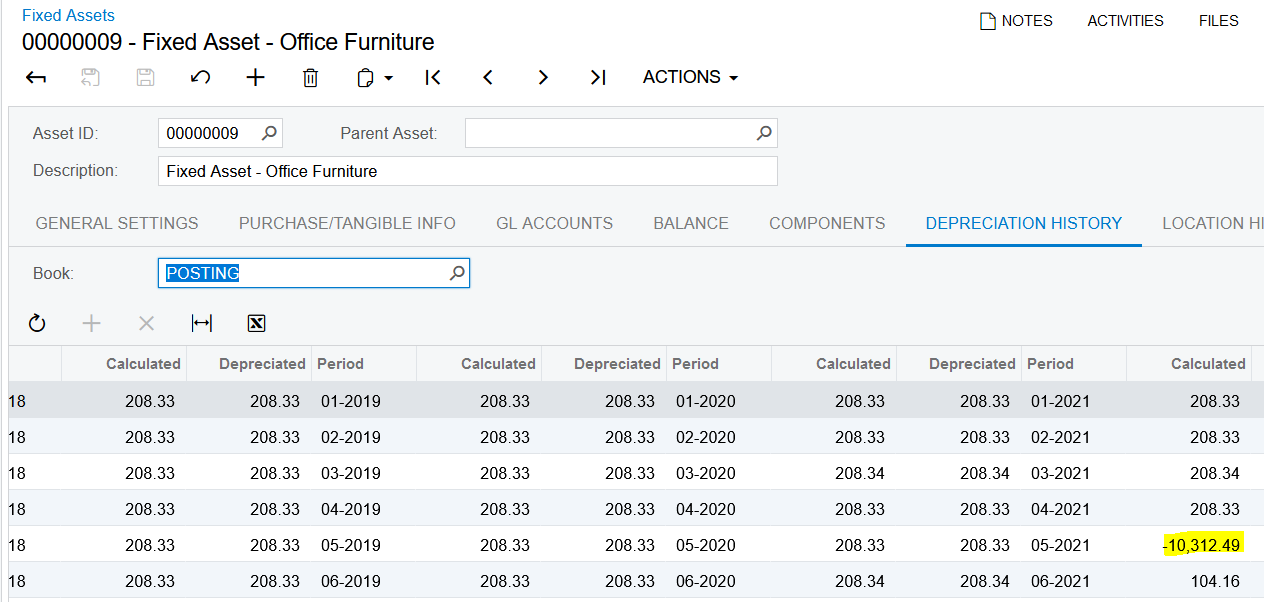

Fixed assets - depreciation appears as negative when asset still active with positive net value

Fixed assets - depreciation appears as negative when asset still active with positive net value

Best answer by kwilson03

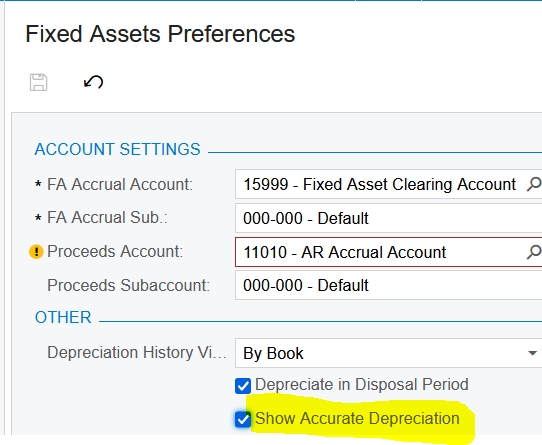

When the show accurate depreciation is checked the first depreciation ran in the system will deduct the accumulated depreciation brought in from the system. Then when depreciation is ran the next time, it will enter the correct depreciation and put the accumulated in the periods it should have been.

Here is the system explanation:

The way calculated depreciation amounts are displayed in the system. Leave the check box clear to view the calculated depreciation amounts. Alternatively, you can select the check box to display the accurate (that is, reported) depreciation amount for the previous financial periods and the depreciation adjustment for the current period. The adjustment is calculated as follows.Adjustment = B2 – B1 + A1In this calculation,

B2

is the calculated depreciation amount for the current financial period,

B1

is the calculated amount of the previous financial period, and

A1

is the reported depreciation amount of the previous financial period.

Reply

Enter your E-mail address. We'll send you an e-mail with instructions to reset your password.