Hi,

We have a client who has the project and payroll module activated within Acumatica’s tenant. Originally, they had the payroll preferences to only post payroll actual costs to project. The issue with this setup is having sensitive payroll data being posted to project transactions and employees are now able to view this data. Even if we “Hide Employee Name” within the payroll preferences, it is still possible to figure out who this employee is.

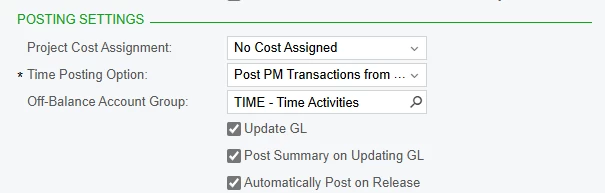

We want to be able to post the labor rates, defined within the labor rates table, to the associated projects and also showing it in the “Actual Expenses” within the projects. Currently, I’ve been testing this type of scenario but the only option I have within the Payroll Preferences (Posting Settings) is Post PM Transactions from Time Activities using an Off-Balance Account Group. This type of setup doesn’t show the labor rates hitting within the Actual Expense.

Would it be possible within Acumatica to have the Time Activities create a project transaction and also creating a journal transaction. So debit Expense account and credit Expense Accrual account? The actual cost coming from payroll should just debit expense that is identified within the Earning code itself and no project transactions.

Your help is greatly appreciated.

Thank you,

Joey