Hi there,

I’ve been trying to test allocations following the video on YouTube:

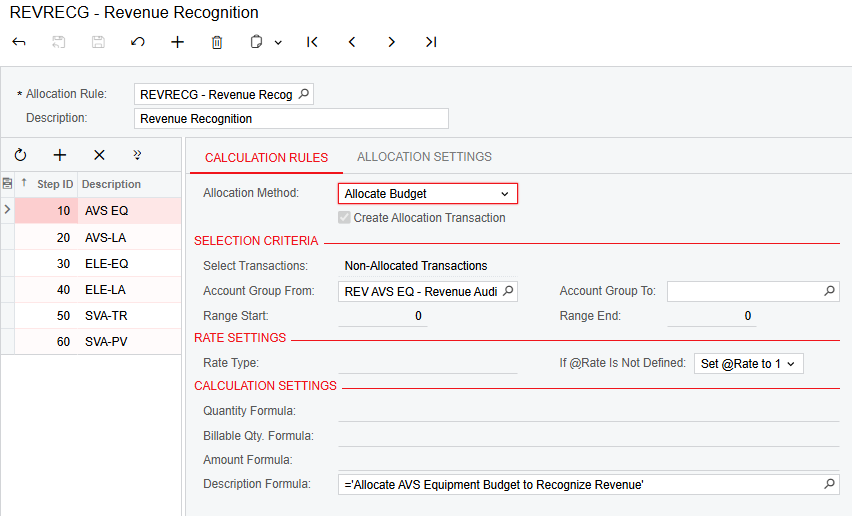

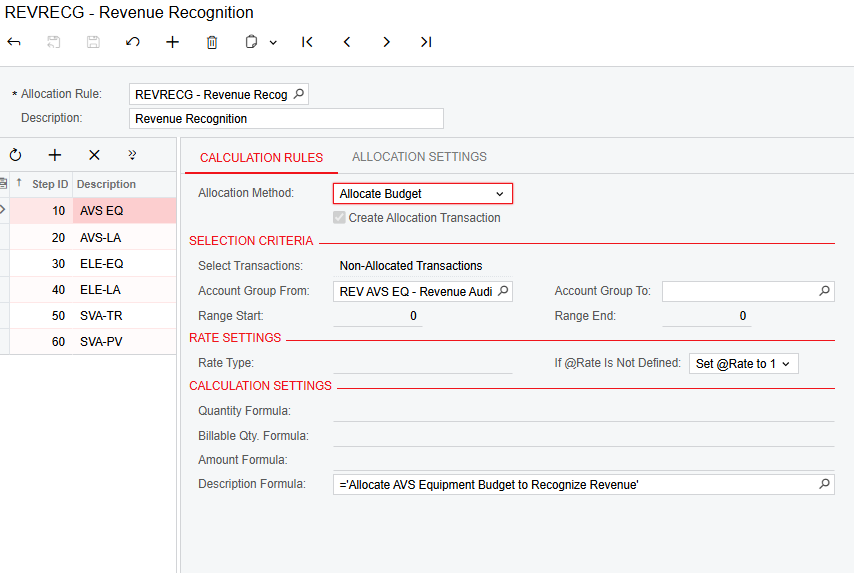

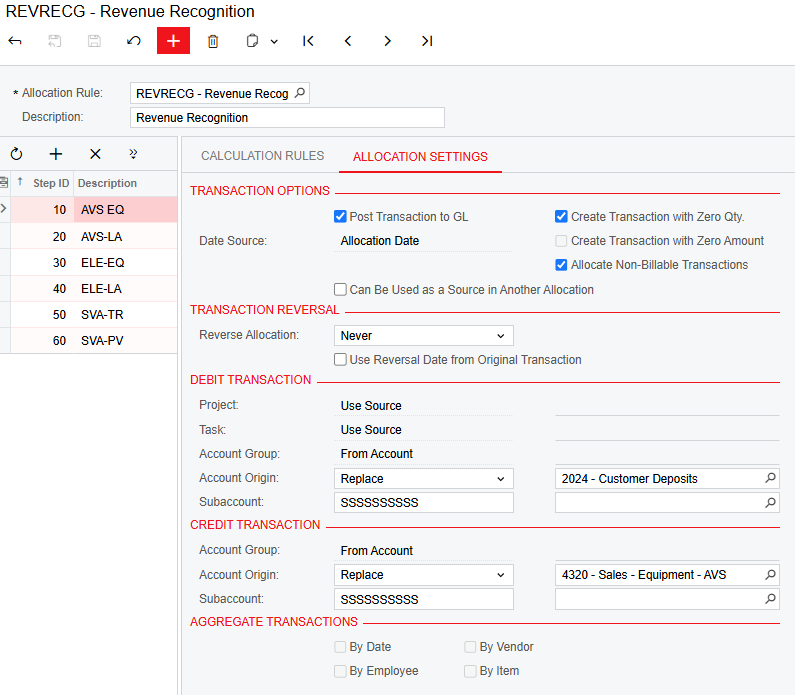

Set up Allocation Rules to Recognize Revenue - Acumatica Construction Edition

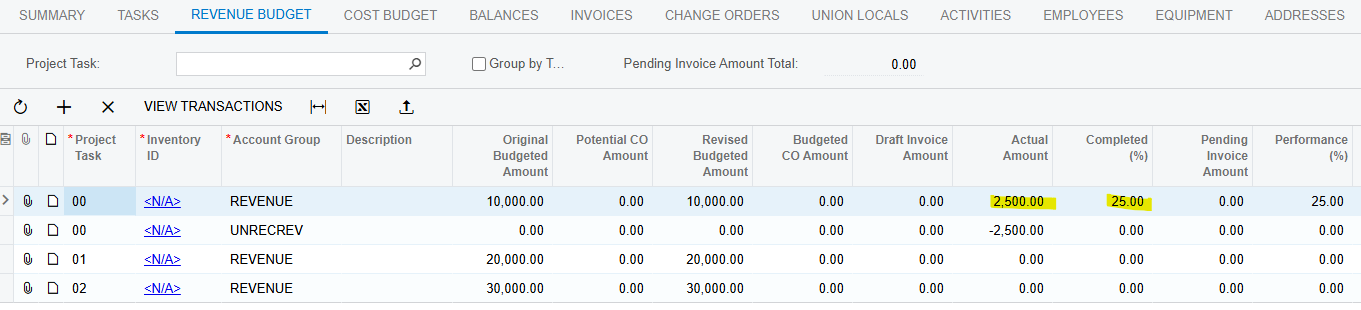

I used REVREC allocation rule and UNRECREV billing rule in the demo tenant. It works fine, billing reduces 21050 as shown on the video and other steps are good.

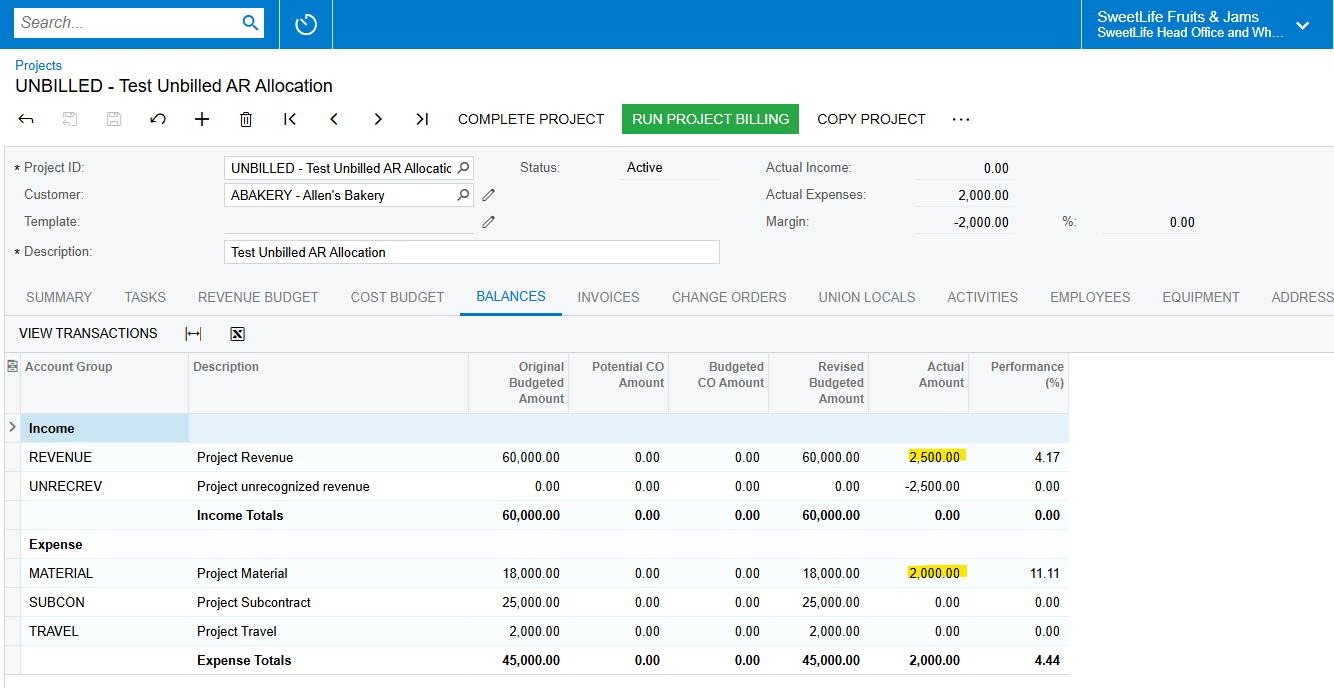

However, when it comes to out of the box reporting it doesn’t work well.

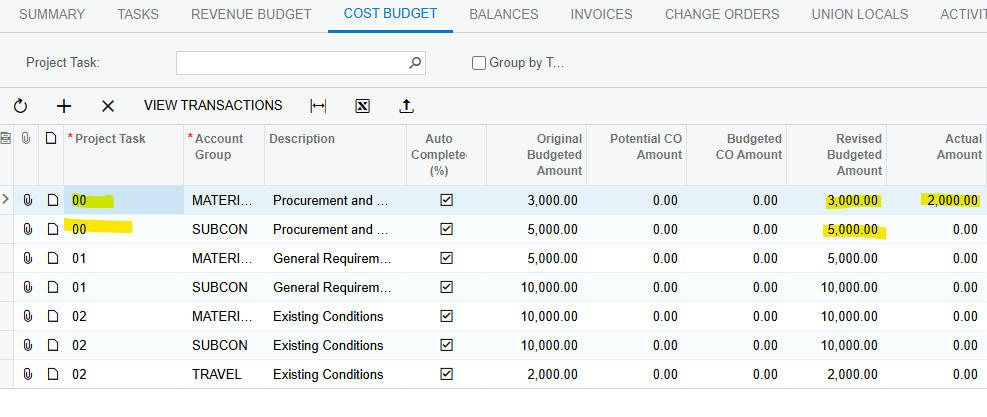

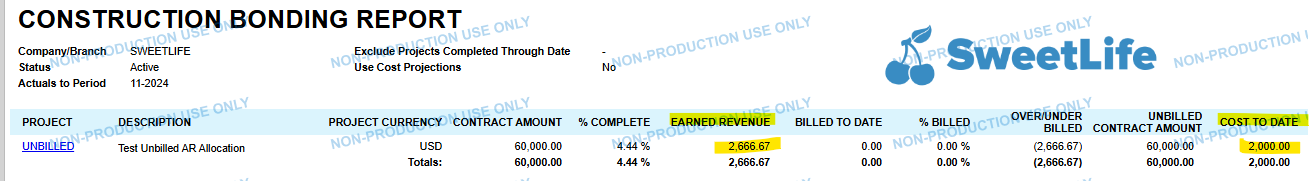

For example, Construction Bonding Report shows revenue recognized (earned revenue) as Earned Revenue = % Complete * Contract Amount. I guess that makes sense as it’s just multiples total % complete by the total contract amount. But it does look weird and inconsistent.

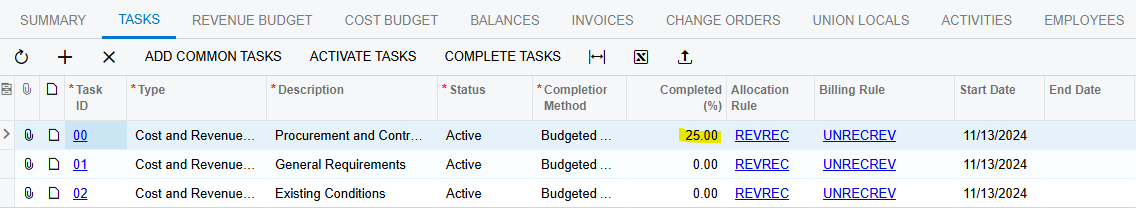

In this example below, the system automatically recognized 25% of task revenue based on the 25%cost task completion.

However, on the bonding report it calculates the earned revenue using total contract (not task revenue or sum of income recorded).

Question, is it possible to design an allocation rule that will actually calculate recognized revenue (unbilled AR) using total cost per project and total contract revenue? Not by task. Essentially the unbilled AR number will match the earned revenue calculation $$$ on the bonding report.

Thank you,

Felix