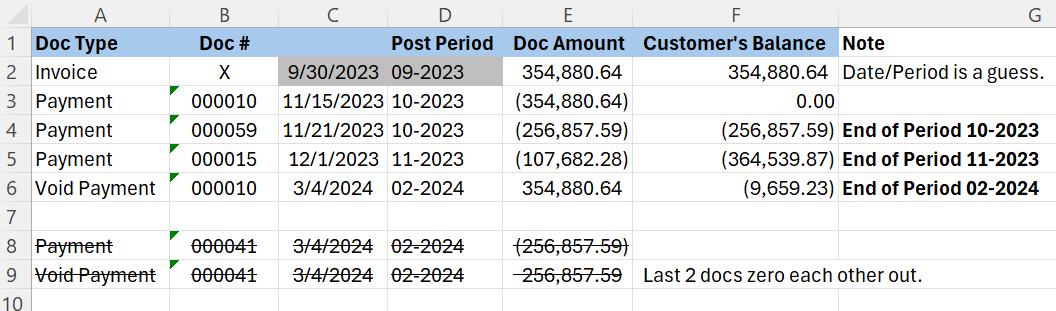

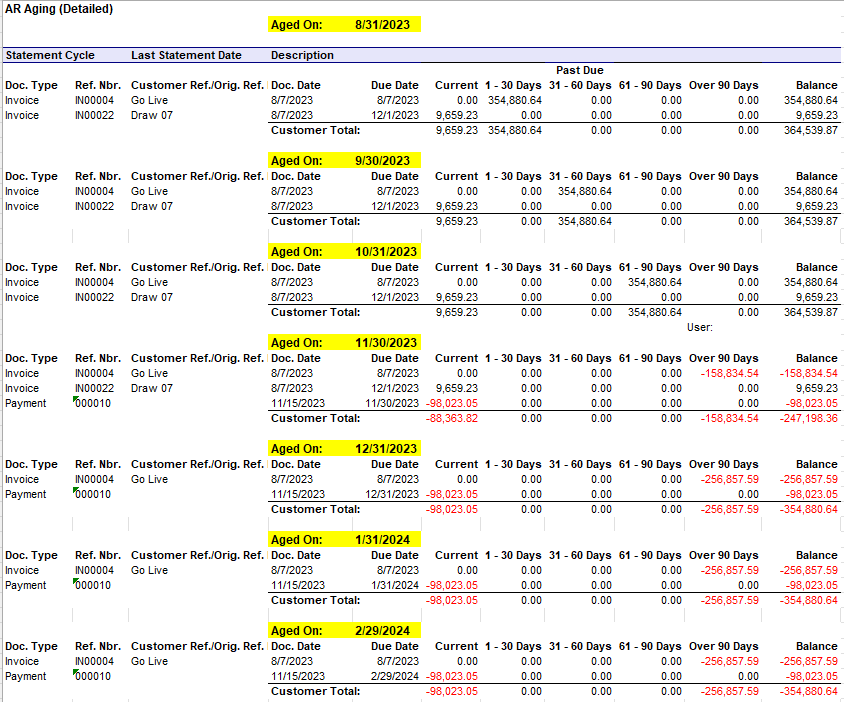

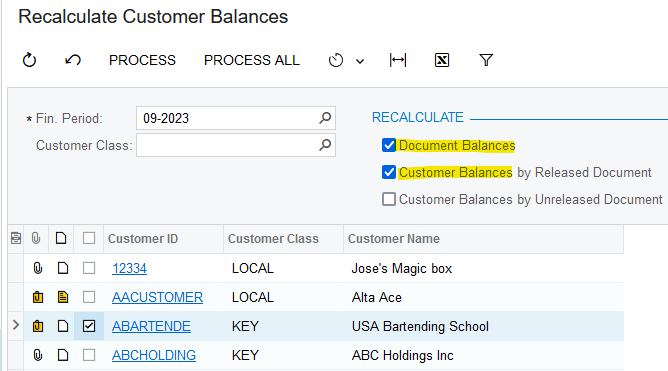

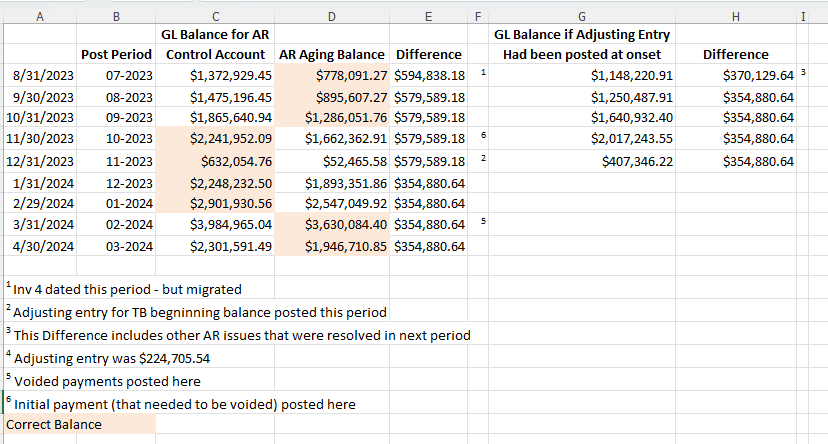

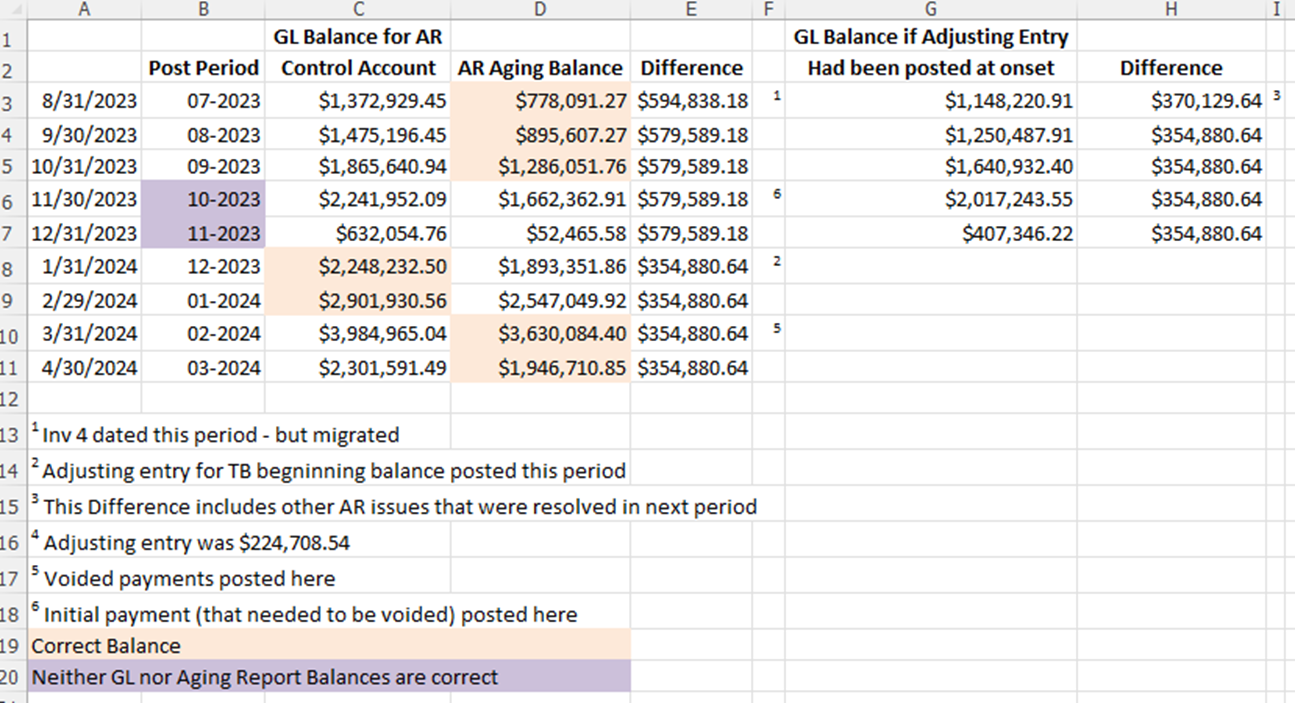

At transition, the team made several errors when posting invoices and payments. And when correcting the errors, additional issues were created. Scenario:

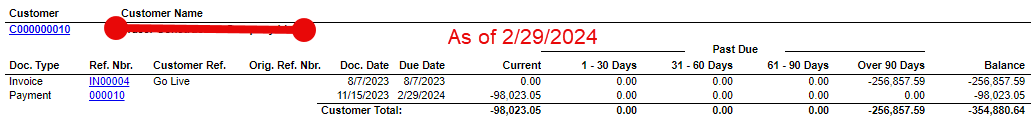

- AR Invoice was posted for $354k - invoice was paid by client in two payments.

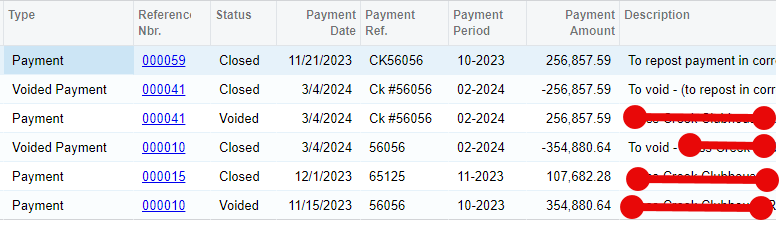

- When the 1st payment was applied, the Amount was not changed and the payment was posted as the full inv amount, but the payment was for $256k. Transactions were posted 11/2023.

- When the second payment was posted, it resulted in a negative AR.

- To correct the issue, the 1st payment was voided, but the void was posted in the wrong month. Voided posted in 03/2024.

- To correct the incorrect month, the re-posted payment was voided (2nd Void posted in 03/2024) and reposted in the correct month 11/2023.

- Learned through this that you can’t void a void. And have since reviewed a post on this forum how to correctly move an incorrectly posted voided payment from month to month.

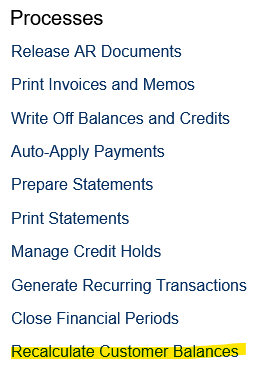

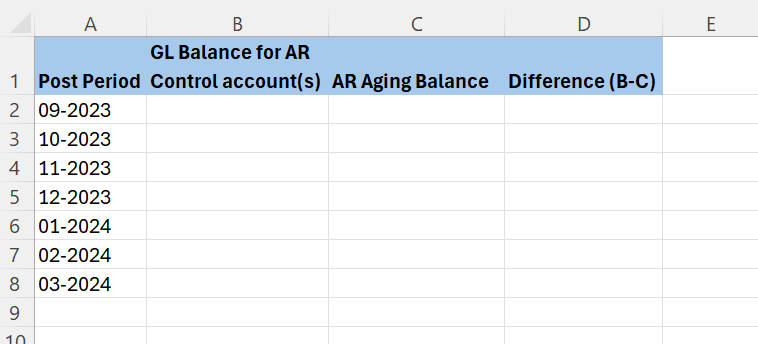

- But the result of these voids is a discrepancy in the AR GL account. It is overstated by the full amount of $354k.

- Cash account is reconciled.

Any advice how to credit AR GL account without impacting cash account?