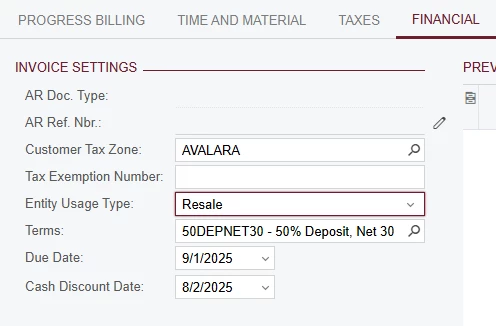

We often work for General or Electrical Contractors, who are not tax exempt. However, the project we are working on may be tax exempt. Since we use Avalara, the Project Revenue Tax Zone must be AVATAX—but there doesn’t appear to be an Entity Usage Type field to communicate to AVATAX that the project is exempt because it's a hospital, school, etc. The exemption type is important in completing tax returns for several states we work in, but as far as I can tell there is no such field in Projects!

How do we set up the Project so that Avatax knows 1) the project is exempt and 2) the type of exemption (entity usage type in Customer).

We can’t just add the Entity Usage Type to the GC/EC account, because we may be doing one project at a school and another at a federal building, both billed to the same GC/EC. It really needs to be specific to the project. Having to remember to modify the Project Billing invoice before posting is a hassle, so would love it if I’ve just missed something simple.