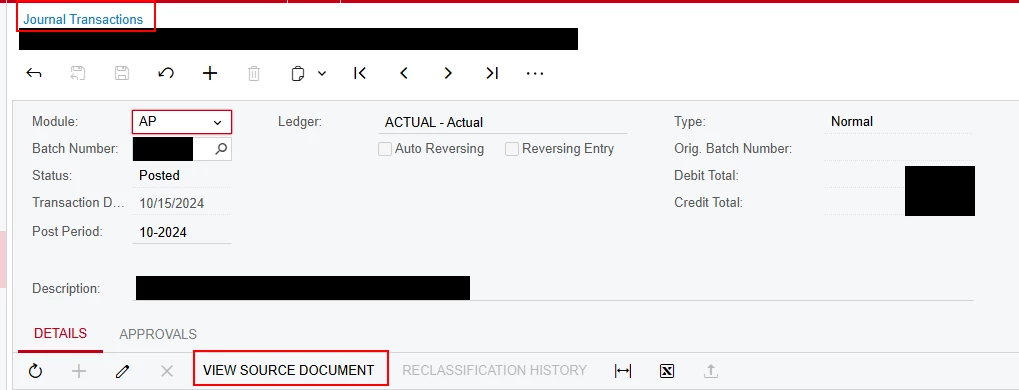

I posted a journal entry to a project ID and the resulting PMTRAN does NOT agree to the journal entry.

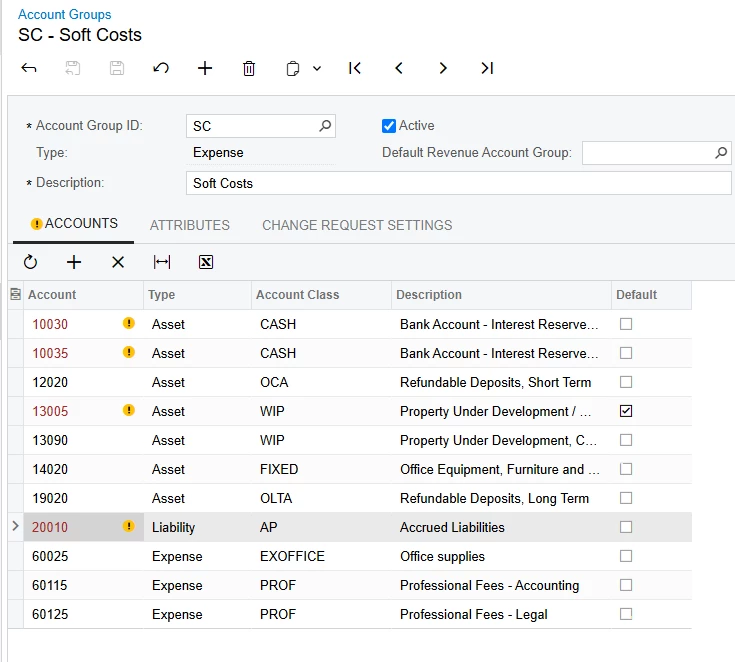

The journal entry hit two accounts, but both lines were to the same ProjectID - only the CostCODEID were different.

The journal entry, obviously, balanced but the resulting PMTRAN has two debits.

I have no idea what I could have done to get Acumatica to do this. I know I can post a PMTran to correct this but I’m concerned that this happened. Up to this point I have not posted ANY PMTrans (accumatica has generated all of my PM activity) and I have been able to fully reconcile all of my GL activity to my PM activity.

Does anyone have any suggestions?