I’m attempting to create an AP Bill that should post to the FA Accrual Account (142920) in order to track the CIP of an asset. Since this is a project-related transaction, I used the FA Accrual Account, which is configured in the Account Groups on the AP Bill, so that the actual values flow through to the project.

Below is a screenshot of the AP Bill entry

The Journal Entries: Debit the FA Accrual Account (142920) and Credit Accounts Payable (205101) which is correct.

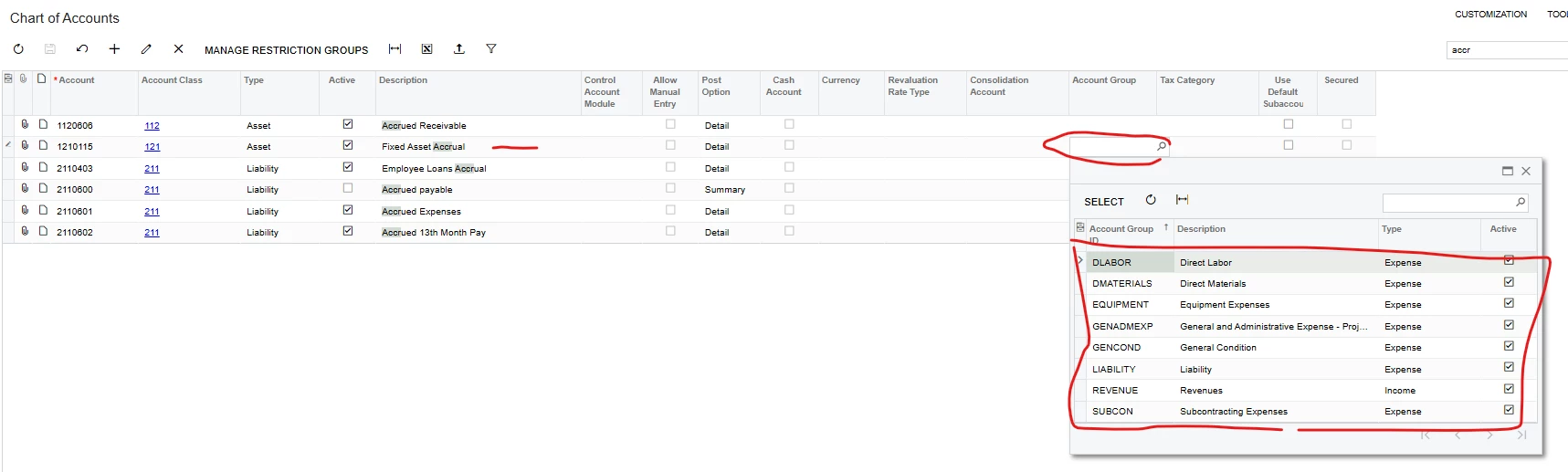

Screenshot of the Accounting Group showing the GL Account linked to the AP Bill, ensuring project costs update correctly.

When I try to convert the purchase to an asset, on the release of the entry, I get the error: Error: Inserting 'GL Transaction' record raised at least one error. Please review the errors. Project is Required but was not specified. Account '142900 ' used in the GL Transaction is mapped to Project Account Group message.

You will notice the error is referring to account 142900 (Project WIP Account) which is configured as the Fixed Assets Account for the Asset in question.

Below is a screenshot of the purchasing transaction I am trying to reconcile, the last entry on the Reconciliation Tab.

Account 142900 (Project WIP Account) is also added to an Account Group for when I need to add entries to the project that needs to reflect in the WIP account for the project.

This is happening for all fixed assets convert purchases to assets transactions.