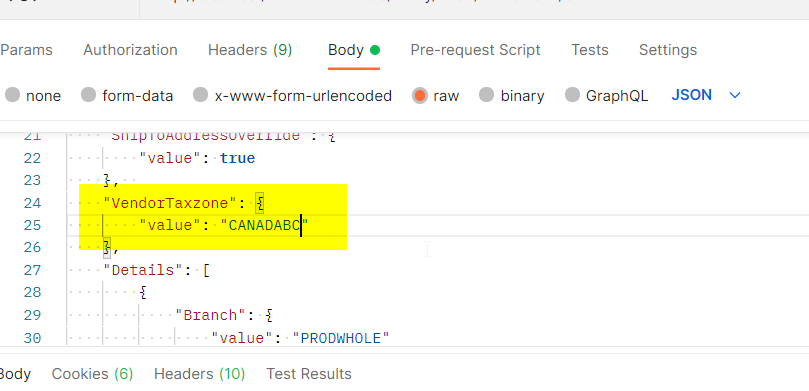

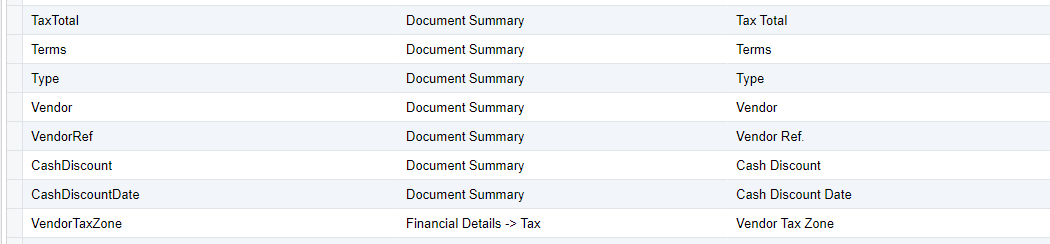

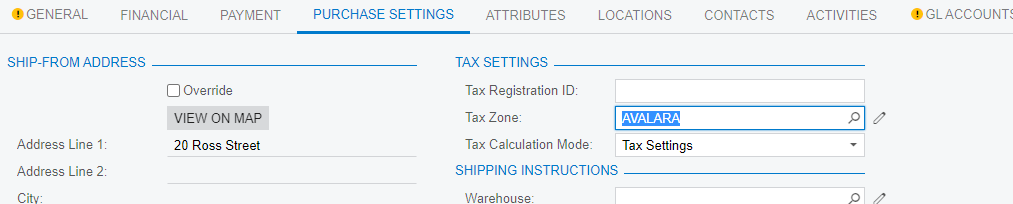

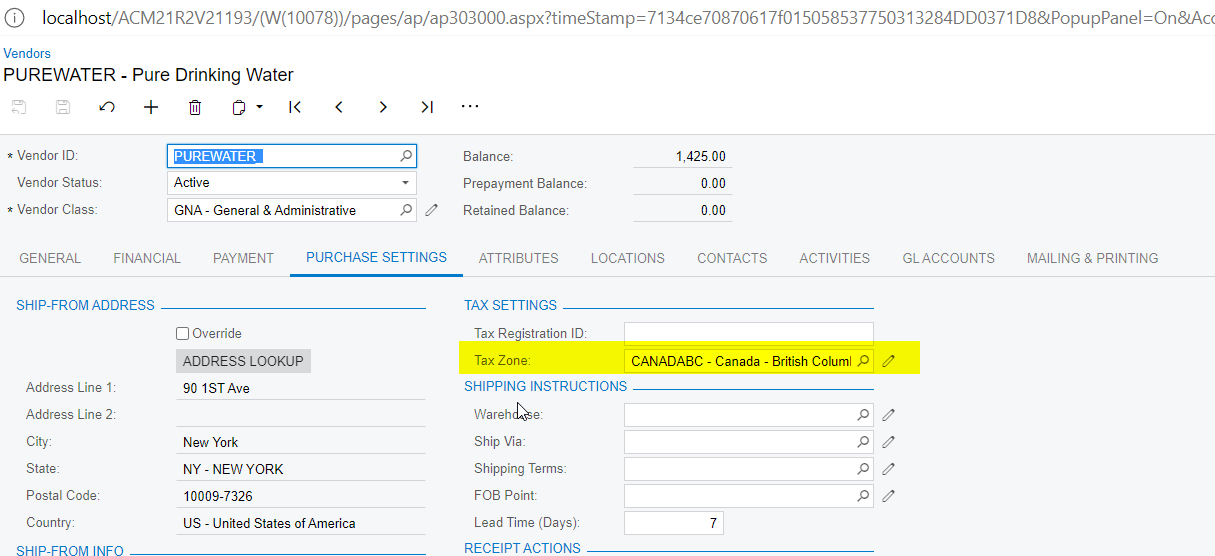

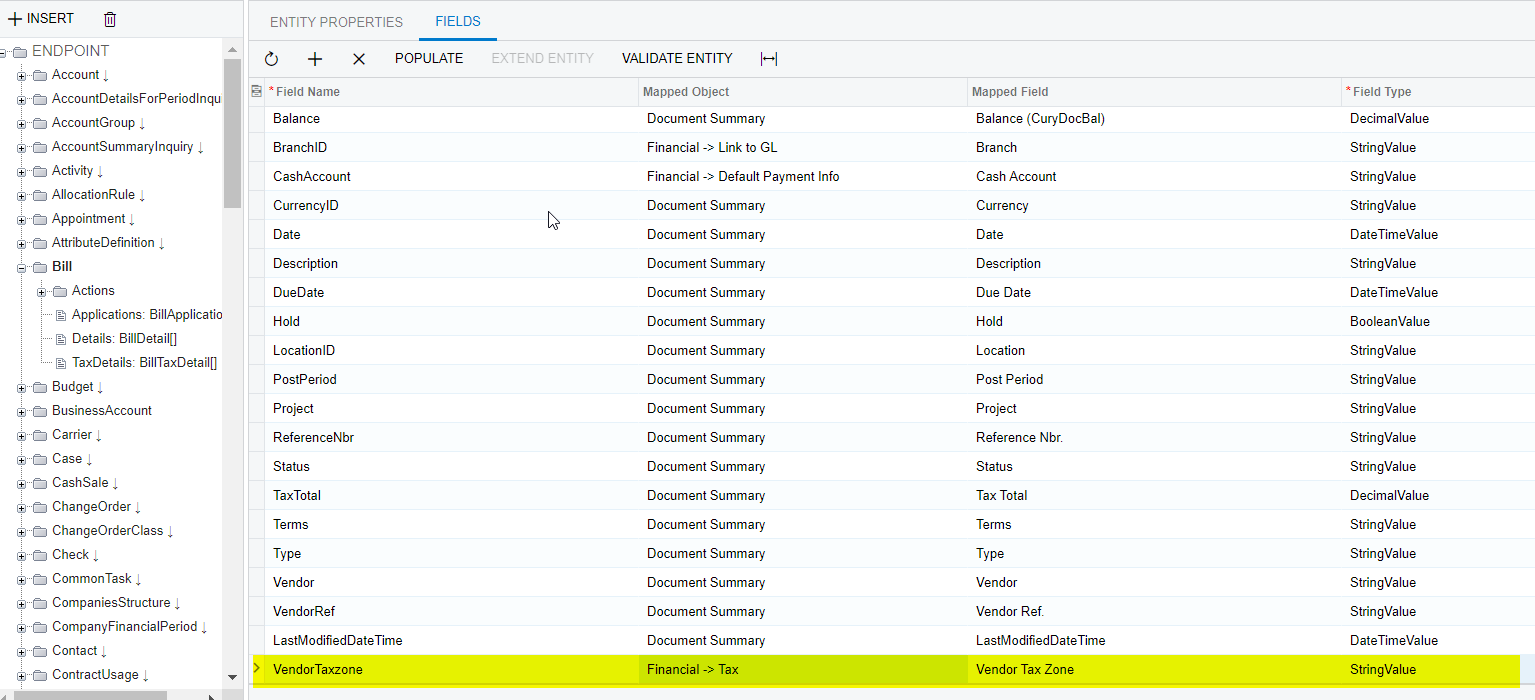

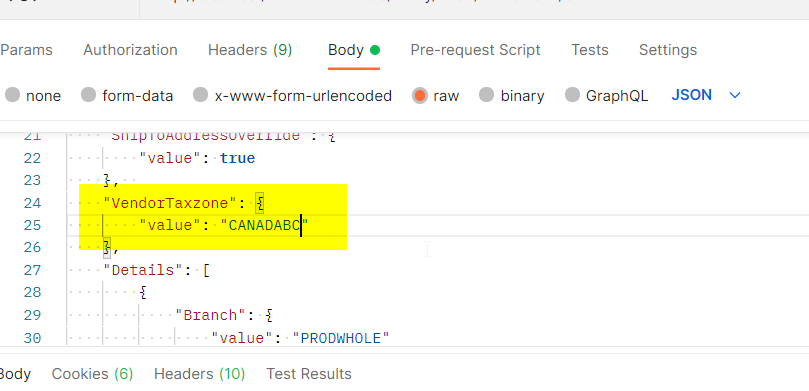

- Need to configure the Tax zone at the Customer level or need to send the value in the API request call

Customer Level

Through API

2. No need to send the tax details on the API call. Based on the provided tax rate or the Tax provider, the bill will calculate the tax by default.